armaments

Commented by Armin Schulz on January 4th, 2024 | 07:45 CET

Almonty Industries, Volkswagen, Rheinmetall: Which share will take off in 2024?

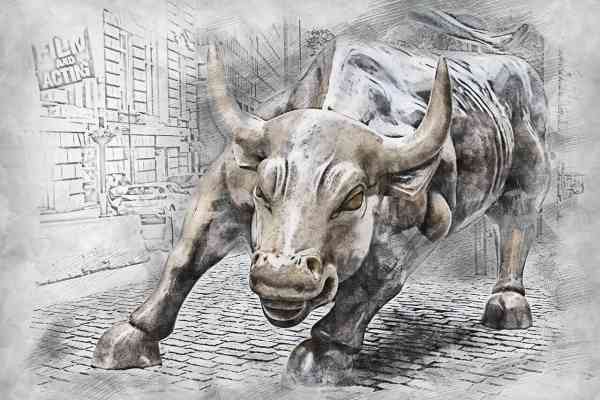

The new year has barely begun, and investors are looking for the winning stocks for the coming year. Investors should keep an eye on the critical raw material tungsten, which Almonty Industries produces. There is significant dependence on China and Russia in this sector. The areas of application are diverse and range from electric cars, which Volkswagen builds, to medical products, metal alloys, industrial applications, electronic devices and the defense industry, where Rheinmetall operates. In times of increasing conflicts and escalating trade disputes between the US and China, essential resources such as tungsten are increasingly coming to the fore. We look at which of the three shares could take off in 2024.

ReadCommented by Armin Schulz on December 6th, 2023 | 08:00 CET

Siemens Energy, Defense Metals, Rheinmetall - Rare earths as a risk factor

The scarcity of and access to rare earths has become a major global concern. China plays a decisive role in the production of rare earths, as the country mines 60% of all rare earths worldwide and processes 85% of them. After the US banned the export of AI chips, China considered banning the export of rare earth metals. These trade blockades from both sides are causing tensions in international trade relations and concerns about supply bottlenecks. Rare earths play an important role in wind power, armaments, medicine, electromobility and the electronics industry. As an investor, one should be aware of these risks.

ReadCommented by Stefan Feulner on November 13th, 2023 | 07:00 CET

Plug Power falters, Almonty Industries and Rheinmetall with exclamation marks

The hydrogen sector, which has been touted as having a promising future in terms of achieving climate goals, has been punished in recent months. Following Plug Power's disastrous quarterly figures, many peer group companies have now seen further sell-offs. In contrast, there are rays of hope to report from China in the photovoltaics sector, suggesting that the market leader could be on the verge of a strong turnaround.

ReadCommented by Stefan Feulner on November 6th, 2023 | 07:30 CET

These shares are right on trend - BYD, Defense Metals, Rheinmetall

After the correction of recent weeks, the DAX was able to send a positive signal for a year-end rally by exceeding the 15,000-point mark. Despite the escalating events in Gaza, the world's stock markets appear to be heading north. They are receiving a tailwind from monetary policy. This could mean the end of interest rate hikes for the time being. The badly battered companies in the technology sector, in particular, are likely to benefit from this.

ReadCommented by Stefan Feulner on October 25th, 2023 | 07:35 CEST

Rheinmetall, Power Nickel, Nio - The situation is getting critical

The further escalating conflicts in Ukraine and Israel, as well as tensions in the economic relations of global powers, are placing enormous strain on global supply chains. China's dominance in product manufacturing is becoming increasingly apparent, which must be minimized in the future. Last week, for example, the Middle Kingdom said it will require export licenses for some graphite products to protect national security, surprising everyone with another attempt to control supplies of critical minerals.

ReadCommented by André Will-Laudien on October 17th, 2023 | 08:10 CEST

Strategic metals, rare and in demand! Rheinmetall, Almonty Industries, JinkoSolar

We all know that the electrification of mobility and the energy transition is unstoppable. At the same time, there are numerous trouble spots in this world that make reliable access to such important metals difficult and threaten supply chains. The supply of essential raw materials has, therefore, long since become a matter for governments, while private alliances that can be terminated at any time appear too uncertain. We examine companies that are doing well in this environment and offer one or two solutions to the problem. For investors, this means promising returns!

ReadCommented by André Will-Laudien on October 11th, 2023 | 08:30 CEST

Investing against the tide! Rheinmetall, BYD and Power Nickel with 100% potential?

In challenging times, it takes a lot of nerve to weatherproof one's investment strategy. Despite all the crises, however, there is no denying that the key underlying trends in the economy will continue. Occasional setbacks, therefore, always provide new entry levels for the agile investor, naturally in the conviction that we in Germany can do little to change the global situation and its upheavals. Life goes on, and stock market prices have to find a new equilibrium. In the area of defense and mobility solutions, Rheinmetall, BYD and Power Nickel stand out with good positioning. Where do the opportunities lie?

ReadCommented by Armin Schulz on October 9th, 2023 | 06:50 CEST

ThyssenKrupp, Almonty Industries, Rheinmetall - Good buying opportunities

Today, we are looking at three companies that offer good buying opportunities. For ThyssenKrupp, the recent positive news was that the unions are not demanding a 4-day workweek for the time being. Almonty Industries is benefiting from the fact that tungsten is being used in more and more new technologies. This includes the rising demand for tungsten in electric vehicle batteries. Rheinmetall could be an interesting buy candidate after the setback. Read the article to find out where the strengths of the three candidates lie.

ReadCommented by Stefan Feulner on October 2nd, 2023 | 08:10 CEST

Rheinmetall AG, Almonty Industries, Commerzbank - A run-up to the end of the year

After a strong first half, the stock markets corrected in the third quarter, driven by continuing risks such as high inflation, rising interest rates and the weakening economy with existing recession scenarios. The commodity markets were also unable to decouple themselves from this. Nevertheless, there are opportunities for a year-end rally in the final quarter.

ReadCommented by Stefan Feulner on September 25th, 2023 | 08:10 CEST

Shell, Hard Value Fund, Rheinmetall - All for performance!

Sustainability is a significant and important topic. Due to recent developments, it is often associated with the environmental and social sustainability of financial products. However, investing purely based on these two criteria can cost investors dearly. For example, global leaders in the hydrogen sector, such as Plug Power, lost around 90% of their value within two years, while wind turbine manufacturer Nordex experienced a peak decline of around 70%. In contrast, fossil fuel producers such as Shell, BP and Exxon enjoyed a boom and were able to multiply their share prices over the same period. Whether investments should, therefore, be made exclusively in ESG-compliant stocks is more than questionable from a return point of view because many companies do not yet offer one thing: financial sustainability.

Read