XIAOMI CORP. CL.B

Commented by Stefan Feulner on August 26th, 2024 | 07:30 CEST

BYD, Altech Advanced Materials, Xiaomi - Battle for the gold of the energy transition

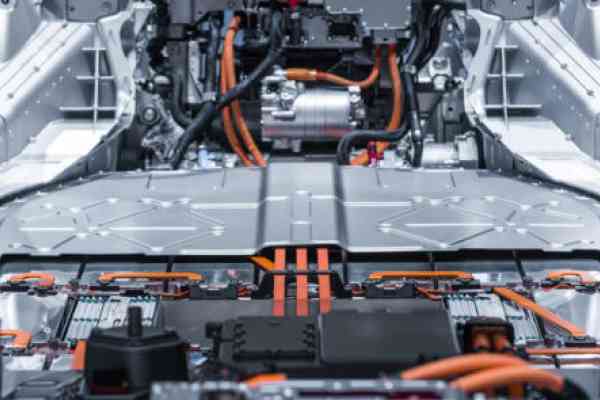

The energy transition is underway, and demand for electric vehicles is increasing, albeit more slowly than expected. Lithium has so far been fundamental to the electrification of transportation. To minimize dependence on China, which controls a large part of the mining and processing of the rare metal, the European Union is turning to Serbia, where considerable deposits for battery production lie dormant. However, in addition to lithium-ion batteries, there are alternatives "Made in Germany" that could set the future standard.

ReadCommented by Stefan Feulner on April 3rd, 2024 | 07:45 CEST

Ballard Power, Exasol, Xiaomi - Shares on the rise

The stock market year 2024 is entering its second quarter and has again started with record highs. The DAX reached new all-time highs of 18,571 points, while the Dow Jones broke through the 40,000-point barrier for the first time in its history. Despite the boom in the most important stock market barometers, many sectors are still in a deep sleep and are waiting to be kissed awake. The recent weeks have shown, with cannabis stocks as an example, how quickly a rebound can be initiated.

ReadCommented by Armin Schulz on March 13th, 2023 | 13:07 CET

First Majestic Silver, Blackrock Silver, Xiaomi - Is the silver price about to rise again?

Silver significantly outperformed gold from September into February. In 2022, silver demand set a new record of 1.24 billion ounces at an average price of USD 21.70. This year, the Silver Institute projects an average price of USD 23. Increased interest rates mean investing in precious metals is less attractive. If the interest rate policy of the FED changes, which is expected for the second half of the year, silver should also increase significantly again. Especially since industrial demand is growing due to the expansion of renewable energies and the electronics industry cannot do without silver, to name just two sectors. We, therefore, take a look at three companies around silver.

ReadCommented by Stefan Feulner on August 22nd, 2022 | 12:23 CEST

NIO, Almonty Industries, Xiaomi - China's advantage

Tensions between the United States of America and China are increasing due to the unnecessary provocation with Nancy Pelosi's visit to Taiwan. In the event of an escalation of the conflict, the Western economy would be hit by economic consequences not yet imagined. The Middle Kingdom has a virtual monopoly on several raw materials that are vital not only for the production of renewable energies. For years, the US, in particular, has been trying to reduce this dependence, but with little success so far. The few Western producers of rare raw materials thus face a golden future.

ReadCommented by Armin Schulz on January 10th, 2022 | 11:14 CET

Alibaba, Hong Lai Huat, Xiaomi - Asian stocks catching up?

The year 2021 was often a year to forget for investors in the Asian region. Chinese stocks, in particular, suffered from government regulation, causing many stocks to plummet despite good numbers. After the dip in 2020 due to the Corona pandemic, the economy made significant gains, but this rapid growth will not continue so quickly in 2022. Nevertheless, the first investors are sensing a trend reversal due to the discrepancy in stock market developments. While the US stock market climbed strongly in 2021, the Hang Seng fell 13% plus. There has not been such a difference since the Asian crisis. We take a look at three interesting shares from the Asian region.

ReadCommented by Stefan Feulner on November 30th, 2021 | 10:07 CET

RWE, Aspermont, Xiaomi - Regrouping after the sell-off

Omicron shakes the perfect stock market world. After the emergence of a new mutant in South Africa, the stock markets have plummeted. The end of the year-end rally seems to be sealed. The DAX is threatened with falling below the psychologically important mark at 15,000. But, on the other hand, investors are already taking advantage of the low prices again to invest in promising companies at more favorable price levels. Holding the important mark could still lead to belated Christmas presents despite the short break.

ReadCommented by Stefan Feulner on November 24th, 2021 | 10:13 CET

Nordex, Kodiak Copper, Xiaomi - Long-term trend

The current copper chart could have been copied from the textbook "Technical Analysis of Financial Markets" written by John J. Murphy. After a ten-year high at USD 10,720.15, the red metal corrected to the support zone at around USD 8,800. After several months of sideways movement, it is now heading north again. Once the USD 9,700 mark has been overcome, a new attempt to reach the five-digit range should only be a matter of time. Copper is in demand as never before and will remain so in the coming years.

ReadCommented by Stefan Feulner on November 8th, 2021 | 13:14 CET

Nikola, Kleos Space, Xiaomi - Earth is not enough

New technologies by adding satellites launched into space are increasingly used for a wide variety of services. Probably the most famous project is that of Tesla founder Elon Musk. The SpaceX "Starlink" project aims to make fast Internet available everywhere in every little corner of the world. In crime prevention, the view from above is also being used through the targeted use of satellite clusters. The market for this is gigantic and is still in its infancy.

ReadCommented by Armin Schulz on October 27th, 2021 | 11:43 CEST

Defense Metals, Nordex, Xiaomi - Battle for raw materials intensifies

China is scaling back its magnesium production due to electricity problems. The Chinese government is aiming to reduce energy consumption and thus emissions. It will inevitably lead to supply bottlenecks worldwide, and in Germany, it will initially affect the metal industry. However, since China produces 90% of the world's magnesium, there are, in fact, no alternatives. Similar problems exist with tungsten and rare earths, needed for almost all new technologies, from renewable energies to consumer electronics and e-cars. If you want to reduce this dependence, you have to look for alternatives.

ReadCommented by Stefan Feulner on October 22nd, 2021 | 13:23 CEST

Infineon, Sierra Grande Minerals, Xiaomi - New attack

2020 shows an extreme increase in government debt in the Eurozone. Due to the Corona Crisis, the ratio of public debt to gross domestic product increased to 90.7%, according to the Eurostat statistics agency. The situation worsened further in the crisis countries, especially in Greece. There, the debt-to-GDP ratio was 205.6%, followed by Italy with 155.8% and Portugal with 133.6%. There is no end in sight to this spiral. In the long term, however, investors can protect themselves by investing in the precious metals sector.

Read