BYD CO. LTD H YC 1

Commented by Nico Popp on May 17th, 2021 | 09:59 CEST

Saturn Oil + Gas, NEL, BYD: Here come the multipliers!

The stock market offers something for every type of investor: the cool calculator, the bold speculator and the rational decision-maker. The bull market in hydrogen stocks around the turn of the year was a case for daring gamblers: the technology is not ready for the market yet, and every investment is a bet on the future. Investors in Saturn Oil & Gas are likely to have felt like gamblers at times during the past year, which was marked by a collapse in the oil price that has now been compensated for. But since the end of last week, it has become clear that the share is also interesting for cool calculators and rational decision-makers. The reason lies in an acquisition that takes the Company to a whole new level and should also mean enormous potential for the share price.

ReadCommented by Stefan Feulner on May 14th, 2021 | 15:56 CEST

BYD, Saturn Oil + Gas, Varta - Now the lid is flying off!

In April of last year, the outbreak of the Corona pandemic caused a crash in the oil markets. A sharp drop in demand due to global lockdowns and a massive supply overhang caused the sell-off and caused oil prices to drop below USD 20. Oil producers tried to save what could be saved by hedging and shutting down production. In contrast, other players used the Crisis as an opportunity and took over distressed competitors at bargain prices. One Company is now announcing a long-planned takeover of a major project that will multiply both sales and profits in one fell swoop - The rise to a new dimension with revaluation.

ReadCommented by Nico Popp on May 12th, 2021 | 10:20 CEST

BYD, Volkswagen, NewPeak Metals: Who benefits from electromobility?

Scarcity rules in Germany. A year ago, it was noodles, canned food and toilet paper. Today, it is down to the last detail: building materials, metals and other essential materials are in short supply and correspondingly expensive. The first joineries have even had to cancel orders that were calculated months ago - wood has become too expensive. The automotive industry is also driving demand for basic materials, especially critical metals for batteries. We outline the investment stories of two carmakers and get to the bottom of the question of how raw material shortages can be countered.

ReadCommented by Stefan Feulner on May 11th, 2021 | 10:12 CEST

BYD, Silkroad Nickel, Volkswagen - Exciting development in the electric car industry!

So far, the development of the electric car industry has been trouble-free, the sales figures of e-car manufacturers have skyrocketed and the displacement of combustion engines seemed to be only a matter of time. But currently, the first major obstacle is approaching producers. The chip shortage is leading to production stops and short-time work. The issue of scarcity is likely to become the dominant theme of this industry over the next few years. Raw materials for production such as lithium, nickel or cobalt are scarce commodities. The primary beneficiaries of this development are the raw material producers, who are already barely able to meet demand.

ReadCommented by André Will-Laudien on May 10th, 2021 | 11:10 CEST

VW, BYD, Plug Power, Almonty - The e-mobility breakthroughs!

Driving electric vehicles is becoming more and more popular! The Volkswagen Group delivered 133,300 electrified vehicles in the first quarter - more than twice as many as in the previous year, as the Wolfsburg-based Company points out. 59,900 buyers (+78%) opted for a fully electric vehicle, while plug-in hybrid drive models still lead the way, reaching sales of 73,400 units (+178%). Tesla, the self-proclaimed e-mobility technology leader, only managed 499,550 vehicles in the whole of 2020 (+36%). What does this mean for the manufacturers' shares?

ReadCommented by Carsten Mainitz on May 6th, 2021 | 10:37 CEST

BYD, Nevada Copper, Varta - A dedicated line for share price gains?

Electromobility is an important component of mobility concepts. To what extent other types of drive will overtake the electric car, or whether we will have to realize in 10 years that the whole topic was politically misguided, is another matter. The fact is that the demand for electric cars and batteries is growing enormously. The demand for the raw materials used in them, such as lithium and copper, is also increasing. We present three promising investments that reflect different facets of the investment trend.

ReadCommented by Nico Popp on May 5th, 2021 | 09:10 CEST

Varta, BYD, SunMirror: Short-term prospects in check

Shares related to electromobility and hydrogen have been the yield drivers in recent months. But why are stocks like Varta and BYD weakening now? After the enormous price increases, speculators are pulling back. But this is not necessarily a bad signal. Stocks showing relative strength in the current phase could be at the forefront of the subsequent rise. We outline three exciting investment stories.

ReadCommented by Armin Schulz on May 3rd, 2021 | 10:32 CEST

Amazon, Blackrock Silver, BYD - Growth, growth, growth!

Despite the pandemic, there is growth everywhere - but why? Looking for the answer to this question, one comes more and more often to the answer that there are hardly any alternatives. Cryptocurrencies are more for the younger generation. Then there are still precious metals, where prices are only slowly picking up, and there are bonds.

However, bonds have become entirely unattractive in the course of the money glut, so the only option left, especially for institutional investors, is to reach for shares. The billions from the bond market thus flow into the stock markets and ensure new highs despite the pandemic.

So you should invest your money in high-growth stocks. Based on this premise, we have taken a look at three promising candidates.

Commented by André Will-Laudien on May 2nd, 2021 | 19:04 CEST

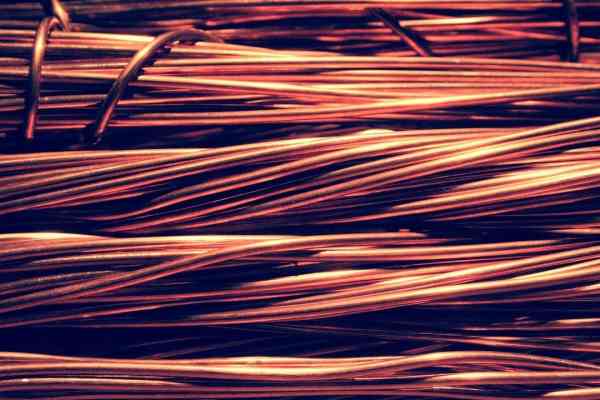

BYD, NIO, Varta, Kodiak Copper: No e-mobility without copper!

The copper price is just about to climb the USD 10,000 mark. For many market participants, the scenario for the industrial metal is set. Because since the public declaration of the automotive industry to make the e-vehicle the No. 1 means of transportation, the demand for copper and battery metals is shooting through the roof. Mine operators worldwide are alarmed, but how do you increase capacity in the short term when there are too few developed projects? We dive into the market.

ReadCommented by André Will-Laudien on April 27th, 2021 | 12:00 CEST

BYD, NIO, Nikola, Nevada Copper - The Tesla hunters step on the gas!

The appointment of the candidates for chancellor in Germany has led to a significant increase in the Green Party. While at the same time, the current government parties have been punished. For consumers, this means continued tax incentives of the highest magnitude for so-called "environmentally friendly technologies," which, in addition to solar panels and wind power, include above all battery-powered mobility and hybrid vehicles. The German Federal Office of Economics and Export Control (BAFA) is subsidizing the purchase of electric cars throughout Germany until the end of 2025 - this year, the bonus is particularly high. This environmental bonus supports not only the purchase but also the leasing of electric cars. One half of the subsidy comes from the manufacturer, the second half from BAFA. The stock market likes to hear this, and the manufacturers' shares are selling like hotcakes. It seems that this bull market can start again with every political statement.

Read