VONOVIA SE NA O.N.

Commented by Nico Popp on September 19th, 2023 | 08:25 CEST

Interest rates at a high - What to consider now: Deutsche Bank, Vonovia, Viva Gold

The European Central Bank (ECB) recently raised interest rates by 25 basis points. For many market observers, this could mean that the benchmark interest rate within the Eurozone has reached its peak. In the US, the signs also point to a pause in interest rates. Here, we explain what this means for various asset classes and how investors should navigate the high-interest rate environment. Additionally, we will explore an interest-free alternative that has its merits for various reasons.

ReadCommented by Armin Schulz on September 18th, 2023 | 07:40 CEST

Deutsche Bank, Globex Mining, Vonovia - What are the consequences of the ECB's latest interest rate hike?

After a long period of zero interest rate policy, the ECB is stepping up the fight against inflation and last week raised interest rates for the 10th time in a row. The effects are very different. For banks, on the one hand, profit may increase via higher interest rates, but it may also decrease if fewer loans can be made. For commodities, the rise in interest rates in Europe could lead to a stronger US dollar. However, this is rather unlikely, as interest rates in the US are still higher. For the real estate sector, rising interest rates are poison. Loans are becoming more expensive, and thus, demand for real estate is falling. Today, we look at one company from each sector.

ReadCommented by Juliane Zielonka on September 5th, 2023 | 08:10 CEST

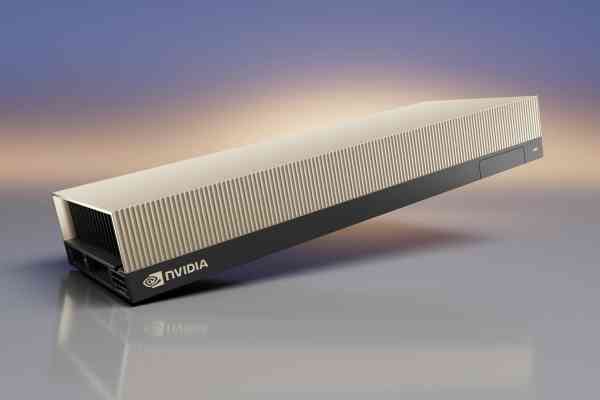

Gold rush mood at NVIDIA and Desert Gold - Concrete gold share Vonovia crumbling

Stock market darling NVIDIA is behaving bullish again after a moderate decline. Over 50% of NVIDIA's buying comes from S&P500 heavyweights like Microsoft, Google and Amazon. All these companies invest heavily in GPUs to develop AI models. The rising importance of Artificial Intelligence (AI) and the increased use of GPUs in this industry contribute to the increased demand for gold and other commodities used in the manufacture of GPUs. Desert Gold, an exploration and development company in Mali, is benefiting from this trend. Its main project, the SMSZ project, covers 440 sq km and has proven and indicated gold resources of 8.47 million tons with a grade of 1.14 g/t gold. The venerable concrete gold real estate market is currently experiencing severe dislocation. 31% of project development volume in Germany is experiencing delays in residential construction. We look at what investors should do now to protect their portfolios.

ReadCommented by Juliane Zielonka on August 11th, 2023 | 08:00 CEST

Viva Gold Corp., Novo Nordisk, Vonovia - Gold Rush in Nevada - Dampened mood in Bochum

Viva Gold Corporation is reporting promising progress at its Tonopah Gold Project. Drilling to date proves that the Company can expand new, shallow, high-grade zones of gold mineralization in the Nevada area. For those searching for affordable housing in Germany, affordable living space has become the new gold in recent years. In light of the latest quarterly results, Group CEO Rolf Buch says Vonovia should be charging EUR 20 rent per sqm. Affordable housing is thin on the ground in Germany. Thin is the magic word for the fat plus of the Novo Nordisk share. Since the weight loss injection Ozempic has been on the market, the share price of the Danish pharmaceutical company has been rising inexorably.

ReadCommented by Fabian Lorenz on August 10th, 2023 | 08:00 CEST

Caution with Nikola share! Are Vonovia and Desert Gold bargains?

Hype stock or bargain? The Nikola share is undoubtedly one of the stock market stars of recent months. Within two months, the share has multiplied to EUR 3. Now, it has crashed to EUR 2. Is the hype over? Caution is advised. The Company is running out of capital, and the boss is jumping ship. In contrast, shares such as Desert Gold and Vonovia are at rock bottom. However, the gold explorer is a real bargain. Could the stock rise now? Analysts also see significant upside potential for Vonovia. Despite this, the DAX-listed group has had to make massive write-downs on its real estate portfolio. Where is the rise worthwhile now?

ReadCommented by Juliane Zielonka on August 4th, 2023 | 07:40 CEST

Saturn Oil + Gas, Vonovia, First Hydrogen, VW - How energy and propulsion are changing the markets, winners, and losers

Saturn Oil & Gas is adding three experienced forces to its leadership team. Janet Yang brings her expertise in finance and strategy, Andrew Claugus is a versatile petroleum engineer, and Grant MacKenzie will serve as Chief Legal Officer. Their knowledge and years of experience in the oil and gas industry make them valuable resources for the Company and its future development. Vonovia is severely undervalued due to the current real estate situation in Germany. First Hydrogen is making strides with a hydrogen refueling that covers a distance of 630 km, while Volkswagen is reducing the production of its electric car, ID.4. Let's find out who the winners and losers are in the stock market this time.

ReadCommented by Armin Schulz on July 27th, 2023 | 07:15 CEST

BioNTech, Defiance Silver, Vonovia - Waiting for the turnaround

The stock market is not a one-way street, so it happens time and again that companies that initially performed well run into problems, leading to falling prices. After an extended period of underperformance, bargain hunters often step in, seeking the right entry point to profit from a potential turnaround. One announcement can turn the tide and influence the price of a stock. We have selected three candidates where a turnaround could be imminent, provided an appropriate news catalyst exists.

ReadCommented by Nico Popp on June 20th, 2023 | 07:00 CEST

Real estate - A golden future: Vonovia, BYD, Grid Metals

The numbers are shocking. The number of building permits in Germany plummeted by 32% in April compared to the same month last year - the sharpest drop since 2007. What is the reason behind this sudden halt in construction? What makes real estate future-proof today? And which stocks can profit? We take a look at the current trends for you.

ReadCommented by Nico Popp on June 7th, 2023 | 08:45 CEST

Buy (concrete) gold below value: Vonovia, Aroundtown, Desert Gold

Real estate was the Germans' favourite asset class for years - until the interest rate hammer came. In the meantime, prices for many residential properties have fallen back. There was simply hardly any demand left. Here we explain why the shares of real estate companies are still under pressure and which asset class could soon overtake real estate.

ReadCommented by Nico Popp on May 31st, 2023 | 09:00 CEST

Electrification wave! How investors can benefit: Siemens Energy, Vonovia, Defiance Silver

The electricity supply in Germany is a hot topic. Now even the German Trade Union Federation is calling for a guaranteed maximum price for industrial electricity. Critics fear that this would provide too little incentive for industrial companies to adapt to the new conditions - if electricity is cheap, there is no need to save, so the argument goes. We present three stocks related to the energy transition and shed light on their medium-term prospects.

Read