Comments

Commented by Carsten Mainitz on June 9th, 2021 | 10:41 CEST

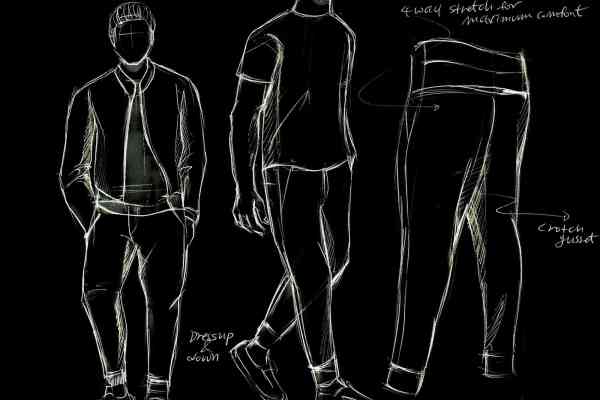

SAP, RYU Apparel, Zalando - Do not miss it!

The Internet has turned our lives upside down and is now indispensable. According to a forecast by Statista, around EUR 2.37 trillion will be generated in the B2C e-commerce market with physical goods in 2023. According to this forecast, the fashion sector will account for the largest share of sales, at EUR 816.55 billion. The increasing importance of e-commerce is also reflected in the sales performance of global players such as Amazon. Be surprised by three exciting stocks.

ReadCommented by André Will-Laudien on June 9th, 2021 | 10:41 CEST

BYD, Nordex, Kodiak Copper: The green revolution!

They have not yet been seen in the state elections of Saxony-Anhalt! However, the political green wave in Germany is starting to warm up for the federal election. Consumers expect greater awareness of the Paris Climate Agreement with corresponding measures in our country, especially in Europe. Already today, this is getting investors to focus correctly on the issues of the future. In plain language, this means continued tax incentives of the highest magnitude for so-called "environmentally friendly technologies" that include solar plants and wind power, including, above all, battery-powered mobility and hybrid vehicles. We shed light on some of the favorite stocks.

ReadCommented by Armin Schulz on June 9th, 2021 | 10:20 CEST

windeln.de, NSJ Gold, MorphoSys - High flyers of today and tomorrow

These are crazy times on the stock market and it is not easy to find the next high flyer. At the moment, even in Germany, there are gambler stocks, such as Adler Modemärkte. Markets are at their all-time highs and even if many cannot comprehend it, I guess you have to get used to it. Money that would otherwise have gone into government bonds flows into the equity markets, bringing a dividend yield instead of interest. Today we present three possible high flyers, whereby windeln.de has probably already gone too far.

ReadCommented by Stefan Feulner on June 9th, 2021 | 08:56 CEST

Plug Power, NewPeak Metals, Xpeng - Turbo stocks for your portfolio

Stock market stars of 2020, the shares of companies in the hydrogen, electromobility and fuel cell technology sectors, recovered after heavy losses in the first quarter and are currently on the verge of further price gains. Future prospects for these sectors remain intact. Due to the demand resulting from the energy transition, investors are also focusing on the necessary raw materials. In this context, the shift to a low-carbon economy is only at the beginning of a major upheaval.

ReadCommented by Nico Popp on June 9th, 2021 | 08:28 CEST

NEL, Troilus Gold, K+S: After the hype is before the hype

For some time now, more and more private investors have been flocking to the trading floor. New, low-cost smartphone brokers and innovative technologies have attracted these investors. Hydrogen stocks, in particular, triggered a stock market boom in 2020. But what is next for these new stock market investors when the shares of NEL, Ballard Power and others no longer perform? Where are there still opportunities? We provide answers.

