Commodities

Commented by Carsten Mainitz on January 27th, 2026 | 07:20 CET

Let profits run: Power Metallic Mines, Barrick Mining, and TKMS – There is still a lot of potential here!

The bull market for precious metals is gaining momentum. Gold and silver reached new historic highs with prices above USD 5,000 and USD 100 per troy ounce. Prices for critical raw materials and industrial metals are also rising. This is fueling further price increases for precious metal and commodity producers such as Barrick Mining. Up-and-coming producers such as Power Metallic Mines, whose assets have strategic value due to their jurisdiction, size, and quality, also offer promising opportunities. In addition, defense stocks continue to be popular with investors.

ReadCommented by Fabian Lorenz on January 27th, 2026 | 07:15 CET

Silver is unstoppable! Defense stocks in demand! Steyr Motors, Deutz, and Silver North Resources in focus

Silver is currently breaking all records and even eclipsing its big brother, gold. Yesterday, the price of silver climbed to over USD 108. And for good reason: the precious metal is not only a crisis currency, but is increasingly becoming a "critical commodity." Investors who want to profit should not only look at the basic investments, but also at the second-tier winners. In the case of silver, this is Silver North Resources. The explorer's two projects in Canada are so convincing to investors that the current capital increase has been topped up, and the Company is fully financed for two years. The stock now offers an entry opportunity. Steyr Motors shares are also back in the fast lane. A framework agreement with minimum purchase quantities from Asia is providing new momentum. Deutz shares are close to their all-time high. Both engine manufacturers are benefiting from the defense boom.

ReadCommented by Stefan Feulner on January 27th, 2026 | 07:05 CET

Alamos Gold, DRC Gold, Rio Tinto – Gold, silver, and metals poised for another surge

Gold and silver are racing from one high to the next, sending a clear signal to the markets. What was long considered a short-term flight to safety is increasingly becoming a structural trend. Exploding government debt, persistent inflation risks, and a fragile geopolitical situation are increasing the need for investors worldwide to hedge their bets. In this environment, industrial metals and strategic commodities are coming into focus alongside traditional precious metals. Supply bottlenecks, geopolitical dependencies, and rising demand due to the energy transition and digitalization suggest that 2026 could be another profitable year not only for gold and silver but for the entire commodities sector.

ReadCommented by Fabian Lorenz on January 26th, 2026 | 07:15 CET

Record highs for gold, silver, and copper! But tungsten is really taking off! Almonty shares are eclipsing Barrick Mining and MP Materials!

Commodity prices are running wild. But anyone who thinks that developments in gold and silver are record-breaking should take a look at tungsten. It is increasingly becoming the number one critical metal. Within a year, the price has surged from just over USD 300 to more than USD 1,200. Almonty Industries is benefiting from this. Almonty Industries is benefiting from this. From the perspective of CEO Lewis Black, however, the price itself is not the decisive factor, but something else entirely. Although tungsten is increasingly emerging from the shadow of rare earths, it is still the rare earths that dominate the headlines. MP Materials has both the US government and Apple on board, and analysts continue to see outperformance. Barrick Mining should also be making a fortune at the moment. Not only is gold at record levels, but copper is too.

ReadCommented by Nico Popp on January 26th, 2026 | 07:05 CET

Silver boom for First Majestic & Co.: How Silver Viper Minerals could become the next big takeover story following the Vizsla playbook

The silver market is experiencing a structural supply deficit so severe that it threatens the industrial supply chains of the future. While the photovoltaic and electric vehicle industries are absorbing every available ounce of the precious metal, geologists and investors are looking intently at the Sierra Madre Occidental in Mexico. This mountain range is not only historically the heart of global silver production, but it is also still the place where exploration successes can make investors rich. There is a dynamic reminiscent of the great gold rush: anyone who strikes high-grade veins here can multiply the value of their company in no time. But the easy deposits have long since been found. Today, the key to success lies in applying modern geological models to forgotten or overlooked districts. In this environment, Silver Viper Minerals is positioning itself as an explorer that has precisely the ingredients that have already led to spectacular price gains for its competitors in recent years. While the market is still focused on the big producers, Silver Viper is preparing the next big discovery story in the shadow of the giants.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:05 CET

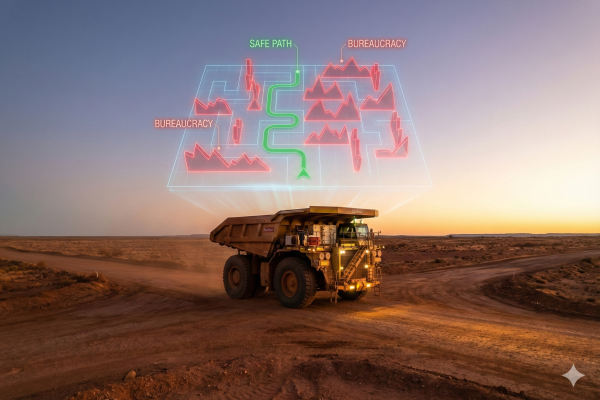

The battle for resources is being fought in the data room: How Aspermont Uses AI to Boost the Returns of Rio Tinto, Alamos Gold & Co.

