BARRICK GOLD CORP.

Commented by Carsten Mainitz on July 19th, 2021 | 11:05 CEST

Barrick Gold, GSP Resource, SMA Solar - Buy Prices?

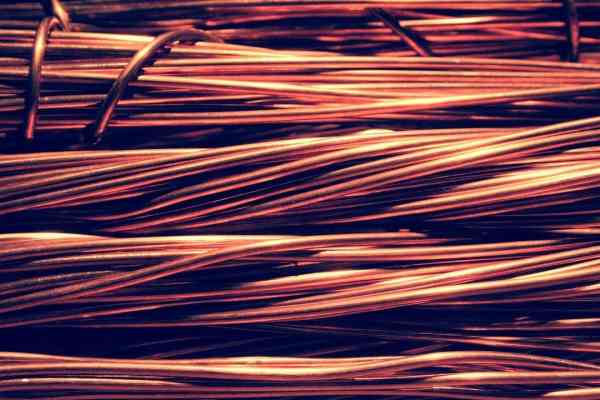

Raw materials and energy are central prerequisites for our life as we know it not to stand still. Often it is only when there are supply bottlenecks and significant price jumps that we become aware of the importance of what is suddenly no longer readily available. Due to their fundamental importance, commodities and energy are therefore forward-looking investment themes. We present three exciting companies. Who will win the race?

ReadCommented by Nico Popp on July 16th, 2021 | 11:31 CEST

Barrick Gold, Triumph Gold, Standard Lithium: Get in relaxed with stragglers

Inflation is here - and it is not going away: Inflation rose by 5.4% in June within the USA compared to the same period last year. That is more than even pessimistic experts had expected in the run-up to the figures. Inflation is also picking up speed; compared with the previous month, inflation rose by 0.9%. The answer to this development may be gold. Shortly after the figures were published, the precious metal surged. We highlight two gold stocks and use the example of another currently very popular commodity stock to show why the time is favorable for gold now.

ReadCommented by Nico Popp on July 12th, 2021 | 12:22 CEST

Barrick Gold, Carnavale Resources, Yamana Gold: Where gold still shines

Public debt in Germany has exceeded the EUR 2.2 trillion mark for the first time, the Federal Statistical Office announced a few weeks ago. Per capita, the debt thus stands at EUR 26,532. Of course, such figures also unsettle investors. If the public sector is so indebted, this could also impact future monetary policy - after all, rising interest rates would significantly increase the cost of refinancing. That is an argument for the ultra-loose monetary policy to continue. That includes all the negative consequences, such as rising prices for tangible assets and products for daily use.

ReadCommented by Carsten Mainitz on July 8th, 2021 | 14:56 CEST

Barrick Gold, Triumph Gold, Sibanye-Stillwater - invest with foresight!

In the medium term, many market participants agree - the gold price will and must rise. The monetary policy is too expansive, and historically, the precious metal has always been in high demand when there is a crisis. At around USD 1,800 per ounce, the gold price is still more than USD 250 away from the summer high of 2020. But even the current price level allows producers to earn high profits, deleverage, pay higher dividends, buy back their shares, or diligently acquire projects. We show you three promising investment ideas from the gold sector. Who is the favorite?

ReadCommented by Nico Popp on July 2nd, 2021 | 13:04 CEST

Barrick Gold, Desert Gold, Steinhoff: Knowledge instead of hope and fear

Gold has recently gone under the wheels, but that does not necessarily mean anything. The experts at Commerzbank are still sticking to their gold price forecast of USD 2,000 by the end of the year. Given the recent correction, the potential for price gains is therefore even greater. We outline how investors can invest based on two companies from the gold sector. We then distinguish speculative gold investments from gambler stocks.

ReadCommented by André Will-Laudien on July 1st, 2021 | 10:41 CEST

CureVac, Barrick Gold, Troilus Gold - Now it is important to keep your nerves!

The bull market is maturing a bit more every day. It is no longer young - because it has been running steadily since 2015. Admittedly, it stuttered a bit in March 2020, but the subsequent recovery was all the more violent. There are long-term fundamental trends, so-called megatrends, such as digitalization or e-mobility. At present, we can assume that the mining industry will also boom again in contrast to the crypto world. That is because the medium-term parameters here match the current economic trends. Here is a small selection of well-positioned stocks.

ReadCommented by Nico Popp on June 29th, 2021 | 14:04 CEST

SAP, Barrick Gold, GSP Resource: How to invest smartly

Stocks rise and rise. A little more than a year ago, the hope that not everything would be so bad in the end boosted share prices. The end of the pandemic now seems to be near. Linked to this is the hope that the future will bring many new things and that established companies, in particular, will be able to secure a large piece of the pie. But which sectors are exciting? We take a look at two different industries and discuss the opportunities and risks.

ReadCommented by Carsten Mainitz on June 21st, 2021 | 14:19 CEST

Barrick Gold, NSJ Gold, First Majestic Silver- Buy and stay patient

In Gold we trust - is the name of a publication that has been published since 2007 and has become a benchmark for interested gold investors. The authors believe that gold and silver have an excellent chance to climb to higher prices at the end of the current year. For the end of the decade, the experts forecast at least a price of USD 4,800 per ounce of gold. Given such optimistic forecasts, we will look below at three shares that should benefit significantly from this.

ReadCommented by Stefan Feulner on June 18th, 2021 | 11:34 CEST

Bayer, White Metal Resources, Barrick Gold - Trendsetting news

At Federal Reserve's meeting, runaway inflation was the topic par excellence. With US consumer prices up 5% in May, market participants assumed at least an announcement of a pullback in bond market volume. However, an interest rate hike, which would actually be necessary for price stability, is not considered before 2023, according to FED Chairman Jerome Powell. Thus, through the continued ultra-loose monetary policy, he refers to the attitude that economic growth and a rising stock market are more important than low inflation.

ReadCommented by Carsten Mainitz on June 17th, 2021 | 13:58 CEST

NewPeak Metals, Barrick Gold, Aurelius - A league of their own, performance without end!

Most experts agree gold will soon reach a new high. Who wants to invest not only physically in the precious metal can participate in "gold companies." As a rule, good quality companies perform better than the "underlying." The safest option is to invest in producers, but the potential return is much higher with exploration companies due to the higher risk. Which will you choose?

Read