The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on December 11th, 2025 | 07:20 CET

On the winning side – now and in 2026: Antimony Resources and Bayer, crash at Evotec!

The year 2025 is drawing to a close. It is time to focus on stocks and investment themes that could offer attractive returns in 2026. Trends such as AI, defense, and robotics are expected to continue. Further involvement in the commodities sector also appears lucrative. Here, investors can find an exciting second-tier investment story in the still largely undiscovered Canadian company Antimony Resources. But opportunities also exist in the blue-chip segment. Bayer has established a solid foundation this year, and analysts have recently raised their price targets significantly. For heavily punished stocks like Evotec, a turnaround could also emerge next year.

ReadCommented by Carsten Mainitz on December 10th, 2025 | 07:15 CET

What is going on? Sharp price swings for Almonty Industries, Klöckner & Co., and RENK!

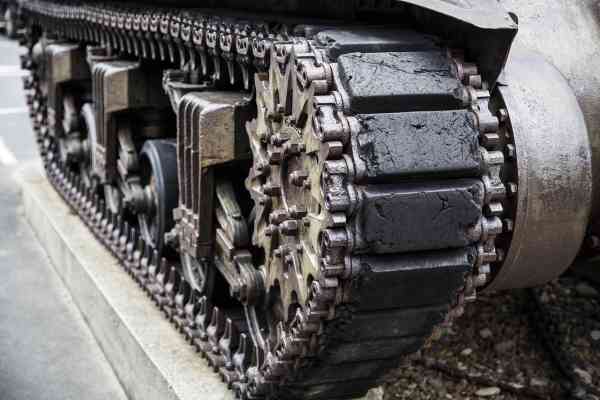

Negotiations to end the war between Russia and Ukraine are dragging on. The 28-point plan originally drafted by the US government has now been reduced to 20 points and is to be presented to Ukraine. In general, skeptical voices are growing louder, with many not expecting an agreement to be reached anytime soon. Against this backdrop, defense stocks such as Rheinmetall and RENK are rising. Equally exciting is Almonty Industries, a Canadian manufacturer of the critical metal tungsten, which is also in high demand in the defense industry. Recently, the stock fell significantly to an attractive price level.

ReadCommented by Carsten Mainitz on December 2nd, 2025 | 07:20 CET

Watch out! Take advantage of the price correction in Almonty Industries, Rheinmetall, and RENK!

According to a study by consulting firm EY-Parthenon and DekaBank, direct defense investments by European NATO countries are expected to rise to EUR 2.2 trillion by 2035. Based on this enormous surge in demand, companies and analysts are forecasting strong growth with rising margins. The medium- and long-term outlook is therefore positive. A possible price consolidation presents a good opportunity to pick up a few shares at a low price. Another exciting investment area is critical metals, which are indispensable for the defense industry, among others. Tungsten producer Almonty Industries stands out positively in this regard.

ReadCommented by Carsten Mainitz on November 28th, 2025 | 07:00 CET

Attention! Major Updates from NEO Battery Materials, Xiaomi, and RWE

Geopolitics are once again dominating global headlines. A 28-point plan brokered by the United States aims to end the war between Russia and Ukraine and pave the way toward sustainable peace. Viewed soberly, an approaching end to the war puts pressure on defense stocks. One area that has gained significant importance due to the Ukraine conflict is drones. Battery technology is playing an increasingly important role here. However, the use of powerful batteries is also essential in many other areas, such as robotics. The still largely unknown NEO Battery Materials is delivering one positive update after another. How can investors benefit now?

ReadCommented by Carsten Mainitz on November 27th, 2025 | 07:05 CET

Everything is lining up! Take advantage of lower prices to enter Antimony Resources, RENK, and Hensoldt!

Is peace finally coming? Efforts to end the war between Russia and Ukraine have intensified significantly in recent days. But Russia remains the unknown factor. As a result, stock market volatility driven by shifting news or rumors is to be expected in the near future, especially for defense stocks. Setbacks offer investors opportunities to build up positions. In addition, special topics such as critical metals or raw materials that are indispensable for the defense industry and other key sectors remain attractive. This is where the undervalued Antimony Resources stands out.

ReadCommented by Carsten Mainitz on November 26th, 2025 | 07:10 CET

New EU initiative boosts the hydrogen market! Pure Hydrogen, Nel, and SFC Energy stand to benefit!

With the Hydrogen Mechanism, the EU has launched a new and important instrument on the market. The launch took place just two weeks ago, so it is still too early to draw any interim conclusions. However, the approach has the potential to take the hydrogen market to a new level of development, as the platform brings together supply and purchasing interest and provides information on available financing instruments. Smaller providers, such as Pure Hydrogen, should benefit in particular.

ReadCommented by Carsten Mainitz on November 20th, 2025 | 07:20 CET

Pure excitement! Take advantage of the current correction with UMT United Mobility Technology, Aixtron, and AMD!

Tech stocks are currently correcting. However, artificial intelligence (AI) is undeniably an unbroken trend. AMD CEO Lisa Su expects the AI market to be worth USD 1 trillion by 2030. It is absolutely healthy to let some of the air out of the sometimes ambitious valuations. Apart from the well-known names, there are many mid-caps, small-caps, and micro-caps whose potential is only slowly being recognized. We take a look across the industry.

ReadCommented by Carsten Mainitz on November 20th, 2025 | 07:00 CET

Perfect signals: Take advantage of setbacks at Almonty Industries, Rheinmetall, and Steyr!

Geopolitical tensions are expected to lead to drastic increases in defense budgets in the future. Riding this wave, defense stocks remain popular investments. However, the wheels of government bureaucracy sometimes turn too slowly. This means that orders can be delayed, dampening companies' short-term forecasts – and disappointing the capital market. But since the "big picture" is positive, weaker prices represent good entry opportunities. Investors should not forget commodity producers, which are of great importance to the defense industry.

ReadCommented by Carsten Mainitz on November 19th, 2025 | 07:15 CET

Silver boom continues unabated – Take advantage of setbacks at Silver North Resources, First Majestic, and SMA!

In light of geopolitical tensions and real purchasing power losses, precious metal prices are on the rise – and there is no end in sight. While gold is traditionally considered a "safe haven," silver has even more advantages, as it is also in high demand from industry. Around 10 to 15% of global silver production is demanded by the solar industry each year. Silver is indispensable because it is the best electrical conductor, thus maximizing power yield. Therefore, there are significant interdependencies between solar module manufacturers, as consumers of silver, and suppliers such as silver producers.

ReadCommented by Carsten Mainitz on November 18th, 2025 | 07:10 CET

Takeover fever! LAURION Mineral Exploration, Evotec, and Mutares are tempting investors to get on board!

M&A – mergers and acquisitions - remain powerful performance drivers for shareholders of potential takeover targets. But companies that acquire others also benefit from increased growth, access to new markets and technologies, and cost synergies. According to a recent study by Bain & Company, the majority of M&A activity in the current year, amounting to around USD 265 billion, has taken place in the energy and commodities sectors. In healthcare and life sciences, deals with a volume of USD 107 billion were recorded. So who could the next takeover candidates be?

Read