The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on January 14th, 2021 | 18:50 CET

BYD, Deutsche Rohstoff AG, Ballard Power - There is huge potential here!

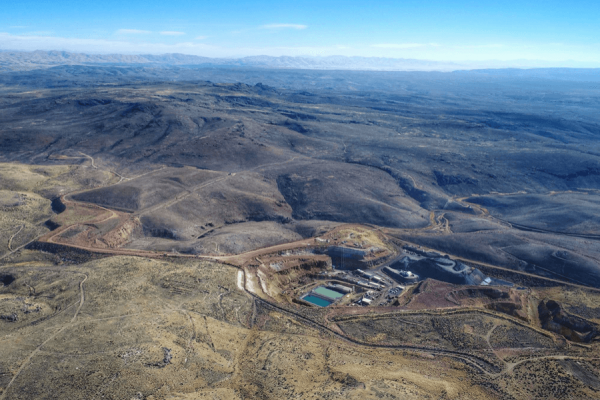

Since the historic crash last March due to the Corona pandemic, the oil price has stabilized well above USD 50.0. The large investment houses assume further rising prices of the black gold. Experts also see most commodities rising sharply due to the ever-increasing demand caused by new technologies. The scarcity of the required materials will increase enormously in the next few years. As a result, prices are likely to climb dramatically.

ReadCommented by Stefan Feulner on January 14th, 2021 | 17:34 CET

Geely, Nevada Copper, Xpeng - Invest in the future!

If you think investing in future technologies like blockchain, hydrogen or electric mobility will offer the most significant returns in the coming years, you could be wrong. These new technologies, in particular, require raw materials and metals that are already in short supply. The sales forecasts for electric car manufacturers, for example, point to one thing for the next few years: a shortage of raw materials. This shortage will lead to a drastic excess in demand and thus to exploding prices. The decade of raw materials!

ReadCommented by Stefan Feulner on January 13th, 2021 | 10:55 CET

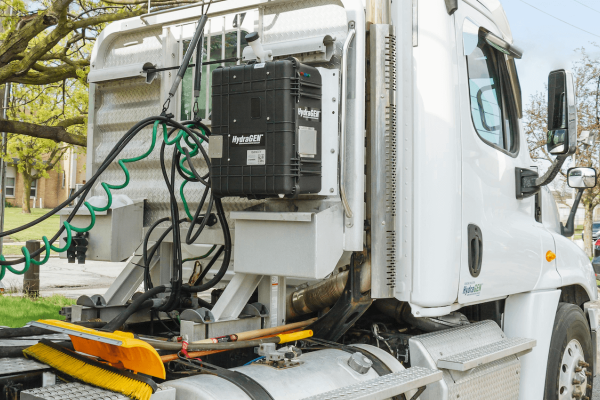

NEL ASA, dynaCERT, Everfuel - Is the hydrogen bubble bursting?

The valuations of most hydrogen stocks are skyrocketing to immeasurable heights. Compared to the current balance sheet figures, this seems irrational and unjustified. Only the future forecasts in terms of sales and profits are used as a benchmark. Much is reminiscent of the year 2000 and the new market, when shares such as Gigabell or Metabox were maneuvered into orbit, only to fall from the sky like shooting stars a short time later.

ReadCommented by Stefan Feulner on January 12th, 2021 | 07:46 CET

Plug Power, Almonty, Alibaba - Watch out, a breakthrough!

Electric motors, hydrogen, fuel cells, new trends are coming to the capital markets all the time. But it is not only the latest technologies that will multiply in the coming years. Essential is the extraction of the raw materials needed for these technologies. The scarcity that we are sure to face in the next few years is likely to be seen by the stock market in the near future. At the moment, there is no sign of hype around scarce commodities.

ReadCommented by Stefan Feulner on January 11th, 2021 | 10:08 CET

Geely, Desert Gold, Li Auto - Incredible development!

The trend towards electromobility and away from combustion engines is developing more and more rapidly. Almost all the electric car manufacturers across the board increased their sales figures by 100% in 2020. With new models and better battery technologies, the old automobile world's replacement is being strongly forced. The big technology groups are now getting into the lucrative electromobility business. In cooperation with Hyundai, Apple is probably making a start and others will follow, giving the industry another considerable push.

ReadCommented by Stefan Feulner on January 7th, 2021 | 09:50 CET

JinkoSolar, Defense Metals, BYD - demand boom leads to catastrophe!

The sales figures for all major electric car manufacturers for the full year 2020 are on the table. 100% more e-cars were sold compared to the same period last year. But even more significant for the future is that vehicles with electric motors have overtaken pure combustion engines in new deliveries. The disruptive replacement is in full swing. However, shortages are emerging in the raw materials needed for the production of batteries and motors.

ReadCommented by Stefan Feulner on January 6th, 2021 | 17:30 CET

Palantir, Silver Viper, TUI - the timing is crucial!

Gold and silver are bullish again. While the two precious metals provided investors with returns of 20% in each of the past two years, the trend stalled somewhat from August onwards. The correction was due to brightening sentiment regarding the Corona pandemic, significant successes in vaccine research, and the voting out of the Donald Trump administration in the United States. What remains, however, is the sharp rise in sovereign debt issues and extremely low interest rates.

ReadCommented by Stefan Feulner on January 5th, 2021 | 08:27 CET

BYD, Blackrock Gold, Xpeng - electric cars, where's the limit?

The disruptive replacement of combustion engines with electric motors is in full swing. Pioneers of e-mobility such as Tesla, BYD, NIO and soon Apple, are overrunning the traditional car manufacturers. The latter have either underestimated the development in recent years or do not have the necessary technical know-how. This development can be seen impressively in both the sales increases and the stock market values. The trend seems unbroken, and there is little to suggest a change in the near future.

ReadCommented by Stefan Feulner on January 4th, 2021 | 11:12 CET

NIO, Fokus Mining, TUI - Off to new heights!

There were records upon records set in one of the most exciting stockmarket years, 2020. Both the DAX, Dow and the technology exchange Nasdaq jumped to new highs. The leading cryptocurrency Bitcoin started an incredible comeback and raced through its 2017 high to now USD 34,000.00. Records will tumble again in 2021. Cryptocurrencies and hydrogen and electric cars will continue to be in demand, but highs in other areas are also possible.

ReadCommented by Stefan Feulner on December 30th, 2020 | 09:29 CET

Everfuel, Q&M Dental Group, SAP - Focus on change!

The year is drawing to a close. It has been an exciting year for the capital markets due to the Corona pandemic. In addition to reaching new highs at Dow, DAX & Co., the boom in IPOs, especially in the USA, was another surprise. The situation in the real economy is different, though. While Europe, South America and the United States are still suffering from the lockdowns, the Asian economies are recovering far faster than expected.

Read