Mining

Commented by Nico Popp on August 13th, 2025 | 07:00 CEST

50% upside potential – And what lies beyond? Almonty, Hensoldt, and MP Materials

This is a week of truth for Ukraine. However, there are many indications that no resolution will be reached by Friday: the global power blocs continue to face off against each other, and security will continue to dominate the international agenda. More and more investors are realizing this and understand that defense is much more than just a passing trend. In line with this shift in perception, several respected research firms have recently published studies on Almonty Industries. As the only significant Western tungsten producer, Almonty plays a crucial strategic role, particularly as the US will ban the use of Chinese tungsten for military purposes starting in 2027. Here, we outline what this means for investors today and why the conditions for Almonty are unique.

ReadCommented by André Will-Laudien on August 12th, 2025 | 07:25 CEST

Crash in the defense sector? Geopolitical conflicts drive up metal prices! Rheinmetall, Sranan Gold, Hensoldt, and RENK

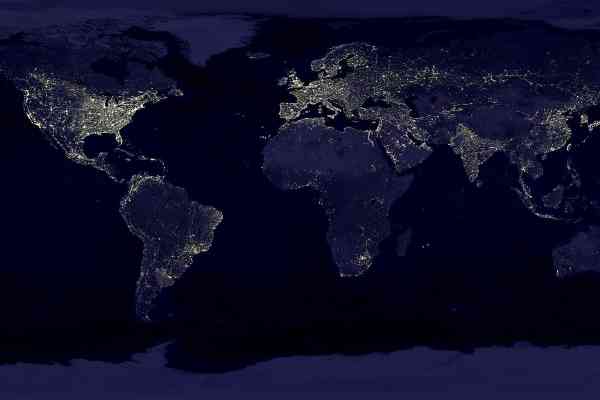

Strategic metals are a decisive factor in the economic strength and military power of entire nations. International hotspots like the Middle East, Ukraine and, most recently, Africa are exacerbating shortages, as long-established trade routes can collapse abruptly. The high concentration of production in a few countries increases the vulnerability of supply chains to political intervention. Export bans, sanctions or targeted supply restrictions by China or Russia can quickly lead to critical supply shortages. In this environment, precious metals like gold, which is currently trading at historic price levels, are becoming even more important for investors, not least against the backdrop of record-high government debt worldwide. Those who act flexibly can benefit from this commodity dynamic. The long-running favorites of recent months in the defense sector now appear to be consolidating. Where to put the money?

ReadCommented by Armin Schulz on August 12th, 2025 | 07:10 CEST

Lithium? Zinc! Steel! BYD's supply chains, Pasinex's deposits, thyssenkrupp's recycling: Your triple protection against trade wars

Trade conflicts are escalating! New US tariffs and stricter export controls on critical raw materials like lithium and rare earths are destabilizing global supply chains. Experts warn of rising prices and supply risks, especially for future-oriented technologies. Investors are therefore now seeking out resilient companies. Preference is given to those with vertically integrated supply chains, direct access to strategic mineral deposits, or revolutionary recycling technologies. Those who master the new reality of raw materials will win. Three players exemplify this transformation: BYD, Pasinex Resources, and thyssenkrupp.

ReadCommented by Stefan Feulner on August 12th, 2025 | 07:00 CEST

Canopy Growth, Silver North Resources, Vonovia – Clear signals

Market volatility continues to rise, yet the US stock markets are still managing to defend their record highs. The price of silver made a comeback last week, closing above the USD 38 mark after several weeks of sideways movement. The ongoing uncertainty in both geopolitical and fiscal policy could help propel the precious metal to reach new highs, which should benefit both producers and exploration companies alike.

ReadCommented by André Will-Laudien on August 11th, 2025 | 07:10 CEST

Buying frenzy – Indices are heading upward! Another 150% possible with Palantir, European Lithium, VW, and BYD

The NASDAQ and DAX 40 indices are basking in sunshine. A veritable buying wave is sweeping across tech stocks, especially Palantir Technologies. The share price continues to rise, driven by an almost irrational demand for AI and outstanding business performance. At the same time, short positions on this stock are rising sharply to over 50 million shares - a warning sign of potential short-covering scenarios. There is currently no sign of the typical summer slump. On the contrary, the stock markets are climbing from one high to the next as if the tariff decisions were a blessing for the global economy! In contrast, BYD is experiencing weaker-than-expected sales performance in July. Quarterly figures are down, and the stock is coming under considerable pressure. There is also plenty of movement in the commodities sector, as the US seeks stable supply chains. But where can these be found?

