AIXTRON SE NA O.N.

Commented by Stefan Feulner on November 29th, 2023 | 09:55 CET

Aixtron, Blackrock Silver, Coinbase - Ready for the year-end rally

Bets are increasing that the US Federal Reserve may have at least paused to raise interest rates further. This prompted the gold price to reach a six-month high of USD 2,016 per ounce. As with its little brother silver, the signs point to further price rises in the short term. The world's largest cryptocurrency, Bitcoin, even reached a new high for the year of over USD 38,000. Optimists are already anticipating prices well above the USD 50,000 mark.

ReadCommented by Stefan Feulner on March 1st, 2023 | 14:10 CET

Aixtron, Altech Advanced Materials, Sixt - Prospects remain rosy

Despite the continued uncertain environment of the Ukraine war, inflation and rising interest rates, many companies are surprising positively in their full-year 2022 figures. In addition, forecasts are extremely positive despite pessimism regarding the struggling global economy. In terms of innovations, too, the trend is steeply upward. In this context, one German company in particular could rise to become a leading player in battery technology.

ReadCommented by Stefan Feulner on October 19th, 2022 | 10:44 CEST

Deutsche Bank, Meta Materials, Aixtron - A time for optimists

Fears of a global recession and a hard landing of the economy are becoming more likely every day. The sharp rise in the US dollar, the energy crisis in Europe and the slump in growth in China are the main reasons for the prevailing pessimism. Concerns about a further sell-off are also growing on the stock markets. Last week, for example, the Fear & Greed Index peaked at 18 with the verdict "extreme fear". In parallel, the S&P 500 also marked its interim low. Since then, the signs have been pointing to recovery, both in sentiment and on the markets. An opportunity for the optimists!

ReadCommented by Stefan Feulner on August 3rd, 2022 | 12:52 CEST

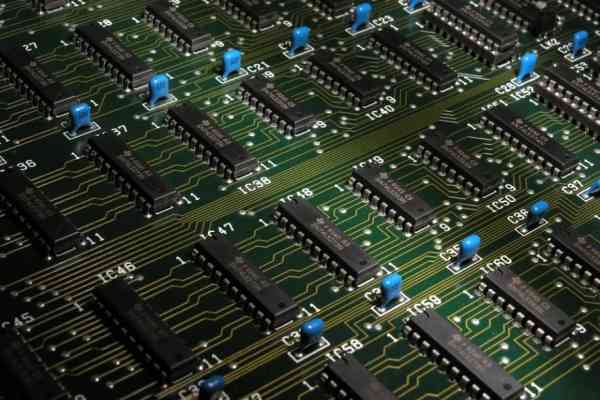

Is the turnaround coming for chip stocks? Intel, Nvidia, BrainChip, Aixtron and AMD

Last year, semiconductors were declared the new gold due to blown-up supply chains and the resulting shortages. After the recent boom and the build-up of overcapacity, the market could now grind to a halt by 2023 at the latest. High inflation, a global economic downturn and a possible recession in the industry could do the rest. Last week, Intel was already in the red with a slump in sales. In contrast, other companies from the chip sector could report positive surprises.

ReadCommented by Carsten Mainitz on February 10th, 2022 | 13:40 CET

Alerio Gold, Aixtron, Siltronic - The signs point to growth!

The US Federal Reserve (Fed) has for some time begun to scale back bond purchases massively and will raise the key interest rate at its next meeting in March. Semiconductor manufacturers have indicated that the chip shortage will level off over the course of the year. How will these developments affect commodity prices and cryptocurrencies?

ReadCommented by Stefan Feulner on December 16th, 2021 | 11:42 CET

Formycon, CoinAnalyst, Aixtron - Buy the dip

As an investor, who would not wish to buy stocks after a major setback at their lowest point and then go straight back to the top with them? The "buy the dip" strategy is mainly heard from self-appointed gurus from the crypto scene. But beware. Although major setbacks have recently emerged as lucrative buying opportunities in the highly volatile segment, Bitcoin & Co. are threatened with another slide to an even lower level.

ReadCommented by Carsten Mainitz on December 1st, 2021 | 10:44 CET

Defense Metals, Aixtron, TUI - Winners or losers?

Supply chain problems have hit many industries hard in the wake of the Corona pandemic. Essential parts and components were missing, and as a result, production lines at automotive manufacturers, among others, came to a standstill. In addition, raw materials and components such as chips have become much more expensive. Now, in the wake of the new wave of the pandemic, there are signs that the situation will worsen. Who are the winners, and who are the losers?

ReadCommented by Stefan Feulner on November 25th, 2021 | 13:42 CET

XPeng, Meta Materials, Aixtron - Welcome to the Metaverse

Sound fundamental analysis is essential to be successful in the stock market in the long term; at least, this was the basic rule before the Reddit hype about GameStop & Co. The news that Facebook wants to reinvent itself under the name "Meta" prompted investors to buy shares in the Company of the same name. The Company is quite promising and has great potential in the long term due to the development of new materials for 5G, photovoltaics and consumer electronics. From our side, "Congratulations, dear Meta shareholders."

ReadCommented by André Will-Laudien on September 6th, 2021 | 13:17 CEST

Tencent, Alibaba, Kainantu Resources, Aixtron - Asia on the rise!

The international supremacy of the USA is closely linked to the status of the US dollar as the world's reserve currency. However, the United States has turned the debt wheel too far and weakened itself through unwise policies. Outdated power interests and isolationism hinder economic dynamism, and they undermine well thought-out trade strategies. Asia has relied on modern infrastructure for decades, and not just at home. Public infrastructure in the US is dilapidated to the level of the last millennium. The new Silk Road and the takeover of international seaports and airports have recently given China a crystal-clear lead. That is why the Silk Road does not end in New York but Europe.

ReadCommented by Stefan Feulner on July 30th, 2021 | 13:28 CEST

Aixtron, Defense Metals, Nordex - Strong growth

The global economic recovery and rising investment in more climate-friendly energy infrastructure are driving higher commodity prices amid supply chain disruptions. Shortages of industrial metals, which are urgently needed for climate change, are likely to materialize further in the coming years. The swelling trade conflict between the USA and China will exacerbate this significantly. There is a threat of massive bottlenecks in production and sharply rising prices for the respective materials.

Read