VOLKSWAGEN AG VZO O.N.

Commented by Stefan Feulner on July 14th, 2021 | 12:32 CEST

BYD, GSP Resource, Volkswagen - Follow the trend

The future is to become climate-neutral and low-carbon. With the energy concept and the energy turnaround, Germany is phasing out nuclear energy and switching from oil to renewable energies. Today, the entire mobility sector is still highly dependent on oil, but this is now to change as quickly as possible. The car industry has already sung the farewell song of the combustion engine in favor of battery-powered vehicles. But we are only at the beginning of long-term development.

ReadCommented by Stefan Feulner on July 9th, 2021 | 14:51 CEST

Volkswagen, Carnavale Resources, Daimler - Prepared for the future

In addition to the global economic recovery, a long-term structural change towards a climate-neutral future is driving raw material prices. Copper is considered a key element for electromobility and renewable energies. It is used in the production of batteries, electric cars, solar modules and wind turbines. Other essential materials such as nickel, cobalt and lithium are primarily produced in China. Demand threatens extreme shortages and skyrocketing prices. Profit from this cycle.

ReadCommented by Stefan Feulner on July 1st, 2021 | 13:43 CEST

Nordex, Osino Resources, Volkswagen - The correction as an opportunity

Both cryptocurrencies and precious metals corrected sharply in recent weeks. While the negative tweets of Elon Musk and the trading bans and stricter regulations in China were cited as reasons for Bitcoin, Etherum & Co, it is the fears of possible early interest rate hikes for gold and silver. In the short term, there should still be some correction potential, also from a chart perspective. In the long term, the lights are green for a rising gold and silver price.

ReadCommented by Stefan Feulner on June 28th, 2021 | 12:07 CEST

Nel ASA, Mineworx Technologies, Volkswagen - The next stage ignited

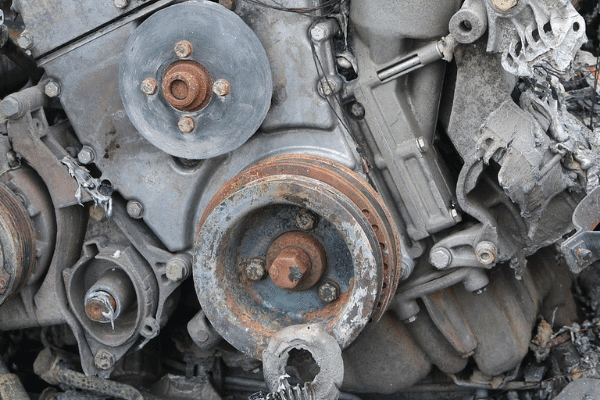

Without question, electric cars are the big winners of the mobility revolution. If Germany wants to meet the targets of the Paris climate agreement, CO2 emissions are to fall by at least 50% by 2030. This seals the slow farewell to combustion engines. But now, new problems are emerging concerning electromobility. In addition to the scarcity of the required raw materials, the issue of recycling the batteries and recovering the raw materials is coming up. Here, a market worth billions opens up with huge potential for the respective companies.

ReadCommented by Armin Schulz on June 23rd, 2021 | 12:21 CEST

Commerzbank, wallstreet:online, Volkswagen - What is the German stock market doing?

Last Friday, there was the so-called witches' Sabbath, and the DAX fell by over 300 points, but by Monday, the buyers returned. All signs point to economic recovery, also in the USA. The FED has announced that it does not intend to raise interest rates before 2023, despite inflation significantly higher than Germany. The European Central Bank has not yet announced anything about raising interest rates. They are trying to keep the economy going, and Mr. Draghi had tried to fan inflation for a long time but failed at the time. The ECB would undoubtedly like to see inflation of 2-3% over a more extended period, and that makes investing in stocks or other tangible assets still attractive.

ReadCommented by Stefan Feulner on June 22nd, 2021 | 13:26 CEST

Volkswagen, EuroSports Global, Geely - Enormous future potential

Electromobility is one of the growth markets of the coming years. The switch from combustion engines to battery-powered vehicles is already a done deal and is being driven forward by automakers at an ever-faster pace. Even far away from automobiles, e-mobility will be a central component of a smart and resource-conserving lifestyle. A market in which companies outside the automotive industry will also participate. Seize the opportunity!

ReadCommented by Stefan Feulner on June 17th, 2021 | 11:21 CEST

Volkswagen, Defense Metals, Salzgitter AG - Disastrous consequences!

The NATO summit in Brussels last weekend once again showed the increasingly hardening relations between the USA on the one hand and China and Russia on the other. At the same time, the NATO powers seem to underestimate how dependent they are on the Middle Kingdom in terms of the energy transition. By capping access to rare minerals essential for electric vehicles, wind turbines and drones, the Western states are threatened with a bottleneck that will have a major impact on the development of new technologies.

ReadCommented by André Will-Laudien on June 15th, 2021 | 14:17 CEST

NIO, Volkswagen, Toyota, Silkroad Nickel - Now it really starts!

Armin Laschet (CDU), the CDU/CSU candidate for chancellor, does not want to give the internal combustion engine an expiration date, even though he himself drives an electric car. He also warns against focusing solely on the electric vehicle regarding climate protection in the transport sector. "I do not believe that this will be the form of mobility for the next 30 years, even though I drive an electric car myself," the CDU federal chairman told Handelsblatt. "There are ecological implications, for example, in battery production and the extraction of raw materials. We will still see many technological leaps." So in terms of e-mobility, the last word has not yet been spoken. Nevertheless, the industry is gearing up for a politically motivated wave of purchases. For this, it needs raw materials.

ReadCommented by Nico Popp on June 14th, 2021 | 08:48 CEST

NEL, dynaCERT, Volkswagen: Investment ideas from conservative to speculative

The automotive industry is on the move again! Premium manufacturers, in particular, are enjoying good business. Although the trend is towards electric cars, there are alternatives, especially for trucks and other machinery: In recent months, hydrogen titles have been elevated to a pedestal in the media. But despite its good prospects, the technology is not yet ready. We explain what forms of mobility are available and how investors can invest.

ReadCommented by Nico Popp on June 4th, 2021 | 08:11 CEST

Lufthansa, Almonty Industries, Volkswagen VZ: Fresh starts and takeover fantasies

It starts again. More and more companies are leaving the crisis behind. Restaurants are full even with mandatory testing, carmakers are picking up where they left off before the crisis, and airlines are once again enjoying more vacationers and business travelers. With the economy making a comeback, certain companies are in particular focus. Others reveal great opportunities only at a second glance. We present three stocks.

Read