VALNEVA SE EO -_15

Commented by André Will-Laudien on May 31st, 2022 | 12:03 CEST

Watch out: BioNTech, NervGen, MorphoSys, Valneva: Biotech shares in check!

The initial sell-off in biotech stocks seems to have been digested. With last week's NASDAQ turn, spring air is now moving through the stock markets again. That is because many investors realize that, in the face of a multitude of new diseases, a major research effort is needed to protect humanity from the burgeoning dangers. Financing via the stock market was correspondingly easy for the biotech giants during the last pandemic because investors sensed big profits in the event of success. This picture is likely to repeat itself in the next movement. Where are the current opportunities in the biopharma sector?

ReadCommented by Stefan Feulner on May 23rd, 2022 | 13:01 CEST

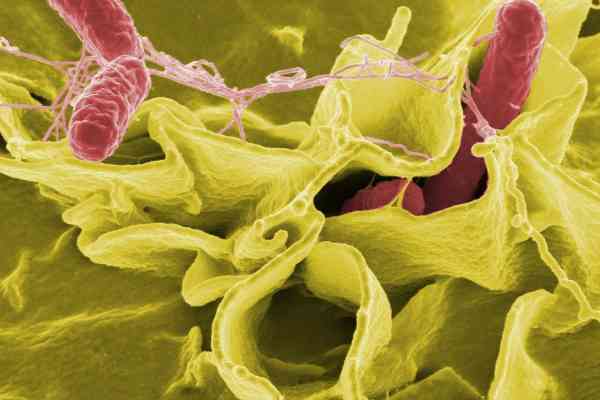

BioNTech, Monkeypox, Defence Therapeutics, Valneva - Is the next threat coming after Corona?

The Corona pandemic is not over yet, but we should already prepare for future viruses. The next pandemic will come. When it will come is uncertain, and so is which pathogen will we have to deal with. Monkeypox is now spreading globally, and there are already the first cases in Germany. We find out what is known so far, where the dangers lie and what opportunities there are for the biotechnology sector from Dr Moutih Rafei, a renowned pharmacologist and head of research and development at the innovative company Defence Therapeutics Inc.

ReadCommented by Juliane Zielonka on May 19th, 2022 | 11:14 CEST

Amazon, Edgemont Gold, Valneva - The real gold wins

Only 'cash is king' seems to be the motto of this stock market week. High inflation is bringing tech stocks to their knees, and heavy artillery is also being brought to bear on Valneva's dead vaccine development front. The EU Commission wants to cancel the preliminary contract if the vaccine is not finally delivered within a month. Depth is also to be expected at Edgemont Gold, only this time, good things are hidden there. The gold exploration company is getting promising results from its third drill hole.

ReadCommented by André Will-Laudien on May 18th, 2022 | 12:48 CEST

Biotech stocks: BioNTech, XPhyto Therapeutics, Novavax, Valneva - Crashing, the choice remains difficult!

For pure play vaccine companies, the environment is getting tougher. On the one hand, the winter is over, and on the other, Corona has lost its horrors, especially as the Omicron variant presented like a cold for most infected people. 77.6% of the German population have received at least one vaccination dose so far. 63.1 million people have thus already received basic immunization, and 49.5 million people went for another shot. Only 4.6 million people, or 5.5%, have already received a second booster vaccination. 18.6 million people have not been vaccinated, or 22.4% of the population. With currently only 4,000 vaccinations per day, the many millions of vaccine doses ordered are likely to remain on the shelf. For vaccine manufacturers, future orders will plummet. Which Company has a plan B in place?

ReadCommented by Nico Popp on May 17th, 2022 | 09:54 CEST

Alzheimer's share? Ask the CEO! Valneva, NervGen Pharma, Bayer

High blood pressure, diabetes, stroke and Alzheimer's disease are scourges of our time. As people in industrialized countries grow older, it becomes increasingly likely that they will also suffer from one of these diseases. While there is likely to be a genetic predisposition for all of the ailments mentioned, lifestyle also plays a role. Lack of exercise and obesity often leads first to high blood pressure, then to diabetes, and ultimately to even worse conditions. In the event of a pandemic, all people with such pre-existing conditions belong to a high-risk group. Reason enough to take a closer look at stocks related to these issues and ask how investors can profit.

ReadCommented by Nico Popp on May 5th, 2022 | 11:52 CEST

Biotech-Investments also work conservatively: BioNTech, XPhyto, Valneva

Biotech stocks are often seen as all-or-nothing investments - either a bet works out, or the companies disappear into oblivion. But innovative companies in the pharmaceutical and biotech sectors do not always operate in just one area. They are not always spectacular projects that are dependent on approval procedures. We outline the investment opportunities around three well-known biotech stocks.

ReadCommented by André Will-Laudien on May 2nd, 2022 | 13:27 CEST

BioNTech, Defence Therapeutics, Valneva, MorphoSys - Biotech stocks that will still be fun tomorrow!

One of the most churned areas on the growth stock market is the biotech sector. There was too much disappointment on the drug development side; even in the COVID sector, only a few winners remain. However, the current sell-off could turn out to be an entry opportunity in the medium term because there are more and more people on earth and, fortunately, they are getting older and older; even the Corona pandemic is not likely to change this. There are already 1 billion people worldwide over the age of 60, and forecasts predict that this figure will rise to 2 billion by 2050 - with a total population of more than 9 billion people predicted at that time. Which values have been unjustly neglected, and where are the current opportunities for investors?

ReadCommented by Carsten Mainitz on April 21st, 2022 | 12:57 CEST

Valneva, Power Nickel, K+S: The perfect mix for traders and long-term investors!

As is well known, the profit lies in the purchase. On the question of how quickly and in what amount this should be realized, traders and long-term investors certainly have quite different answers. The current market phase is interesting for both types of investors. For many sectors, such as commodities or life science, the general conditions are good, so the wave of success can be ridden further. Increased fluctuations also offer short-term opportunities.

ReadCommented by Nico Popp on April 20th, 2022 | 10:29 CEST

The million-dollar opportunity: Valneva, Edgemont Gold, BASF

No one can see into the future. But investors can estimate which topics will move share prices in the near future. There is not always a connection between what is important and what is played out in the media. Issues such as climate change are timeless but disappear from the front pages from time to time. It is currently a similar situation with the pandemic. We dare to take a look into the future and ask what could move prices this summer.

ReadCommented by André Will-Laudien on April 19th, 2022 | 10:49 CEST

Watch out: BioNTech, NervGen, Valneva, CureVac: The next waves of biotech stocks are rolling!

The start of spring - and where to now? The mild flu outbreaks due to the Omicron variant and associated massive relaxations of Corona measures in many countries are weighing on the prospects of vaccine manufacturers in the short term. After all, there are no clinical bottlenecks, and the vaccination rate does not want to increase despite massive public campaigns. Mandatory vaccination is also off the table, and for the biotech industry and vaccine producers, this results in a need to keep researching other topics! Many diseases are more dangerous for us humans than Corona. We look at important protagonists.

Read