renewableenergies

Commented by Stefan Feulner on November 27th, 2023 | 07:10 CET

ExxonMobil, Prospera Energy, Deutsche Rohstoff AG - New opportunities in the supercycle

After a sharp rise of around 30% to an annual high of USD 95.50 for the US West Texas Intermediate, black gold entered a correction and has since lost about 20% in value. Even events like the Hamas attack on Israel and OPEC+ production cuts were unable to halt the current decline. From a technical chart perspective, this appears to be a normal correction. In the long term, oil is expected to reach new highs with the next upward movement. JP Morgan, for instance, issued an updated price target of USD 120 per barrel as recently as September.

ReadCommented by Juliane Zielonka on November 24th, 2023 | 07:00 CET

Renewable energies - which market environment currently offers the best investment opportunities for Altech Advanced Materials, Plug Power and Siemens Energy

Wind, hydrogen, electric batteries - in this article today, you can find out which renewable energy technology offers an exciting investment case for investors. Altech Advanced Materials AG is to build a battery plant in Germany, focusing on innovative anode technology that can increase the performance of batteries by around 30%. According to CEO Marsh, Plug Power has strong fundamentals, but is the market environment in the US and Europe ready for green hydrogen? In recent months, Siemens Energy experienced challenges in the wind sector, especially with the acquired wind energy company Siemens Gamesa, which still requires repair measures. Which market environment now offers good investment opportunities in renewables?

ReadCommented by Fabian Lorenz on November 23rd, 2023 | 07:40 CET

Buy now? Morphosys, Siemens Energy and Desert Gold share

What do renewable energies, biotech and gold have in common? Shares from these sectors have predominantly experienced significant losses in 2023. Morphosys, Siemens Energy and Desert Gold are examples of this. However, the underperformers in the current year are often among the top performers in the upcoming year. Can this apply to these three shares? In the case of Morphosys, the latest study data has been confusing, and the share has given back its gains of the year. Analysts are now expressing their views. Siemens Energy has lost over 30% of its value due to operational problems, and the price targets of the experts vary widely. Explorer Desert Gold has been quiet recently. Is it the calm before a price jump? In any case, the share is anything but expensive.

ReadCommented by André Will-Laudien on November 23rd, 2023 | 07:30 CET

Getting in now? Hydrogen - The analysis: Nel and Plug Power sold off, rebound at dynaCERT!

It was like a crash. The hype sector hydrogen experienced one of the most significant sell-offs in recent stock market history with a complete reversal to the downside. Parallel to otherwise bullish markets, losses of 70 to 90% were not uncommon. The rationale behind this is understandable and frustrating at the same time: green-oriented governments around the world are trying to accelerate the climate transition but often have the wrong targets in mind due to their lack of expertise. Hydrogen is just a selectively applicable technology and not a solution for global energy supply. Studies show that only the complete, green production of H2 makes any economic sense. Investors have long since seen through the game, and politicians may have to fail before the necessary insight comes. Nevertheless, there are some opportunities for sensible hydrogen applications. We delve into the topic and put current models to the test.

ReadCommented by Stefan Feulner on November 23rd, 2023 | 07:10 CET

Significant events at TeamViewer, Power Nickel and Nordex

Global stock markets continue to head north and find themselves in the midst of a year-end rally despite the uncertainties in geopolitics. This rally is likely fueled by the ongoing easing on the interest rate front. The DAX, Germany's leading index, remains close to the critical 16,000-point mark. In addition, technology companies that have corrected sharply in recent months will likely face a sharp wave of recovery.

