AURUBIS AG

Commented by Tarik Dede on February 25th, 2026 | 07:30 CET

AI drives demand: Three copper stocks for the boom - Freeport-McMoRan, Power Metallic Mines, and Aurubis!

A few years ago, copper was considered one of the most boring metals. Demand grew steadily, but not dramatically. The red metal was used everywhere, from construction to power lines, but it lacked appeal. And the price remained so low that there was hardly any investment in the development of new deposits over the past decade. With the AI revolution and global electrification, this has changed dramatically. Copper is the most efficient electrical conductor after silver and now plays a major role. For example, an electric vehicle requires three to four times more copper than a combustion engine. Added to this are wind turbines, solar parks, and the massive expansion and modernization of power grids. Analysts estimate that by 2040, the world will need to produce more copper than humanity has consumed in its entire history. After electric vehicles, artificial intelligence has triggered the next wave of demand due to the enormous power requirements of data centers. The huge server farms of NVIDIA, Google, Amazon, and others require kilometers of copper cable and massive copper rails for power distribution. As a result, there is now renewed investment in new copper deposits. Investors should diversify their portfolios to benefit from this development in the long term.

ReadCommented by Nico Popp on October 28th, 2025 | 07:05 CET

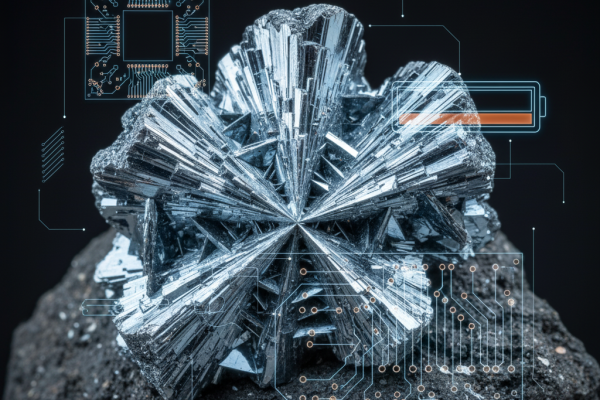

Antimony remains scarce and in demand: EnerSys, Aurubis, Antimony Resources

Antimony is a semi-metal with a silvery sheen, primarily used in lead-acid batteries, flame retardants, electronics, and military technology. In recent months, China has severely restricted its antimony exports. According to estimates, China produced around 60% of the world's antimony in 2024, followed by Tajikistan. China's dominance is heightening supply fears: as Reuters reported in June this year, US battery manufacturers are already referring to a "national emergency." This is reason enough to take a closer look at the supply chain in the West and examine the role of Antimony Resources, which recently attracted attention in the stock market.

ReadCommented by Fabian Lorenz on October 22nd, 2025 | 07:30 CEST

SHARE PRICE EXPLOSION for commodity gems!? Nordex, Aurubis, Salzgitter, and Power Metallic Mines!

Shares in the commodities and precious metals sector have been unstoppable in recent weeks. Power Metallic Mines could soon become an explosive latecomer to the rally. There are good reasons for this, as the CEO recently made clear. At Aurubis, the rally appears to be over for now. Analysts are skeptical, and the major shareholder is cashing in his shares - albeit in an unusual way. So should you sell now, too? The past few months have been unusually positive for Nordex. There is currently no sign of a slump in the wind business. What are analysts saying after the latest order intake?

ReadCommented by Stefan Feulner on June 15th, 2023 | 08:35 CEST

Lufthansa, Tocvan Ventures, Aurubis - Optimism is growing

In the run-up to the interest rate decision in the US, investors were in a buying mood and lifted Germany's leading index, the DAX, to a new all-time high. The fact that the monetary guardians are stopping short of further increases in this interest rate cycle offers room for further price gains. The travel industry, which has been badly hit by the Corona pandemic, is also receiving a tailwind. The sharp drop in share prices in the recent past should offer attractive entry opportunities at the current level.

ReadCommented by Carsten Mainitz on April 13th, 2022 | 17:45 CEST

Nevada Copper, Aurubis, Nordex - Fueling the energy transition!

A study commissioned by the International Copper Association (ICA) concludes that copper demand will be strongly driven by the massive expansion of cabling for solar, wind power and electric vehicle infrastructure. Experts estimate that the volumes demanded from the solar and wind sectors will multiply by 2040. A projected increase in the number of charging ports for electric vehicles from 3.2 million in 2021 to 152.3 million in 2040 will exponentially increase copper demand in this sector. As a result, an increasing supply shortage is emerging, which in turn will lead to further price increases for the industrial metal. Copper producers such as Nevada Copper or recycling companies such as Aurubis will benefit from these general conditions.

ReadCommented by Carsten Mainitz on January 27th, 2022 | 11:41 CET

Aurubis, Nevada Copper, Daimler - Copper: Fueling the mobility and climate shift

No metal represents the step into our electrical century more than copper. The reddish shimmering metal with excellent conductivity is in demand wherever electricity is concerned. Experts estimate that about three to four times as much copper needs to be installed in e-cars than in a conventional combustion engine for mid-range cars, which currently comes to about 25kg of copper. Due to the high demand, copper consumption could increase more than tenfold in the next ten years.

ReadCommented by Carsten Mainitz on August 17th, 2021 | 11:12 CEST

Memiontec, Bayer, Aurubis - Do not miss this trend!

According to estimates by some experts, water demand will already exceed supply by 40% in 2030. That is a dramatic forecast and should wake us up. Of course, climate change is an influencing factor. The increasing water consumption of agriculture in the wake of the growing population presents us with major challenges. In addition, water treatment plays a central role. Some promising investment ideas can be derived from the scarcity problem of the vital resource water.

ReadCommented by Carsten Mainitz on May 11th, 2021 | 15:26 CEST

Aurubis, Osino Resources, ThyssenKrupp - Winners of the digitalization, energy transition and e-mobility trends

The three trends mentioned have one thing in common: they need electricity. And wherever electrons do work, materials for transporting and storing electricity are in demand. Different materials are used depending on the application. Gold, for example, is mainly used in connectors, as is silver, but it is also found in numerous coatings, e.g., for seat heaters or in infotainment systems. Copper, on the other hand, is the material of choice for all cable connections, while materials such as lithium or cobalt are needed to store electricity or hydrogen in the future. The following companies are fully in line with the trend with their products and should not be missing in any portfolio.

ReadCommented by Carsten Mainitz on December 29th, 2020 | 09:13 CET

Glencore, Almonty, Aurubis - Scarcity drives share price

If you have listened to the old master of the stock market André Kostolany, then you have thought about aluminum in the past, and that's a good thing. If you bet on companies that focus on industrial metals or strategic metals, you should see a good performance next year. Rising demand in the wake of electromobility is driving up the price of copper. But so-called strategic metals, such as tungsten, are also used in various ways and are difficult to substitute. The availability of strategic metals is more limited than that of industrial metals. At times, there can be a large gap between supply and demand. Investors then profit from scarcity prices. We reveal where opportunities are tempting.

ReadCommented by André Will-Laudien on November 5th, 2020 | 11:06 CET

Defense Metals, Orocobre, Aurubis – Everyone is a specialist!

Strategic metals are indispensable. They are very rare in the earth's crust and only occur in certain places. For the free economy, there is a procurement problem per se, because, on the one hand, China has the largest reserves, on the other hand, the states intervene in the distribution of the existing quotas. In times of a pandemic, mine closures lead to minor shortages in these metals, but prices are usually negotiated with buyers on a long-term basis. Since the metals usually cannot be procured in alternative ways, it is in everyone's interest to improve the supply situation. But how to procure, if not steal...?

Read