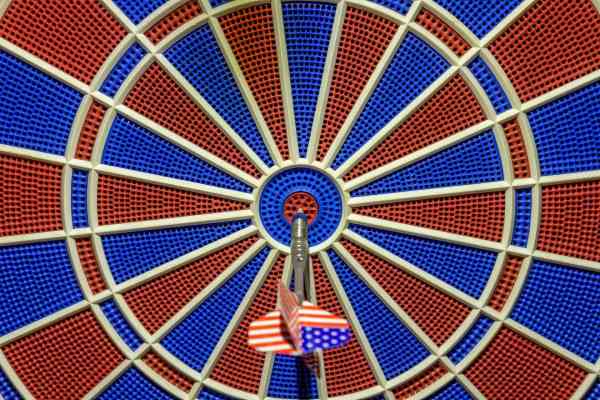

takeover

Commented by Nico Popp on December 17th, 2025 | 07:15 CET

Gold rush: After producers Barrick Mining and Equinox Gold, it is now the turn of explorers – why Desert Gold is a takeover candidate

Forecasts for the gold market in 2026 are clear and point to a continuing supercycle. However, while producers such as Barrick Mining and Equinox Gold have already benefited massively from higher gold prices in recent months and expanded their margins, the valuation of exploration companies is still lagging behind. This historical divergence is likely to close in the coming year. Experience shows that capital flows cyclically: first, investors buy the security of cash flows, then they seek the leverage of resource development. In this environment, Desert Gold Ventures is coming into focus. The Company controls one of the largest non-producing land packages in West Africa, and is active precisely where industry giants are urgently searching for new supply.

ReadCommented by Mario Hose on February 10th, 2025 | 15:10 CET

Almonty: The Hot Takeover Candidate! Who Could Prevail in a Bidding War?

The global economy is on the brink of a new era – and one company stands to be among the biggest beneficiaries. Almonty Industries Inc. (TSX: AII | ISIN: CA0203981034) is uniquely positioned to meet the soaring demand for tungsten, a critical raw material for high-tech and defense industries. While China tightens its export restrictions, Almonty is on track to emerge as the largest producer outside the Middle Kingdom. The Company does not need to seek buyers – customers are scrambling to secure supplies. And this is only the beginning. The stock has already doubled in value, and it could be just getting started!

Read