Biotech

Commented by Nico Popp on June 14th, 2022 | 12:26 CEST

Unheeded crisis signals! What is next: BioNTech, Lufthansa, Triumph Gold

There are always comeback stocks on the stock market. The airports are full of travellers who are being drawn to distant countries. So the tourism industry, and airlines too, could almost strap themselves in for a comeback. If only it weren't for the new BA.5 virus variant, which has infected large parts of the population in Portugal within a very short time. It seems investors have to choose between travel stocks and pandemic stocks when looking for comeback stocks - or is there a laughing third party?

ReadCommented by Armin Schulz on June 10th, 2022 | 11:48 CEST

BioNTech, NervGen Pharma, Valneva - Which stock will make the breakthrough in incurable diseases?

The number of cancer patients increases every year, and only if the disease is detected at an early stage might a cure still be possible. With other diseases such as multiple sclerosis or Alzheimer's, there is no chance of a cure at all. The deterioration progresses slowly and unstoppably. COVID-19 has also shown us how vulnerable humanity is to a virus. But many biotech companies have taken up the fight against these diseases. Any drug that can stop the progression of these diseases would help those affected. Many biotech stocks have corrected significantly recently. Today we take a look at three companies and their existing potential against incurable diseases.

ReadCommented by Juliane Zielonka on June 9th, 2022 | 12:25 CEST

wallstreet:online, Alibaba, Novavax - Digital pioneers and old hands

The number of young investors in Germany is rising steadily. To date, it stands at 49,000 people who are actively involved in their retirement planning. Both private and institutional investors are discovering the field of neobrokers as an investment. wallstreet:online AG is a candidate from the field with its own community. Alibaba founder Jack Ma has recognized that money has to keep moving in order to flow and is launching the first digital bank in Singapore. Things are somewhat more leisurely in the pharmaceutical sector: with Novavax, Americans now have four vaccines to choose from.

ReadCommented by Carsten Mainitz on June 8th, 2022 | 11:35 CEST

Valneva, Defence Therapeutics, Bayer - Blockbusters: Turbos for your share portfolio!

Blockbusters are drugs with which companies generate sales of more than USD 1 billion per year. Corona vaccines are currently an integral part of the global hit list. But also many application areas in different cancer fields or cardiovascular diseases offer a large market worth billions. Like BioNTech, a company with the right pipeline and the resulting compounds can quickly evolve from a start-up into an established and profitable player.

ReadCommented by Carsten Mainitz on June 7th, 2022 | 11:32 CEST

XPhyto, BioNTech, MorphoSys - The next price wave is coming!

In recent years, Corona has been the most urgent topic that has moved the world and the stock markets. Health care is and remains a megatrend. It is in the nature of things that the focus changes over time. Innovative approaches or forms of drug delivery, on the other hand, remain perennial favorites. There is also a lot of progress in research against cancer. These companies will play a major role in the future.

ReadCommented by Stefan Feulner on June 1st, 2022 | 14:03 CEST

After the slump in biotech stocks - Bavarian Nordic, XPhyto and Evotec under review

Biotechnology experienced a boom in March 2020, when the world realized what biotech innovations could do to fight COVID-19. Investors pounced on the many promising technologies, driving up the stock prices of vaccine producers and making it easier for companies to raise capital for financing. However, since September of last year, the biotech sector has been on a steep downhill slide, at least on the stock market. The NASDAQ Biotechnology Index has lost more than 30% of its value since its high of 5,449.26 points until today. This drastic decline is reminiscent of the bursting of the bubble in the year 2000. But where are the opportunities now, and which stocks should investors rather refrain from investing in?

ReadCommented by Fabian Lorenz on June 1st, 2022 | 13:44 CEST

Rain of money for BioNTech shareholders: What are Nordex and Meta Materials doing?

BioNTech shareholders are in for a windfall. A dividend of EUR 2 per share is to be approved at today's Annual General Meeting. Also on the agenda is a share buyback program with a volume of up to USD 1.5 billion. In addition, analysts at Goldman Sachs have commented positively on the German biotech champion. Meta Materials shareholders are still a long way from a dividend. But the hot stock has announced exciting details about its fight against stroke. At Nordex, by contrast, supply chain problems, plant closures and cyberattacks dominate the headlines. But analysts see the light at the end of the tunnel - and rightly so?

ReadCommented by André Will-Laudien on May 31st, 2022 | 12:03 CEST

Watch out: BioNTech, NervGen, MorphoSys, Valneva: Biotech shares in check!

The initial sell-off in biotech stocks seems to have been digested. With last week's NASDAQ turn, spring air is now moving through the stock markets again. That is because many investors realize that, in the face of a multitude of new diseases, a major research effort is needed to protect humanity from the burgeoning dangers. Financing via the stock market was correspondingly easy for the biotech giants during the last pandemic because investors sensed big profits in the event of success. This picture is likely to repeat itself in the next movement. Where are the current opportunities in the biopharma sector?

ReadCommented by Juliane Zielonka on May 27th, 2022 | 12:39 CEST

BioNTech, XPhyto Therapeutics, Snap Inc. - Tech falls, biotech gains

The bearish market continues to slide. Tech companies like Snap Inc. saw share price declines of 31%. An alternative to high growth stocks are life science accelerators like XPhyto Therapeutics Corp. They are betting on the right partners and funds to bring biotech products to market faster than usual. While still with emergency approval, BioNTech is at the starting line for a Corona vaccine. Both German STIKO and partner Pfizer in the US are now targeting children for a COVID-19 vaccine.

ReadCommented by Stefan Feulner on May 23rd, 2022 | 13:01 CEST

BioNTech, Monkeypox, Defence Therapeutics, Valneva - Is the next threat coming after Corona?

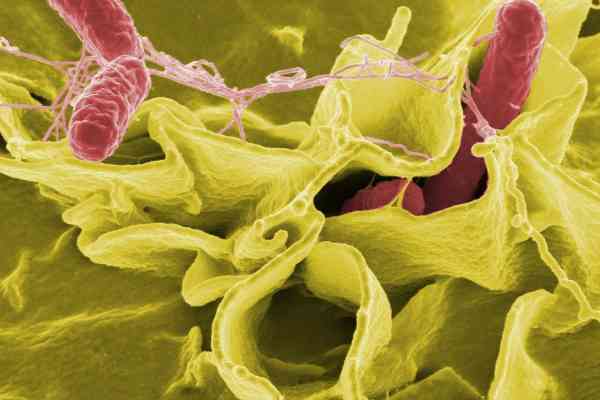

The Corona pandemic is not over yet, but we should already prepare for future viruses. The next pandemic will come. When it will come is uncertain, and so is which pathogen will we have to deal with. Monkeypox is now spreading globally, and there are already the first cases in Germany. We find out what is known so far, where the dangers lie and what opportunities there are for the biotechnology sector from Dr Moutih Rafei, a renowned pharmacologist and head of research and development at the innovative company Defence Therapeutics Inc.

Read