Investments

Commented by Stefan Feulner on October 14th, 2021 | 07:46 CEST

SAP, Kleos Space, Ballard Power - Igniting like a rocket

The storage and processing of data will be one of the themes of our society for the coming years. Big Data will create scientific advances and innovations, increasing the competitiveness of both science and companies across industries. Already today, innovative startups are working on the processing of larger amounts of data using artificial intelligence. The potential is enormous, the predicted growth rates gigantic.

ReadCommented by Armin Schulz on October 11th, 2021 | 11:30 CEST

Allianz, wallstreet:online, Commerzbank - Quo vadis stock markets?

The markets are highly nervous at the moment. First, the Corona numbers went up again, then the Chinese real estate giant Evergrande was on the verge of collapse, and the supply chains are still not back in step. The result was falling indexes. That automatically leads to more fear, as the Fear and Greed Index also showed. Last week, the market calmed down slightly, and the fear index dropped from 27 to 34 points. In Germany, there is also the fact that more people have dabbled in equity investments due to a lack of interest rates. According to the Global Wealth Report, the purchase of securities grew by 65%. Many of the newly added shareholders know only rising stock markets. Consolidation would not hurt the market. On the other hand, there is hardly any alternative to investing money at the moment. It remains exciting.

ReadCommented by Stefan Feulner on October 11th, 2021 | 10:26 CEST

Deutsche Post, Memiontec, Bayer - Here is where the action is

After heavy losses in recent weeks - the DAX losing more than 1,200 points at its peak and briefly slipping below the 15,000-point mark - the mood is brightening again. The German benchmark index, now made up of 40 members, is back on track for a year-end rally despite concerns about stagflation. The 16,000 peak beckons once again. Individual stocks are likely to outperform in the final weeks of the stock market year based on the recently reported fundamental data.

ReadCommented by Stefan Feulner on October 7th, 2021 | 12:00 CEST

Palantir, wallstreet:online, Commerzbank - Significant steps

Stock market trading experienced a real boom last year as a result of the Corona lockdowns. New shareholders, primarily from Generation Z, took a liking to trading in companies. Online brokers' revenue and profit numbers shot through the roof. During the second quarter of 2021, growth now stagnated. The wheat is separating from the chaff. Companies with unique selling points, such as wallstreet:online AG, will continue to grow. Many others will disappear from the playing field.

ReadCommented by Armin Schulz on October 1st, 2021 | 12:05 CEST

JinkoSolar, Memiontec, Encavis - How to profit from the Federal election

Since the Federal election on September 26, it seems clear that the Greens will be in the government. Whether a traffic light or Jamaican coalition, without the Greens, only the GroKo remains, and that is as good as impossible with the CDU as a junior partner. Annalena Baerbock has already made it clear that her party wants to push through demands regarding sustainability. Germany will therefore have to increase its efforts once again. Renewable energies will continue to be promoted, while CO2 emissions will be penalized. This approach can be observed almost everywhere in the world. Reason enough to take a closer look at three companies that are committed to sustainability.

ReadCommented by Nico Popp on October 1st, 2021 | 10:35 CEST

ProSiebenSat.1, wallstreet:online, FlatexDEGIRO: Investing in the power of the media

When Sebastien Thill of Moldovan Champions League participant Sheriff Tiraspol scored the 2-1 winning goal against Real Madrid at the time-honored Bernabeu Stadium a few days ago, the euphoria knew no bounds. When Thill glanced at his smartphone in the hours after the final whistle, the Luxembourger must have been amazed once again: He had received hundreds of messages via social media. The example of the footballer, who was largely unknown until a few days ago, vividly illustrates the power of the media. Just a few seconds in the spotlight are enough to draw millions of people's attention to a topic. The three companies we are presenting today show that money can also be made from this phenomenon.

ReadCommented by André Will-Laudien on September 24th, 2021 | 13:34 CEST

Tencent, Memiontec, Gazprom - Buy when the cannons are firing!

The last few trading days have been dominated by the scandal surrounding China Evergrande. To take pressure off the markets, the management and China's central bank have reacted accordingly and presented measures. The highly indebted real estate company has probably reached an agreement with domestic creditors regarding the outstanding interest payments. No mention was made of offshore liabilities. The People's Bank of China has reportedly injected 90 to 110 billion yuan, the equivalent of just under 14 billion euros, into the banking system in an attempt to calm investors' nerves. Nightingale, "we" hear you galumph!

ReadCommented by Nico Popp on September 22nd, 2021 | 12:04 CEST

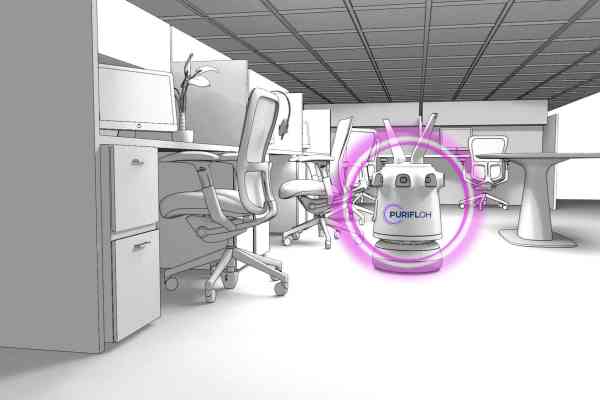

Nordex, PuriflOH, JinkoSolar: Investing in a better world

To make the world a better place. That is the concern of all entrepreneurs - although one can no doubt argue about innovations in detail. There is no doubt about renewable energy and clean water. Every innovation in these areas pays off not only monetarily but in a variety of ways. We profile three stocks that are doing good.

ReadCommented by Carsten Mainitz on September 20th, 2021 | 11:05 CEST

wallstreet:online, Commerzbank, MorphoSys - Things are looking up again!

The stock market environment remains positive. High inflation coupled with low interest rates makes stocks the right investment vehicle. If you are looking for stocks that are noticeably behind the course highs of the last 12 months, you should take a closer look at the following somewhat different companies. Who is ahead at the end of the year?

ReadCommented by André Will-Laudien on September 16th, 2021 | 11:58 CEST

Siemens Healthineers, PuriflOH, Fresenius, Novavax - Focusing on health!

The pandemic outbreak in 2020 ushered in a new era. People's health is once again moving to the center of attention. Politicians worldwide see themselves obligated to make public life safe, but whether this will be 100% successful remains questionable. Ultimately, it will depend on the commitment of private companies to what extent the existing health issues can be solved and by what means. On the capital markets, the healthcare sector has been sailing on the highest wave for months because the dangers for billions of people need to be reduced, and framework conditions for public life need to be created. Who benefits the most?

Read