ReadCommented by Fabian Lorenz on November 22nd, 2023 | 07:20 CET

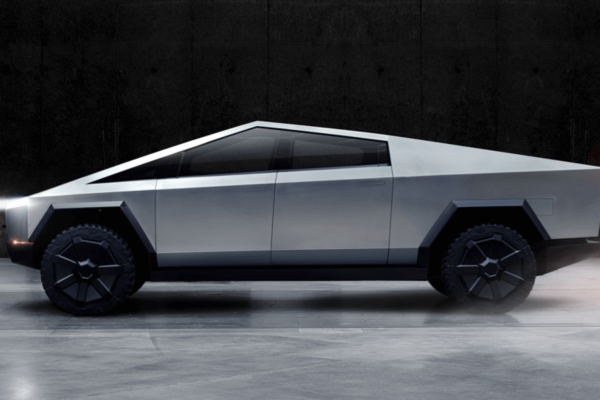

BYD with "Tesla killer", JinkoSolar with sales record, and Klimat X Developments with milestone payment

BYD is currently bursting with energy. The Chinese company is rushing from one sales record to the next. To ensure this continues in the coming year, BYD has unveiled two new "Tesla killers". The mid-range SUVs are designed to make life difficult for the Model Y. For those without a climate-neutral business model, CO2 certificates can be purchased from Klimat X Developments. The Company has just received a milestone payment. When will the shares of the innovative company benefit? JinkoSolar shareholders also need to be patient at the moment. The share is not taking off despite the solar group doing well operationally. While the Chinese have reason to celebrate, another competitor disappoints once again.

ReadCommented by Armin Schulz on November 22nd, 2023 | 07:10 CET

Siemens Energy, Almonty Industries, BASF - Rebound underway, where is it worth getting in?

At the end of October, the mood among investors was gloomy. Many indices were under pressure and had lost more than 10% of their value. Since October 28, the mood has changed, and the markets have rallied significantly. One of the reasons is undoubtedly the Fed's interest rate pause. After three weeks on the upswing, the indices are approaching new highs. Nevertheless, there are still stocks that have not yet been able to benefit from the upward trend. We have picked out three interesting stocks that offer plenty of long-term potential.

ReadCommented by Stefan Feulner on November 20th, 2023 | 07:00 CET

There is clearly room for improvement here - Volkswagen, Globex Mining, Siemens Energy

After the corrections of recent weeks, the bulls have regained the sceptre. Despite the uncertain geopolitical situation and supported by an easing interest rate front, technology stocks were also able to recover significantly from their recent lows for the year. In addition, Germany's leading index, the DAX, knocked on the psychologically important 16,000-point mark. Overcoming this level will likely result in an attack on the all-time high at 16,532 points still within this stock market year.

ReadCommented by Fabian Lorenz on November 15th, 2023 | 06:55 CET

Insider alert at Nel ASA, Freyr Battery reassures shareholders, and Blackrock Silver doubles its resource

Interesting news from Nel. For the first time in many months, insider buying has been reported. Could this signal a turnaround? Following its quarterly figures and the news from industry peer Plug Power, the Nel share fell to a new multi-year low. Yesterday, it sent out a sign of life. Freyr Battery is also sending such a signal. The management of the battery hopeful from Norway addressed shareholders in a letter following alarming news and explained the situation. In contrast, Blackrock Silver is currently doing exceptionally well. The estimate for the gold and silver resources of the flagship project has more than doubled. Which share will achieve the turnaround?

ReadCommented by André Will-Laudien on November 15th, 2023 | 06:30 CET

Greentech sector buybacks - The stage is set for a 100% rally! Nordex, Defense Metals, SMA Solar and Siemens Energy

With the new EU Climate Law, Europe has once again raised its long-term target for reducing greenhouse gases by 2050. Instead of a reduction of 80% to 95%, the aim is now net zero emissions, i.e. "climate-neutral". This is to be followed by negative emissions in subsequent years. The idea sounds promising: emission reducers can offset emission sources! However, climate change generally requires the use of modern Greentech technologies that "produce" these savings. Those looking to reduce or replace fossil fuel consumption typically need large apparatus and innovations, such as various alternative energy sources converted into electricity. Europe, in particular, faces the challenge that most of the necessary metals are classified as critical, making it financially unrealistic to roll out innovative projects on a broad scale. Which shares stand out in this environment?

Read