LUFTHANSA AG VNA O.N.

Commented by André Will-Laudien on February 1st, 2022 | 13:47 CET

Lufthansa, TUI, Diamcor Mining, Aston Martin - Grab strong gains now!

Germany is home to more than 2 million people with assets of more than EUR 1 million - in 2010, this figure was still a good 600,000. The threshold for belonging to the top one per mille is rising steadily. Currently, liquid assets of around EUR 5.5 million are needed to belong to the wealthiest 1 per mille of Germans. Nevertheless, luxury is not only found among the rich because the desire for extravagance is a widespread character trait and less a question of money. We look at companies that rely on liquid clientele.

ReadCommented by André Will-Laudien on January 18th, 2022 | 12:13 CET

Lufthansa, TUI, Desert Gold - Explosive turnaround at the start of 2022!

There was no sell-off in 2021 after all. Although the DAX started to crash in October and November, and the 200-day line was clearly undercut on both occasions at 14,850 points, the market nevertheless held these lines. The crash prophets all went quiet again, and by the end of the year, the index was back to just under 16,000 points. Who would have thought it - twice a whole 1,200 points reversal as if nothing had happened. High inflation figures and Omicron fears could not push the high liquidity out of the market so far. At the beginning of 2022, there are signs of a rebound for some beaten-up stocks.

ReadCommented by Armin Schulz on January 14th, 2022 | 11:06 CET

Lufthansa, wallstreet:online, Block - Shares with catch-up potential

The nervousness was palpable as the US indices fell for five days in a row. Reasons for consolidation are quickly found - the Omicron variant, inflation and the fear of rising interest rates provide uncertainty for the bulls. Especially the big tech companies would suffer from an interest rate hike, and many tech stocks were already punished and investors preferred to invest in value stocks. If the interest rate hike comes, there will likely be further markdowns in the tech sector. Today, we look at three companies that we believe could be on the verge of a turnaround.

ReadCommented by Carsten Mainitz on January 12th, 2022 | 13:21 CET

Deutsche Lufthansa, Kleos Space, BYD - The picture is brightening up

Exploding infection figures, contact restrictions, and no prospect of improvement are some of the impressions one could get from the current news situation. In contrast, individual scientists are cautiously optimistic that the new variant could be the beginning of the end of the pandemic and the change to an endemic. In an endemic situation, people continue to become infected with the virus; however, by that time, most people's immune systems have already been exposed to the virus or are protected by vaccination, so there is no longer a burden on the health care system. A more normal life would thus be possible again, with significantly fewer restrictions.

ReadCommented by Armin Schulz on January 7th, 2022 | 13:53 CET

Lufthansa, Prospect Ridge Resources, S&T - Profits beckon here

2022 is beginning like 2021 - Corona is still the number one topic. Despite the pandemic, one can draw hope from the past year because, despite all adversities, the shares have, in part, made very decent gains. Now, with Omicron, endemicity seems possible. The virus is more contagious, but the course is milder than the previous variants. Infection could bring about the herd immunity that has long been longed for. In addition to Corona, however, one must also keep an eye on inflation. It has been taking hold since mid-2021 and will continue to occupy us in 2022. The question on all investors' minds is: where do the gains beckon in the coming year? Today, we highlight three possible winners.

ReadCommented by André Will-Laudien on December 23rd, 2021 | 13:57 CET

Lufthansa, TUI, Tembo Gold - Full speed ahead to faraway places!

What will the vacation year 2022 will be like? With the emergence of more and more new COVID variants, the new traffic light government has been under pressure from the first minute. How does one protect the citizens and keep spirits up despite all the restrictions? Concessions and prohibitions should align with common sense and ultimately with constitutional requirements. Of course, business and society have a wish list to guide political direction. But if contagions go unbridled through the roof, much is probably just wishful thinking. For the following stocks, things are really heating up now.

ReadCommented by Nico Popp on December 15th, 2021 | 10:47 CET

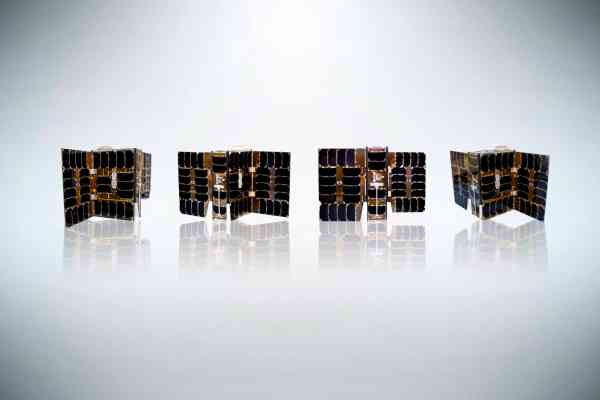

Airbus, Kleos Space, Lufthansa: Investing like Elon Musk

Jeff Bezos and Elon Musk have long been thinking in completely different spheres, as is well known. But the fact that their excursions into space can deliver tangible returns has not yet made its way to every investor. We provide an insight into a growing market and outline three stocks that earn their money above the clouds.

ReadCommented by André Will-Laudien on December 2nd, 2021 | 14:04 CET

TUI, Lufthansa, Alerio Gold, Carnival - This winter travel will not be golden!

The upward movement at the stock exchanges is very advanced because the higher valuation of the shares is continuously alimented by cheap money from the central banks. But now, the statistics show real inflationary pushes; for Europe, the inflation on an annual basis amounted to +4.4% in October. It is generally known that these rates do not correspond very closely to reality due to their hedonic measurement method; the actual price markup in the relevant goods is probably already beyond the 6% mark. Based on these dynamics, FED observers assume that the US central bank could double the pace of the current tapering so that bond purchases could end as early as March. That would probably have the first contractionary effects. What about gold and travel in this environment?

ReadCommented by André Will-Laudien on November 5th, 2021 | 13:56 CET

TUI, Troilus Gold, Lufthansa - These are the turnaround stocks for 2022

If you think about interesting portfolio mixes today, you will find some lagging stocks on the price list alongside blockbuster shares such as Tesla, Apple & Co. There is still a lot of catching up in the travel industry, for example, and in financial stocks. The permissible question is, of course, whether there will be a real comeback to the "old world" for the travel industry after the extended COVID restrictions. Experts deny this hope, but there are huge restructuring and forward-looking cost-cutting measures in tourism stocks in particular. We take a look at some shares and examine the opportunities.

ReadCommented by Carsten Mainitz on October 29th, 2021 | 13:39 CEST

Kleos Space, Lufthansa, TeamViewer - Exciting developments!

The capital market thrives on diversity. The stock market trades in the future and is never a one-way street. The pendulum - as painful as it sometimes is - swings in both directions. Corporate growth is just as much fuel for share prices as euphoria and panic. The following companies have seen a lot of action in the recent past. Who will perform best by the end of the year?

Read