ReadCommented by Carsten Mainitz on June 8th, 2021 | 11:25 CEST

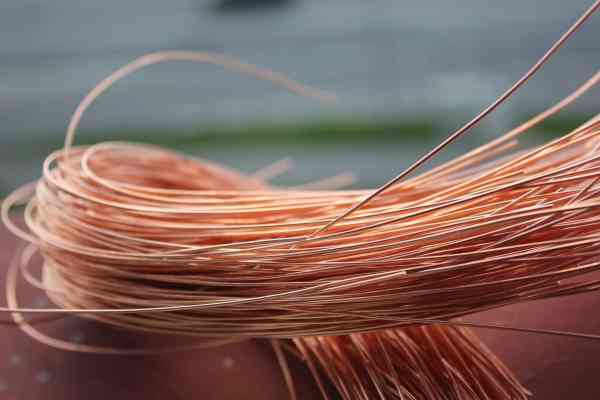

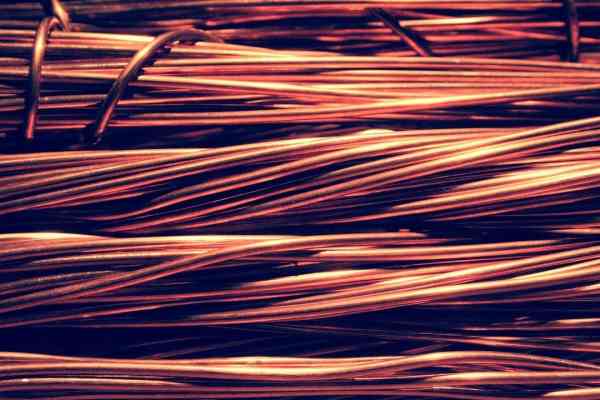

BYD, GSP Resource, Varta - Where do we go from here?

Electromobility is experiencing strong growth rates. The International Copper Association forecasts a considerable increase in demand for copper over the next 10 years, driven mainly by e-vehicles but also by industry and technology. Copper, lithium & Co are making the triumphant advance of electrification possible in the first place. We present you with exciting shares of the megatrend.

ReadCommented by André Will-Laudien on June 8th, 2021 | 11:13 CEST

TUI, TeamViewer, White Metal Resources - Is the breakout to the upside coming?

Calm is different! Actually, with volatility well below 20, there should be a noticeable calm in the market. However, this is not the case. There is high turnover in individual stocks and sectoral movements as not seen for 20 years. The reason for this is the number of active shareholders and market participants willing to trade since the many lockdowns. No longer under the supervision of the bosses, one or two trading platforms are simply running along at home. This increases the depth of trading and turnover on the stock exchanges - and 95% of all speculators are trading long. The percentage of shareholders is also growing steadily; in 2021, it could approach 10% in Germany. We look at stocks with breakout potential.

ReadCommented by André Will-Laudien on June 8th, 2021 | 10:15 CEST

The Power of Digital Media - AMC, ProSieben, Tencent, Aspermont

Sell in May and go away...in 2021, it has not yet worked. The weather in June is much warmer and the markets are rushing from one all-time high to the next. The DAX reached a new high yesterday at 15,732. The mood was outstanding, especially when it came to vehicle values. However, the excesses were slightly slowed down at AMC Entertainment. Now that the Company has placed three capital increases, some calm has returned. We look at a few special situations in this advanced bull market.

ReadCommented by Nico Popp on June 8th, 2021 | 08:25 CEST

Deutsche Bank, Commerzbank, Sierra Growth: Of fast money and true values

Prices are rising ever more sharply. Industrialized countries have now surpassed even the emerging markets in terms of inflation. For banks, the current market phase is rewarding: investment banking has become a mainstay and the prospect of higher interest rates also gives hope for the bread-and-butter business. We look at why investors should nevertheless not bet on bank shares and what alternatives there are.

ReadCommented by Stefan Feulner on June 8th, 2021 | 07:47 CEST

NIO, Almonty Industries, Daimler - The power struggle escalates

The US government bans American investments for 59 companies from China. They are accused of cooperating with the Chinese state apparatus and military. The response from Beijing is not likely to take long. The Middle Kingdom is pulling the strings concerning the globally planned energy revolution. Whether solar plants, wind turbines or electric cars. The switch from fossil fuels to a sustainable energy supply based on renewable energy requires many metals. At the moment, more than 80% of the production of rare metals takes place in China. The currently prevailing chip shortage could be just a precursor.

Read