MORPHOSYS AG O.N.

Commented by Stefan Feulner on June 16th, 2022 | 11:01 CEST

Biotech stocks ahead of the turnaround - Evotec, NervGen and MorphoSys

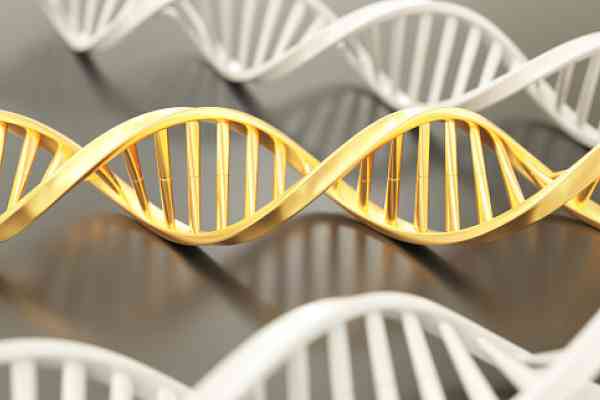

Biotechnology stocks could not escape the current correction. The broad-based NASDAQ Biotechnology Index, for example, has lost around 40% since its peak last August. The fact that biotechnology will increasingly become a key technology in the future was already demonstrated during the Corona pandemic when tests, vaccines and drugs were developed in a very short time and made available in large quantities. Thus, more and more capital is likely to move into the sector in the coming years, with great opportunities for the individual companies.

ReadCommented by Carsten Mainitz on June 7th, 2022 | 11:32 CEST

XPhyto, BioNTech, MorphoSys - The next price wave is coming!

In recent years, Corona has been the most urgent topic that has moved the world and the stock markets. Health care is and remains a megatrend. It is in the nature of things that the focus changes over time. Innovative approaches or forms of drug delivery, on the other hand, remain perennial favorites. There is also a lot of progress in research against cancer. These companies will play a major role in the future.

ReadCommented by André Will-Laudien on May 31st, 2022 | 12:03 CEST

Watch out: BioNTech, NervGen, MorphoSys, Valneva: Biotech shares in check!

The initial sell-off in biotech stocks seems to have been digested. With last week's NASDAQ turn, spring air is now moving through the stock markets again. That is because many investors realize that, in the face of a multitude of new diseases, a major research effort is needed to protect humanity from the burgeoning dangers. Financing via the stock market was correspondingly easy for the biotech giants during the last pandemic because investors sensed big profits in the event of success. This picture is likely to repeat itself in the next movement. Where are the current opportunities in the biopharma sector?

ReadCommented by André Will-Laudien on May 2nd, 2022 | 13:27 CEST

BioNTech, Defence Therapeutics, Valneva, MorphoSys - Biotech stocks that will still be fun tomorrow!

One of the most churned areas on the growth stock market is the biotech sector. There was too much disappointment on the drug development side; even in the COVID sector, only a few winners remain. However, the current sell-off could turn out to be an entry opportunity in the medium term because there are more and more people on earth and, fortunately, they are getting older and older; even the Corona pandemic is not likely to change this. There are already 1 billion people worldwide over the age of 60, and forecasts predict that this figure will rise to 2 billion by 2050 - with a total population of more than 9 billion people predicted at that time. Which values have been unjustly neglected, and where are the current opportunities for investors?

ReadCommented by André Will-Laudien on March 30th, 2022 | 11:36 CEST

Attention: BYD, Edgemont Gold, Delivery Hero, MorphoSys - Shares with the highest dynamics!

The intensity of fluctuation on the capital markets remains high. It is measured by volatility indices such as the EU Vola Index or the VIX on the S&P 500. Both indices had risen well above 30 at the beginning of the crisis, with the EU Vola Index even reaching a peak of 43.3% on March 7. At the beginning of the Corona Lockdown in February 2020, this index rose overnight to values of over 70%. Although these volatility coefficients are slowly trending downwards due to political easing tendencies, hedgers on the derivatives markets are pricing volatility into their products at a higher price. So those who are currently trading options may experience their blue miracle with Vola changes overnight. Some stocks have recently jumped in this environment; where are the opportunities?

ReadCommented by André Will-Laudien on March 21st, 2022 | 13:10 CET

Attention - MorphoSys, Valneva, CureVac, MAS Gold: These shares smell of a turnaround!

The biotech sector, especially around vaccine manufacturers, has recently fallen somewhat out of fashion - Germany's most extensive Corona measures have likely already taken place. The general willingness to vaccinate can hardly be increased, and the vaccination obligation was dropped without a trace after lawyers formed a massive wave of lawsuits. But now that the Omicron infection figures are exploding to unimagined heights, we can expect a hot autumn again after a summer with a breather. "Corona has come to stay!" said Karl Lauterbach when he was not yet health minister. We take a look at some shares that have recently rebounded strongly.

ReadCommented by Carsten Mainitz on March 14th, 2022 | 12:47 CET

BioNTech, Defence Therapeutics, MorphoSys - Shares with blockbuster potential!

Developing a blockbuster drug is the highest achievement in the pharmaceutical industry. A blockbuster is defined as a drug that can generate more than USD 1 billion in revenues per year. According to experts, the vaccine Comirnaty, developed by BioNTech and Pfizer, is likely to have brought in sales of well over USD 30 billion, thus clearly breaking the blockbuster barrier. Outside of vaccine research, there are also numerous companies with high long-term potential.

ReadCommented by Armin Schulz on March 7th, 2022 | 13:05 CET

Valneva, Defence Therapeutics, MorphoSys - Blockbuster potential

Every pharmaceutical or biotech company wants a blockbuster. This term refers to a drug that generates annual sales of at least USD 1 billion. The best-known blockbuster drug currently is the Corona vaccine from BioNTech. In 2020, the rheumatism drug Humira was in the top spot with sales of over USD 20 billion. The Mainz-based vaccine manufacturer is likely to have significantly surpassed this mark in 2021. If a company hits the big time, it can reap the rewards for 20 years before the patent expires. Today, we take a look at three companies that have potential blockbusters.

ReadCommented by André Will-Laudien on February 15th, 2022 | 12:30 CET

Attention: Siemens Healthineers, Perimeter Medical Imaging AI, MorphoSys, Siemens - Riding the next hype with MedTech!

MedTech and pharma giants have been in high demand not only since the pandemic. The technification of diagnostics leads to the early detection of serious diseases and shortens the planning of necessary medical interventions. Of course, COVID-19 significantly impacts the availability and additional demand for high-tech in practices and emergency departments. It is creating a boom in demand from manufacturers rarely seen at this headline rate. We are looking at clear winners in medical digitization.

ReadCommented by André Will-Laudien on February 9th, 2022 | 12:22 CET

MorphoSys, Defence Therapeutics, Valneva, CureVac - Find the bio blockbuster!

The biotech sector is a highly dynamic growth market within the equity universe. It is characterized by investment volumes of unprecedented size, which is also the reason for the high innovation rate characteristic of the sector. Price reactions to positive or negative surprises can be very volatile, and these tendencies are often exacerbated by the intervention of stop orders or the occurrence of derivative slippage. Vaccine manufacturers were down over 50% across the board, as the pandemic is being traded as a phase-out. The vaccination rate does not appear to be increasing significantly. Where are the opportunities for investors at the moment?

Read