XIAOMI CORP. CL.B

Commented by Carsten Mainitz on September 27th, 2021 | 12:20 CEST

Diamcor Mining, TUI, Xiaomi - Consumer stocks are among the winners!

To consume or to save? Everyone is faced with this fundamental decision. The individual rate depends on the level of income and the prospects regarding the labor market and economic growth. In the course of the Corona pandemic, private consumption declined significantly. With economic recovery and the removal of lock-downs, personal consumption is picking up again considerably. The companies mentioned above are benefiting from this.

ReadCommented by Stefan Feulner on September 13th, 2021 | 13:43 CEST

Xiaomi, Troilus Gold, Merck - First-class developments

Substantial gains were recently seen in consumer and producer prices in Germany and Europe. Inflation in Germany reached its highest level in almost 28 years in August and is close to breaking through the 4% mark. In contrast to central banks, which consider the rate of inflation to be temporary and continue to maintain an ultra-loose monetary policy with interest rates at zero percent, economists expect inflation to remain permanently high. There is a threat of a decline in the value of money, which could be slowed down by buying gold. Currently, the precious metal is still trading at a favorable level.

ReadCommented by Armin Schulz on August 30th, 2021 | 12:22 CEST

Porsche, Blackrock Silver, Xiaomi - These stocks are making headway!

Last week, the stock markets were eagerly awaiting the statements of US Federal Reserve Chairman Jerome Powell. His words reassured investors, as the tightening of the reins on the printing press is to be more gradual, and interest rate hikes are currently not an issue. From December, bond purchases are to be reduced by USD 15 billion. The US indices then rose again to near their all-time highs. But even without such events, which the whole world is watching, there are always stocks where exciting things are happening that can boost the stock market price. We are taking a closer look at three of these candidates today.

ReadCommented by Stefan Feulner on August 26th, 2021 | 12:15 CEST

NanoRepro, Aztec Minerals, Xiaomi - The tension is rising

On Friday, the US Federal Reserve symposium gets underway in Jackson Hole. The strong recovery of the economy after the Corona lockdowns and the strong pick-up in inflation pointed to an end of unlimited bond purchases and the first interest rate hikes. But FED Chairman Jerome Powell sees the rise as temporary and is likely to be right. Rising infection figures due to the highly contagious Delta variant are throwing a spanner in the works of further economic growth. Thus, both Jackson Hole and the upcoming FED meeting are likely to be a non-event.

ReadCommented by Carsten Mainitz on August 24th, 2021 | 13:28 CEST

Meta Materials, Xiaomi, SoftBank - Undiscovered potential!

Stagnation is regression. Companies that act too slowly in competition and can only adapt insufficiently to changing conditions lose out. Innovations are a path to success. Some innovations are so significant and far-reaching that a massive upheaval occurs with the technological leap achieved. Electricity and the Internet are well-known examples. AI, 5G, robotics and new materials will have changed our reality in just a few years. As new solutions, products and markets emerge, these stocks will benefit.

ReadCommented by Stefan Feulner on August 9th, 2021 | 11:24 CEST

Plug Power, Silver Viper, Xiaomi - The pressure is mounting

The Federal Reserve is in a tight spot. Due to positive labor market data, the US economy has created more jobs in July than at any time in a year; the bulk of market participants expect a swing in monetary policy soon. Due to the fear of interest rate hikes, the precious metals gold and silver fell drastically. But are the monetary authorities even in a position to raise interest rates significantly due to the general conditions? Probably not, which should cause both gold and silver prices to soar in the long term.

ReadCommented by Carsten Mainitz on August 3rd, 2021 | 09:58 CEST

EuroSports Global, Porsche, Xiaomi - Do not miss out: favorable valuation levels!

With the advancement of electromobility, electricity consumption will increase massively. That means challenges for power generation, the power grid and also the charging infrastructure. However, this does not necessarily mean an increase in household electricity prices, as the results of a Fraunhofer study suggest. The Fraunhofer Research Institution for Energy Infrastructures and Geothermal Energy IEG and the Fraunhofer Institute for Systems and Innovation Research ISI have investigated how electricity prices for private households will change in 2030 if the number of private electric vehicles continues to rise. According to this study, under certain conditions, the expansion of electromobility could help to simultaneously avoid CO2 and ease the burden on private households' wallets. Which of the following three eMobility stocks has the greatest potential?

ReadCommented by Carsten Mainitz on May 31st, 2021 | 11:45 CEST

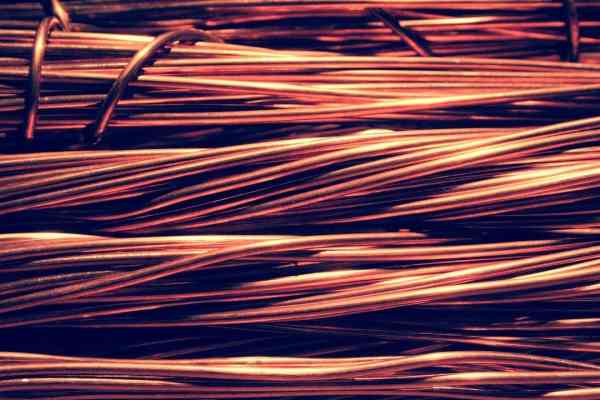

BYD, Kodiak Copper, Xiaomi - Copper: Buy or cash in?

The demand for copper will continue to grow. These are the findings of the recently published study by the International Copper Association (ICA). The ICA predicts that by 2030, more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors. But copper is also in demand in many other industries. Demand exceeding supply or supply bottlenecks can make the raw material more expensive overnight at any time. For this reason, today, we take a look at a budding copper producer. Of course, large demanders such as BYD or Xiaomi must not be missing in the consideration. After all, our everyday companion, the smartphone, contains 15% copper. Let us surprise you with three exciting investment ideas.

ReadCommented by Stefan Feulner on May 28th, 2021 | 08:40 CEST

Bayer, Osino Resources, Xiaomi - Here is what happens now

Pharmaceutical giant Bayer fails once again in court with settlement proceedings and is now calling for a new plan. A court ruling means a liberation blow for another company, which significantly increases the prospects for the future. Future prospects are also rosy for the precious metal gold due to fundamental conditions such as fear of inflation, loose monetary policy, and continued low interest rates. At the current level, there are excellent long-term entry opportunities with healthy profits.

ReadCommented by Stefan Feulner on May 17th, 2021 | 10:20 CEST

Plug Power, Defense Metals, Xiaomi - Easing or escalation?

A trade war between the US and China has been raging since 2018. Now, at the end of last week, news broke that the US Department of Defense has removed Xiaomi, a Chinese technology Company, from its blacklist and all sanctions will be lifted. A ray of hope in relations between the two superpowers? Probably not; after all, the dispute over human rights in China intensifies the conflict between the two countries. Should there be further escalation, the West faces a resource bottleneck that will not only jeopardize the energy transition.

Read