The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on July 13th, 2021 | 10:05 CEST

Bayer, Almonty Industries, Daimler - Shortages without end

The shortage of semiconductors weighs heavily on the auto industry. According to a study by the Duisburg-based Center for Automotive Research, it will be responsible for the loss of production of around five million vehicles this year alone. An end to the chip shortage is not yet in sight. Meanwhile, the next crisis due to the lack of raw materials is already just around the corner. Due to the rapid growth in electromobility, the high demand for lithium-ion batteries means that the next failures are pre-programmed.

ReadCommented by Stefan Feulner on July 12th, 2021 | 13:36 CEST

NIO, Kainantu Resources, BASF - Bright prospects

The first half of the 2021 stock market year is over, and the stock market indices continue to march from high to high. While some market participants were hoping for a stronger correction after the Corona rally, they have been disappointed so far. The FED has now laid the foundation for further rising prices. It sees the rising inflation, which is currently at 5% in the USA, as temporary. In favor of growth, interest rates will remain at historic lows for the time being. In addition, the bond-buying program of the monetary guardians continues unabated - a feast for the stock markets.

ReadCommented by Stefan Feulner on July 9th, 2021 | 14:51 CEST

Volkswagen, Carnavale Resources, Daimler - Prepared for the future

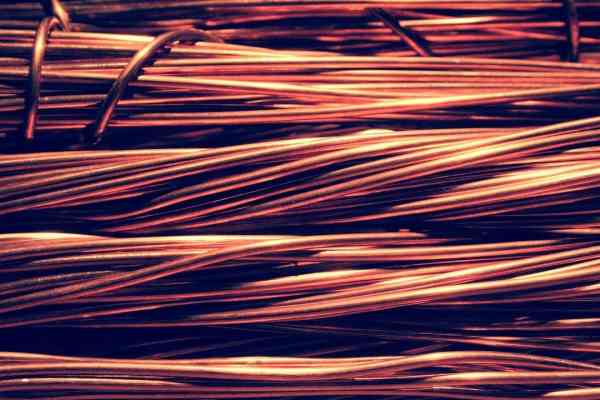

In addition to the global economic recovery, a long-term structural change towards a climate-neutral future is driving raw material prices. Copper is considered a key element for electromobility and renewable energies. It is used in the production of batteries, electric cars, solar modules and wind turbines. Other essential materials such as nickel, cobalt and lithium are primarily produced in China. Demand threatens extreme shortages and skyrocketing prices. Profit from this cycle.

ReadCommented by Stefan Feulner on July 9th, 2021 | 11:27 CEST

Nel ASA, Deutsche Rohstoff AG, Royal Dutch Shell - Flexibility pays off

If you believe the media, fossil fuels have no long-term future. The replacement by renewable energies such as wind and water power or photovoltaics seems to be a done deal. Whether the "green turnaround," as planned by politicians, will occur is still written in the stars. The new technologies have too many open construction sites; think of the weak infrastructure for e-charging stations. Until then, demand for fuels such as gasoline and diesel for cars with internal combustion engines is likely to remain at a high level, much to the liking of oil producers.

ReadCommented by Stefan Feulner on July 8th, 2021 | 13:18 CEST

BioNTech, Defence Therapeutics, Moderna - The wheel keeps turning

After a hesitant start, Germany is making good progress with vaccinations. Around 47.5 million people, or 57.1% of the total population, have been vaccinated at least once. The number of fully vaccinated people rises to 39.9%. Rosy prospects for the summer in the republic. But now comes the Delta variant. According to initial studies, it is more resistant to the vaccines currently on the market than other variants. Research is continuing, and new manufacturers are entering the market to participate in the billion-dollar business.

ReadCommented by Stefan Feulner on July 8th, 2021 | 10:54 CEST

Nordex, The Very Good Food Company, BMW - Megatrend sustainability

Alongside the efficient use of energy, renewable energy sources are an essential pillar of a sustainable climate policy. The use of energy is considered sustainable if it meets the needs of the present without compromising the needs of future generations. At present, the issue of sustainability is preoccupying us in all areas of life. As a result, entirely new sectors of the economy are emerging. Companies that build on these themes face a dazzling future.

ReadCommented by Stefan Feulner on July 7th, 2021 | 14:25 CEST

Infineon, Desert Gold, BASF - Prepared for the future

The energy turnaround and the achievement of climate neutrality are back in the news as the Corona pandemic fades. Politicians around the world are supporting with billions in subsidies. But the industry is under pressure. Climate neutrality requires the introduction of new production technologies in many sectors, and in areas such as basic materials, the conversion of entire production lines. On the other hand, competitiveness should not suffer in this historic transformation.

ReadCommented by Stefan Feulner on July 7th, 2021 | 11:49 CEST

BYD, QMines, Xpeng - Play the Trend

In recent weeks, there have been shortages of many commodities and intermediate goods. The shutdown of production during the Corona pandemic led to supply shortages of lumber, semiconductors and chemicals. In contrast, demand for consumer goods rose sharply after the economy eased. The result was significantly increasing prices due to the shortage. In the long term, this phenomenon will also occur for metals needed for the energy transition. The first tendencies are already becoming apparent. Take advantage of the cycle!

ReadCommented by Stefan Feulner on July 6th, 2021 | 10:55 CEST

NIO, Troilus Gold, Vestas - Shares with a tailwind

US President Joe Biden has been in office for around six months. In contrast to his predecessor Donald Trump, he places climate protection at the center of his policies. The renewed accession of the US to the Paris Climate Agreement was the first official act, and the updated Nationally Determined Contribution to climate protection stipulates that the USA will halve its emissions by 2030 compared with 2005. It aims to turn this around with massive trillion-dollar programs. Companies that rely on renewable energies will benefit from this in the long term.

ReadCommented by Stefan Feulner on July 5th, 2021 | 12:31 CEST

Nel ASA, Royal Helium, Siemens Energy - In the fast lane

Hydrogen can power electric motors, store energy and heat homes with the help of fuel cells. Because of these properties, the most common chemical element in the universe plays a vital role in the energy transition and CO2 neutrality. Shares in hydrogen companies were the stars of the stock market sky last year, alongside electric carmakers. Then came a sharp correction. Currently, most companies have finished their bottoming phase and are turning north again. Do not miss the second chance!

Read