BYD CO. LTD H YC 1

Commented by Nico Popp on June 3rd, 2021 | 11:02 CEST

JinkoSolar, BYD, SunMirror: Rich thanks to climate protection

Sustainability has long been more than just a buzzword. The former core issue of the Greens has now reached all parties. Today, it seems clear that resources should be used intelligently. It is also essential to use regenerative energy. But to manufacture solar panels and store the green electricity generated in this way, raw materials are necessary. Those who have secured these can hope for good business.

ReadCommented by Stefan Feulner on June 3rd, 2021 | 08:25 CEST

BYD, Sierra Growth, JinkoSolar - The opportunity of the year!

The correction of the boom sectors from 2020 - hydrogen, electric mobility and fuel cell technology - seems to have come to an end for many stocks and currently offers extremely lucrative entry opportunities at a significantly lower level. These can now also be found in gold. The precious metal is currently trading at a 5-month high. Due to the potentially escalating inflation, the fundamental conditions for a further increase in the gold price are more than given.

ReadCommented by Nico Popp on June 1st, 2021 | 08:30 CEST

HeidelbergCement, Silkroad Nickel, BYD: Shares with an explosive mix

You do not have to be an economist or a well-connected investment guru to evaluate opportunities on the stock market. It is often the apparent developments and trends that point the market in the right direction. For investors, it is then a matter of interpreting these facts. For example, building materials are scarcer than ever - prices for wood and other essential materials have risen rapidly. Industrial metals are also in high demand. New technology, investment in construction and infrastructure, and the end of the pandemic make for an explosive mix.

ReadCommented by Carsten Mainitz on May 31st, 2021 | 11:45 CEST

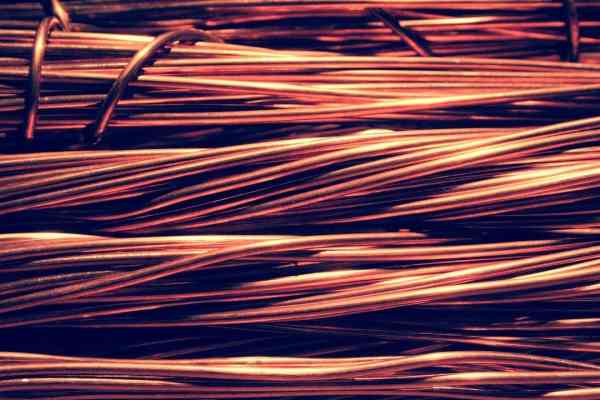

BYD, Kodiak Copper, Xiaomi - Copper: Buy or cash in?

The demand for copper will continue to grow. These are the findings of the recently published study by the International Copper Association (ICA). The ICA predicts that by 2030, more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors. But copper is also in demand in many other industries. Demand exceeding supply or supply bottlenecks can make the raw material more expensive overnight at any time. For this reason, today, we take a look at a budding copper producer. Of course, large demanders such as BYD or Xiaomi must not be missing in the consideration. After all, our everyday companion, the smartphone, contains 15% copper. Let us surprise you with three exciting investment ideas.

ReadCommented by Nico Popp on May 27th, 2021 | 07:50 CEST

Kodiak Copper, ThyssenKrupp, BYD: Three trends in one share

Copper is the metal of the moment. There are several reasons in favor of copper. Firstly, copper is benefiting from the global economic recovery following the end of the pandemic. The industrial metal has always been the primary beneficiary when infrastructure is invested in or otherwise built. It is precisely in this way that countries want to boost their economies after the pandemic. At the same time, there is a dynamic demand from the e-car industry. E-cars and charging infrastructure, none of that works without copper. And last but not least, inflation is getting to us - the Bundesbank is already expecting inflation rates beyond the 4% mark. Again, commodity prices tend to benefit.

ReadCommented by Stefan Feulner on May 26th, 2021 | 11:53 CEST

BYD, Carnavale Resources, NIO - Now into the megatrend

Without question, electromobility will be one of the future industries in terms of the energy transition. Car manufacturers are already vying to determine when the final switch from combustion engines to purely electric cars will occur. In Germany alone, around 12 million e-vehicles will be rolling along the roads in 2030. With the switch to electric-powered vehicles, demand for the necessary raw materials is also rising. The high level of interest offers enormous opportunities to participate in the trend, which is still in its infancy.

ReadCommented by André Will-Laudien on May 21st, 2021 | 09:58 CEST

Trend break, please look closely! BYD, Nel ASA, Bitcoin Group, SunMirror

"Turned on its heel" would be an apt description for Wednesday. Bitcoin was at the record-breaking USD 65,000 mark in mid-April and there were announcements that the USD 100,000 mark would soon be on the cards. Since that high, the cryptocurrency has plummeted by over 50% at the low and immediately stormed back up. The anti-protagonists of this casino mentality cite the decarbonization of the planet as a reason why the entire crypto world should be condemned for its power-hungry mining. Others see blockchain technology as the most significant digitization breakthrough of the future. Some companies are directly affected by these movements.

ReadCommented by Armin Schulz on May 21st, 2021 | 09:28 CEST

BYD, Nevada Copper, AT&T - Nothing works without copper

More and more people worldwide have access to electricity. The electrification of the world is progressing and this requires copper - the non-precious metal that conducts electricity best. Copper was one of the most widely used industrial metals even before the advent of renewable energies and e-mobility. It is found in consumer goods such as air conditioners, telephones and everything around power grids. Increased sales of e-cars are also increasing demand for the "red gold" here, as more copper is needed for these than in conventional passenger cars. Added to this is the charging infrastructure for e-cars, which still has to be built nationwide. Demand will certainly not decrease, but since the supply is not growing at the same time, rising prices are the result.

ReadCommented by Stefan Feulner on May 20th, 2021 | 13:29 CEST

BYD, Saturn Oil + Gas, Everfuel - Transformation in the oil market

Climate change, renewable energies, electric mobility - these are the topics that currently occupy the headlines alongside Corona. People forget that in 2020, more than 75% of the global energy supply was still covered by coal, oil and gas. Due to the resurgent economy after the pandemic, the demand for black gold is increasing enormously. Last year, JP Morgan already predicted the start of a new "oil supercycle" that could propel the price to just under USD 200 per barrel. A feast for producers.

ReadCommented by André Will-Laudien on May 19th, 2021 | 11:00 CEST

BYD, NIO, Nordex, Sierra Growth - Copper soon at USD 20,000?

The meaningfulness of global efforts to curb global warming becomes all the more transparent when one considers the devastating destruction caused by cyclone "Tauktae" in the Indian state of Gujarat. Something has to be done! German industry is attempting decarbonization through various green technologies, aiming to halve greenhouse gas emissions by 2045. Copper is an essential component of electrification; since early 2021, there has been a run on the metal and its suppliers.

Read