ReadCommented by Fabian Lorenz on August 11th, 2025 | 07:00 CEST

Rheinmetall & Hensoldt disappoint! The real WINNERS of the DEFENSE BOOM: Alzchem and Almonty!

Rheinmetall and Hensoldt have disappointed stock market investors with their quarterly figures. Growth, profitability, and, in particular, order intake are lagging behind high expectations. Are the second-tier companies perhaps the real winners of the defense boom? Namely, the suppliers that can deliver to virtually every defense contractor. Take Almonty, for example. The tungsten specialist is inundated with inquiries and is set to begin operations at the largest Western mine later this year. Defense contractors can only dream of such profit margins. Analysts see more than 50% upside potential. Alzchem is also doing good business with numerous defense companies. Among other things, the German company supplies specialty chemicals for explosives. A new major shareholder is causing a stir. However, not all analysts see room for further price gains.

ReadCommented by Fabian Lorenz on August 7th, 2025 | 07:20 CEST

Momentum stocks: D-Wave! Standard Lithium! European Lithium following in the footsteps of MP Materials!

Rare earth projects outside China are in high demand, as MP Materials has demonstrated with the entry of the US government, its cooperation with Apple, and its rise to a multi-billion-dollar corporation. Is a similarly rapid share price development possible for European Lithium? In any case, the stock is currently inexpensive, and the rare earth project in Greenland is delivering strong results. Standard Lithium shares have also performed strongly again recently. And analysts believe the stock has even more upside potential. And what is D-Wave doing? After breaking through the USD 20 mark, the stock is currently consolidating. Operationally, the quantum high-flyer continues to go full throttle, and analysts remain bullish.

ReadCommented by Armin Schulz on August 7th, 2025 | 07:00 CEST

Tungsten crisis hits defense boom: Why Almonty Industries, Rheinmetall, and RENK Group stand to benefit

Geopolitical upheavals are shaking global supply chains. As the trade dispute between the US and China reaches new heights, dependence on strategic raw materials is becoming an existential threat. Tungsten, which is indispensable for defense equipment and high-tech, is in extremely short supply due to Chinese export restrictions. At the same time, global conflicts are fueling a defense boom that is causing demand and prices to skyrocket. Investors are now turning to companies that offer security of supply or technologies that are crucial in warfare. Three players are coming to the fore in this tense environment: Almonty Industries, Rheinmetall, and the RENK Group.

ReadCommented by André Will-Laudien on August 6th, 2025 | 07:30 CEST

DAX celebrates, Palantir sets the pace! Strong rebound for Almonty, Mutares, and Steyr!

It is earnings season, with over 200 quarterly reports coming in from around the world every day. Investors are focusing heavily on revenue growth at defense companies. This is because they should benefit significantly from the lavish contracts awarded by NATO and other defense-oriented countries. The environment remains unstable, and geopolitically, anything is possible. However, defense stocks have often risen so far that the hoped-for earnings figures for 2027 to 2030 are already reflected in today's prices. But the rally continues! After a sharp correction at Almonty Industries, many are delighted to have a cheaper entry point into the tungsten expert, as strategic metals are high on the shopping list, especially in the defense sector. The problem is that they are scarce and difficult to obtain. Where are the opportunities for investors?

ReadCommented by Fabian Lorenz on August 6th, 2025 | 07:25 CEST

Hensoldt disappoints! Puma collapses! And what is Silver North's share price doing?

Silver has outperformed gold in the current year. Investors can benefit from this with Silver North Resources shares. Positive news flow is expected, and following the successful capital increase, the share price can now resume its upward trend. Strong half-year figures should lead to a breakout from the sideways trend for Hensoldt shares. However, the figures were rather disappointing. The defense boom and supercycle are not really benefiting the radar specialist. Puma shares collapsed after the profit warning – and a rebound has not yet materialized. At least one insider is stepping in. Analysts' opinions are strongly divided.

Read