It is the greatest paradox of the modern economy: while demand for copper, lithium, and rare earths is exploding due to trade wars and the insatiable appetite of the AI industry, building a new mine has never been more difficult. Large mining corporations are increasingly failing not because of geology, but because of bureaucracy, environmental regulations, and, in remote regions of the world, geopolitical pitfalls. In this new era, where a legally binding permit is often more valuable than spectacular drilling results, validated information is becoming the most critical resource in the commodities sector. Analyst firms such as McKinsey and the International Energy Agency (IEA) warn of a massive structural supply deficit, as the development of new mines in the West often requires more than a decade of legal wrangling. It is precisely in this area of tension that the Australian media and tech company Aspermont is positioning itself as the decisive problem solver. With a treasure trove of data spanning centuries of industrial history and a new alliance with industry giant Rio Tinto, the Company is transforming itself from a media company into a kind of "Google of mining" – offering investors an opportunity based on intelligence rather than luck.

ReadCommented by Fabian Lorenz on January 23rd, 2026 | 07:00 CET

World class! Over 80% upside potential! RENK, TKMS, and Power Metallic Mines in focus

Once again, world-class results from Power Metallic Mines. The NISK multi-metal deposit in Canada is delivering exceptional data for gold, silver, copper, palladium, and platinum. Analysts are enthusiastic and recommend the stock as a "Buy" with upside potential of more than 80%. Analysts have never seen such grades before, especially for copper. Like commodities, defense companies are also beneficiaries of geopolitical uncertainty. Most recently, US President Donald Trump's speech at the World Economic Forum in Davos confirmed that old alliances are no longer reliable and that billions must be invested in commodity security and self-defense. RENK and TKMS stand to benefit from this. The shipbuilding group is currently riding a wave of success.

ReadCommented by André Will-Laudien on January 22nd, 2026 | 07:10 CET

NATO under pressure – Is silver the new gold? Dream returns with Silver North, fresh momentum for Rheinmetall and TKMS

Geopolitical upheavals are exposing deep rifts of trust between the superpowers. The US approach toward Greenland is reminiscent of long-outdated colonial practices and has alienated the political actors involved. As a result of this blunt conduct on the international stage, trust in political institutions is eroding, and long-standing alliance structures are beginning to fall apart. The wobbling of the transatlantic alliance, NATO, marks a new level of tension and escalation. What this means for the capital markets in the short term remains unclear. However, what is already evident is the almost daily appreciation of gold and silver, along with another surge in valuations of defense stocks. A scenario of rising interest rates is also looming on the horizon. None of this is good news, and investors would be well advised to examine their portfolio structures for weaknesses. Here are a few ideas.

ReadCommented by Carsten Mainitz on January 21st, 2026 | 08:20 CET

These specialists continue to generate significant profits: Globex Mining, Barrick Mining, and Mutares!

Gold is approaching the USD 5,000 mark, while silver is trading at almost USD 100 per ounce. Given these bullish prices, precious metal producers such as Barrick are enjoying substantial profits. Business is also going well for specialized investment companies such as Mutares. The Munich-based company recently announced the largest purchase in its history. However, the transformative nature of this move has not yet been priced into the share price. Globex Mining offers an exciting mix of commodities and investment vehicles with a broadly diversified portfolio of 269 commodity assets. The stock holds significant revaluation potential.

ReadCommented by Carsten Mainitz on January 20th, 2026 | 07:25 CET

Never change a winning team! This triumphant trio belongs in every portfolio: Almonty Industries, TKMS, and Rheinmetall

In the current year, the old favorites remain the new favorites: defense and commodities. Geopolitical tensions and rising defense budgets, as well as demand for critical commodities, are shaping the big picture. Reflecting these conditions, defense stocks and shares in raw materials producers should continue to rise. Almonty Industries stands out in particular. Rising tungsten prices provide significant leverage for Almonty Industries, currently the largest tungsten producer outside China. When will the next price surge come?

Read