RIO TINTO LTD

Commented by Armin Schulz on May 6th, 2022 | 10:43 CEST

Barrick Gold, Edgemont Gold, Rio Tinto - Are gold stocks taking off again?

With the start of the Ukraine crisis, the gold price skyrocketed, but since March 8, we find ourselves in a consolidation. The 200-day line is currently holding, and it could go up again from here. But let's look at the reasons for the weakness in the gold price. On the one hand, there is the strong dollar, which naturally puts pressure on the gold price, and on the other hand, bond yields in the US are climbing again. After the FED announced on May 4 that it would not raise interest rates by more than 0.5 percentage points, which was originally feared, the gold price jumped again. Demand for physical gold remains high. We look at three companies in the gold sector.

ReadCommented by Carsten Mainitz on September 24th, 2021 | 12:09 CEST

Troilus Gold, Rio Tinto, BHP - Exploit uncertainty!

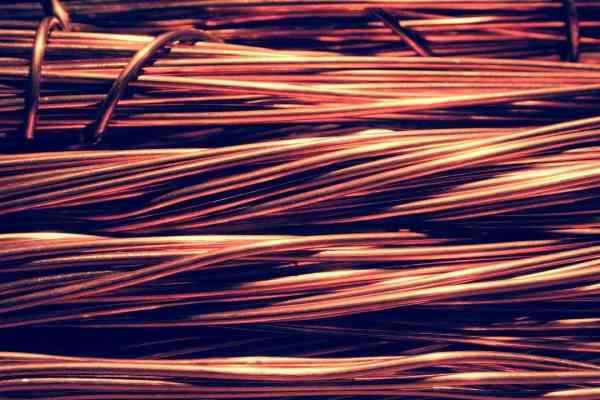

The falling demand for iron ore by the world's largest consumer, China, has put enormous pressure on the prices for iron ore and led to the downward slide in the share prices of major players such as Rio Tinto and BHP. In the medium term, prices will have to rise again due to high demand. Likewise, precious metals should rise in times of high inflation, including copper, which is in demand due to the growth of electromobility, among other things.

ReadCommented by Armin Schulz on September 22nd, 2021 | 11:19 CEST

GSP Resource, Varta, Rio Tinto - The post-fossil age has begun

The phase-out of fossil fuels is already underway. If we want to do something for the climate, this step is unavoidable. The phase-out is to be offset either by nuclear power or renewable energies. In Germany, we are saying goodbye to both nuclear power and fossil fuels. At the same time, the introduction of renewable energies means that more metals are now needed. Whether silver, rare earths, nickel, cobalt or copper - these metals are necessary for technological progress. Copper, in particular, is essential for electrification, and demand is rising steadily. That is due to the growing sales of electric cars, for which more copper is needed than for combustion engines. Today we look at three companies that have a lot to do with copper.

ReadCommented by Carsten Mainitz on August 9th, 2021 | 10:19 CEST

Diamcor Mining, Rio Tinto, Siemens - Tailwind

Diamonds have a number of unique properties, which means that they are in demand in the jewelry sector and industry in particular. Diamonds are considered the hardest material of all; they can withstand high thermal stress and strong electrical resistance. For these reasons, diamonds are sought after in laser technology, in semiconductors, and for a wide range of electronic components. The world's largest diamond producers include Russia, Africa and Australia. Many industry experts expect that current known global diamond production will be insufficient to meet growing demand from China and India. We have three exciting investment ideas in store.

ReadCommented by Armin Schulz on July 30th, 2021 | 14:07 CEST

Barrick Gold, Theta Gold Mines, Rio Tinto - Gold picks up again

After the FED meeting, the gold price was able to gain significantly. Both the lower quoted bond yields and the weakening USD helped the gold price jump. The FED held out the prospect of reducing bond purchases but did not give a fixed date. Global gold demand has brightened significantly compared to previous quarters. Only jewelry demand is well below pre-Corona levels. On the other hand, Central banks have bought three times more gold than usual in the quarter, namely 200 tons. Gold could now soar to new highs.

ReadCommented by Nico Popp on July 22nd, 2021 | 09:41 CEST

American Water Works, Memiontec, Rio Tinto: Solid Company operating in a booming region

Water is a precious commodity - a fact now remembered since the recent flood disaster in parts of Rhineland-Palatinate and North Rhine-Westphalia. People without access to clean water are more likely to suffer from infectious diseases. What is only an issue here for a few weeks after natural disasters is sadly commonplace in other regions. It is not without reason that access to clean drinking water has long been a human right. Protecting water supplies is also a duty for companies. It is no wonder that investments in clean water can yield good returns.

ReadCommented by Armin Schulz on June 25th, 2021 | 10:58 CEST

Carnavale Resources, Rio Tinto, TotalEnergies - Commodities still in hype

Commodities are in demand, as seen from the Bloomberg Commodity Index, which reached a multi-year high on June 11. Among other things, this is due to China's enormous hunger for raw materials and the infrastructure program of the USA. Inflation fears also drive more investors to commodities, as there is no end in sight to the loose monetary policy. In addition, there is a rethinking of climate protection, giving rise to hypes such as hydrogen or e-mobility. These new technologies require raw materials such as copper or nickel, and so commodity prices are picking up significantly in almost all sectors. That's why we are taking a look at three exciting commodity companies today.

Read