NEVADA COPPER CORP.

Commented by Nico Popp on January 5th, 2022 | 09:22 CET

A portrait of three hot stocks: Rock Tech Lithium, Nevada Copper, Porsche

Shift down a gear, change lanes, and then feel the engine's thrust. Friends of sporty driving must have been relieved when the new German government presented the coalition agreement, and it did not include a speed limit. Powerful overtaking maneuvers are generally most successful with an electric car. So sustainability and driving pleasure do not have to be a contradiction in terms. But for e-cars to be truly green, they need sustainably mined raw materials and companies that can make the most of them. We present three shares that not only make driving fun on the road but also give your portfolio a boost.

ReadCommented by Carsten Mainitz on December 30th, 2021 | 11:30 CET

Nevada Copper, Nordex E.ON - What is next in 2022?

Several ingredients are needed to make the energy transition and electromobility a sustainable success. First and foremost, raw materials such as copper and lithium. Then there is a need for energy sources such as solar and wind, and finally, a suitable infrastructure. Therefore, within the megatrend, there are various starting points for profiting with corresponding shares. We have three promising stocks in our bag. Who will win the race in 2022?

ReadCommented by Armin Schulz on December 23rd, 2021 | 12:39 CET

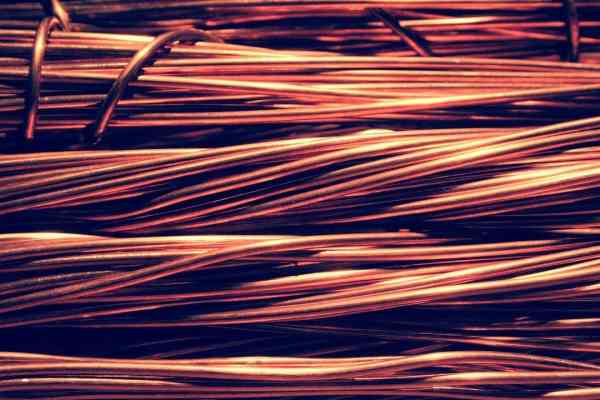

Varta, Nevada Copper, JinkoSolar - Copper in desperate demand

The world is changing. Efforts are increasingly being made to protect the climate, and entire branches of industry are being converted as a result. The energy industry is increasingly relying on renewable energies, and the automotive industry has proclaimed the end of the combustion engine. The new technologies emerging, as a result, require a wide variety of raw materials, but above all, copper. Demand will increase faster than supply can be expanded. The result - rising copper prices. Not for nothing has this raw material been called the red gold. The coming years promise to be exciting on the copper market.

ReadCommented by André Will-Laudien on December 15th, 2021 | 12:30 CET

Infineon, Nevada Copper, Nvidia - The high-tech industry in the copper trap!

Copper is an essential metal for the high-tech industry because of its extreme conductivity. Since 2019, there has already been a supply deficit, and from 2020 to 2021, the price has increased fivefold. A study on copper commissioned by the International Copper Association (ICA) shows that by 2030, more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors in electric vehicles on the road. The increase in copper demand follows the development of the global automotive market, as electric and plug-in hybrid cars will account for around 19% of the total market by 2030. How is the gap closing?

ReadCommented by Stefan Feulner on December 6th, 2021 | 11:41 CET

NIO, Nevada Copper, Volkswagen - Business is booming

It is hard to imagine climate change without electromobility. The shift from combustion engines to battery-powered vehicles promises bright growth prospects for the automotive lobby. Despite the rosy outlook, a problem is emerging, one that has been known for years and is likely to become even greater in the future - the shortage of raw materials. Above all, the sharp rise in prices for essential metals is expected to eat into the margins of the automotive industry.

ReadCommented by Carsten Mainitz on December 2nd, 2021 | 12:52 CET

Nevada Copper, Varta, Aumann - Catching up!

Electromobility is inextricably linked with raw materials such as copper and lithium. The demand for e-cars and batteries is increasing enormously. This megatrend is also pulling up the relevant raw material prices. How can investors profit from this development, and which of the three stocks has the best opportunities in the coming year?

ReadCommented by André Will-Laudien on November 26th, 2021 | 11:28 CET

The copper sensation continues! Nordex, Nevada Copper, JinkoSolar, Daimler

When it comes to calculating the copper market in the next few years, expert opinions differ. According to a study by Wood Mackenzie, primary copper demand will increase by 30% to approximately 25 million tons by 2030. The main argument for further rising prices remains the global copper shortage because demand continuously exceeds supply, and recycling rates cannot cover industrial stockpiling either. The German copper smelter Aurubis is trading at an all-time high and wants to build a multi-metal plant in the USA. Such news is confirmation of an awakening among investors to allow new mining and processing operations to emerge. There are few new mines in sight at the moment, but there is news from Nevada.

ReadCommented by Nico Popp on November 16th, 2021 | 11:56 CET

Varta, Nevada Copper, BYD: Fast 100% with this future trend?

What does the future look like in German inner cities? If we take a survey of Hamburg residents as a blueprint, a lot will likely change in our cities very soon. Hamburgers would prefer to see their city centers car-free and promote electromobility even more strongly. So far, it is primarily city dwellers who are leaning toward the future. But as soon as e-cars paired with autonomous driving bring the surrounding areas closer to the centers, rural residents are also likely to renounce their diesel quickly. Don't believe it? Then let us convince you and find out how you can invest in tomorrow's trends today.

Read