NEVADA COPPER CORP.

Commented by Fabian Lorenz on April 7th, 2022 | 14:20 CEST

Varta, BYD, Nevada Copper: Shares under power

With the "Easter Package", Economics and Climate Protection Minister Robert Habeck wants to accelerate the expansion of renewable energies once again. The central goal is to double the share of electricity from renewable sources to 80% by 2030. In order to achieve this, approval procedures for new projects are to be shortened, among other things. In addition, new areas are to be made available for wind and photovoltaics, and remuneration is to be increased. Electromobility should also benefit because the environment is only really protected if the electricity comes from renewable sources. Companies across the entire value chain should benefit. The Chinese car manufacturer BYD is currently shining with several positive reports. Raw materials producer Nevada Copper also impressed with its quarterly update and is on the verge of a revaluation. At battery pioneer Varta, analysts are having their say after the figures.

ReadCommented by Stefan Feulner on April 1st, 2022 | 12:44 CEST

Glencore, Nevada Copper, BASF - Extreme fantasy in these shares

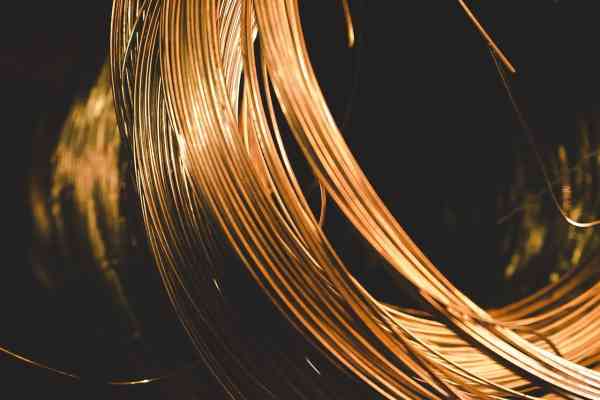

Copper is needed everywhere, especially now due to the energy transition. An electric car, for example, requires up to 4 times more copper than a vehicle with a combustion engine. The production of a wind turbine requires 30 tons of copper per turbine, including a connection to the power grid. Meanwhile, prices are exploding, with 1 ton of the red metal already costing over USD 10,300. The trend is likely to continue in the longer term. The primary beneficiaries of this super cycle, besides copper producers, are attractive exploration companies.

ReadCommented by Juliane Zielonka on March 22nd, 2022 | 14:06 CET

Nevada Copper, Mercedes-Benz, BYD - Price increase for copper expected

The battle for raw material supply chains is intensifying in light of the Ukraine crisis. Copper as a raw material is an indispensable component for electric vehicles. According to Goldman Sachs, due to the geopolitical upheavals, the price of copper may rise rapidly in the coming months. To ensure smooth supply chains, the Company is revisiting Cold War strategies and focusing on local resources. Nevada Copper, a copper supplier in the US, can support Mercedes-Benz's new battery plant. In China, Tesla competitor BYD Electronics is also working with the Stuttgart-based automotive giant to test the luxury segment.

ReadCommented by André Will-Laudien on March 9th, 2022 | 12:56 CET

Panic oil price USD 130: Volkswagen, Porsche, Nevada Copper, Mercedes - Next push for e-mobility!

The panic moves in the oil and gas markets are making a trend increasingly apparent: For raw material importers, the historical dependence on fossil fuels is becoming unaffordable. Consequently, alternative energy and drive concepts are enjoying a renaissance, and GreenTech stocks are already the big winners. The same applies to copper: It is an essential metal for the high-tech industry due to its extreme conductivity. There has been a supply deficit since 2019, and the price has already quintupled in the years 2020 to early 2022. Who will close the dramatic gap?

ReadCommented by Nico Popp on March 3rd, 2022 | 10:44 CET

BYD, Nevada Copper, Mercedes-Benz Group: Price shock also at the charging station

The fact that prices at gas pumps are constantly rising is nothing new for drivers. But with the price shock now also looming at charging stations, it is a new experience for many e-car drivers. Providers of charging infrastructures, such as EnBW, Tesla, Enel and Stadtwerke München, have raised their prices in recent months, in some cases significantly: The kilowatt-hour has become between 8% and 82% more expensive. What will happen now?

ReadCommented by Carsten Mainitz on February 21st, 2022 | 14:49 CET

E.ON, Nevada Copper, Nordex - The only way it works

In the course of the energy transition, renewable energies such as hydroelectric and solar power, wind energy, geothermal energy and renewable raw materials are replacing fossil fuels. By 2050, renewable energy sources are to cover around 60% of national consumption. Another key challenge is to increase energy efficiency. New storage concepts and intelligent energy networks play a central role here. Not to be forgotten are the essential raw materials such as copper, from whose expected price increases commodity producers can profit.

ReadCommented by Stefan Feulner on February 16th, 2022 | 12:29 CET

Glencore, Nevada Copper, Newmont - Commodities as an investment

An escalation of the situation in Ukraine and a possible war directly in Europe is keeping the stock markets in turmoil. In addition, a faster than expected rise in interest rates in the US is causing uncertainty among investors. As a result, the precious metal gold has risen to its highest level since mid-2021 and, at least in the short term, will live up to its status as a crisis currency. Companies from the commodities sector are also performing strongly. The price of a ton of copper, for example, once again exceeded the psychologically important USD 10,000 mark. Due to the strong demand resulting from the energy transition, this trend is also likely to prevail in the longer term.

ReadCommented by André Will-Laudien on February 2nd, 2022 | 13:48 CET

Nordex, Nevada Copper, JinkoSolar: Earning in the copper decade!

According to a 2020 study by the International Copper Study Group (ICSG), Chile, Peru, China and the US were the largest copper producers in the world. Other significant deposits can be found in Australia, Indonesia, Russia, Canada, Zambia, Poland, Kazakhstan and Mexico. While most mines have copper concentrations between 0.2 and 0.8%, there are even deposits in Central and South Africa that can contain 5 - 6% copper. In Europe, the largest copper deposits are found in Russia and Poland. Expert opinions differ considerably when calculating the copper market for the next few years. According to a study by Wood Mackenzie, primary copper demand will increase by 30% to about 25 million tons by 2030. And ore is already in more than short supply today. Where are the opportunities for investors?

ReadCommented by Carsten Mainitz on January 27th, 2022 | 11:41 CET

Aurubis, Nevada Copper, Daimler - Copper: Fueling the mobility and climate shift

No metal represents the step into our electrical century more than copper. The reddish shimmering metal with excellent conductivity is in demand wherever electricity is concerned. Experts estimate that about three to four times as much copper needs to be installed in e-cars than in a conventional combustion engine for mid-range cars, which currently comes to about 25kg of copper. Due to the high demand, copper consumption could increase more than tenfold in the next ten years.

ReadCommented by Stefan Feulner on January 17th, 2022 | 11:20 CET

BYD, Nevada Copper, Nordex - Copper, the next run

After a prolonged sideways movement and a bottoming out in the USD 9,000 area, copper celebrated the recapture of the psychologically important USD 10,000 mark last week. The triumphant march of the red metal is likely to continue in the coming years due to the energy transition. Stronger demand is offset by scarce supply, which is being further fueled by the electrification of transport, among other things.

Read