The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on August 20th, 2021 | 11:14 CEST

Geely, GSP Resource, Nel ASA - Taking advantage of the correction

After a ten-year high of over USD 10,500 per ton, copper is correcting and is currently scratching the USD 9,000 mark. In the short term, there is a favorable entry opportunity to participate in the next supercycle. Copper is the base metal of the energy transition. The high demand due to the switch to renewable energy sources is already being offset by an extremely tight supply. The result is rising prices in the long term.

ReadCommented by Stefan Feulner on August 19th, 2021 | 11:37 CEST

JinkoSolar, Central African Gold, NIO - Energy transition opportunity

With decarbonization and the drive to achieve carbon neutrality, the world is changing. There is a push for electrification and a shift away from fossil fuels. Transitions create opportunities. This transition will require massive additional quantities of copper, cobalt and nickel, whether for electric vehicles, solar, hydro or wind technologies. New industries are emerging that are still in the early stages of a long-term transformation. Seize the opportunity!

ReadCommented by Stefan Feulner on August 18th, 2021 | 11:37 CEST

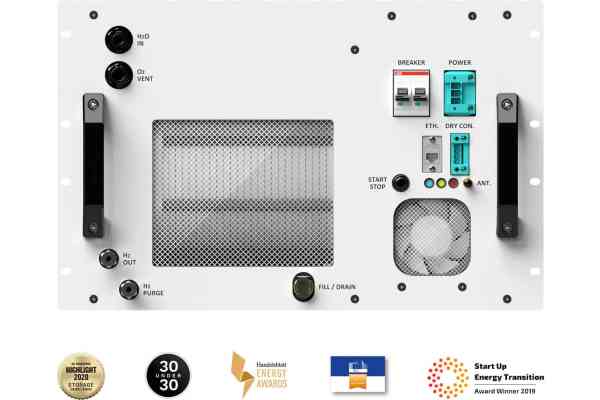

Nel ASA, Enapter, Nordex - Highly acclaimed and deeply fallen

The euphoria around renewable energy shares was huge last year. Companies from the hydrogen, wind energy or electromobility sectors were able to multiply and reached valuations that they would never justify in the next few years. This run was fueled by billion-dollar programs to promote the energy turnaround by politicians. A market shakeout has been underway for months. Which stocks are now promising and which have further correction potential?

ReadCommented by Stefan Feulner on August 17th, 2021 | 12:32 CEST

Deutsche Telekom, Quantum eMotion, Bechtle - The next big thing

The lockdowns due to the Corona pandemic and working from home were a ready-made meal for cybercriminals. The rapid build-up of new technology such as laptops, software or networks caused significant security gaps that hackers used to increase their activities. The damage to the German economy is considerable. At an estimated EUR 220 billion in 2020, it is twice as high as in previous years. An end to this trend is not expected. However, more and more young technology companies are emerging that want to participate in the billion-euro cybersecurity market. Be there from the start.

ReadCommented by Stefan Feulner on August 16th, 2021 | 12:04 CEST

Freenet, Deutsche Rohstoff, Palantir - The clock is ticking

The German parliamentary elections are on September 26, which means there are just under 6 weeks left in which Baerbock, Laschet and Scholz vie for the favor of voters. Climate protection is one of the most important campaign issues. If you look at the party programs, the energy transition enjoys the highest priority among the Greens. They plan an immediate climate protection program that will quickly initiate effective measures in all areas and remove obstacles to expanding renewable energies. To this end, the Climate Protection Act is to be tightened up. Emissions will be reduced by 70% by 2030, and Germany will be climate-neutral by 2035. It should already be clear to every German citizen entitled to vote that much of what is planned in theory can hardly be implemented, or at least not within the specified timeframe.

ReadCommented by Stefan Feulner on August 13th, 2021 | 11:39 CEST

Steinhoff, Kodiak Copper, NIO - At the beginning of the trend

Rising inflation is making living more expensive. The culprit for the increase - in Germany, consumer prices rose by 3.8% in July compared to the same month last year - is increasingly expensive raw materials. In addition to agricultural commodities such as corn and wheat, metals in particular, which are urgently needed for the energy transition, are going through the roof. There is no end in sight to the price increase here; economists are already talking about a supercycle lasting years.

ReadCommented by Stefan Feulner on August 12th, 2021 | 13:42 CEST

ThyssenKrupp, Triumph Gold, Evotec - Growth before inflation

After the disastrous Corona year 2020 filled with profit slumps, the economy is coming back to life. The quarterly figures currently being reported indicate rising returns once again and thus an end to the dry spell. However, the inflation rate is also rising enormously; in Germany, it jumped to its highest level in almost 30 years, according to the Federal Statistical Office. Growth and job creation take precedence over price stability - a dangerous undertaking for the future. The central banks are being challenged.

ReadCommented by Stefan Feulner on August 11th, 2021 | 12:20 CEST

Coinbase, Almonty, Infineon - Deals for the Future

"Thinking about Tomorrow Today" is a quote that not only corporate leaders need to follow when it comes to establishing new business models to secure the future. It also applies to the energy transition. What use are ever more sharply formulated climate targets by politicians if it is not even certain at the moment where the scarce raw materials for the production of renewable energies such as electromobility, photovoltaics or wind power are to be obtained from over the next few years. The companies that have already thought about tomorrow are therefore becoming the new stars on the stock market.

ReadCommented by Stefan Feulner on August 10th, 2021 | 12:45 CEST

Nordex, Saturn Oil & Gas, BP - Pressure on the pipeline

Despite record figures from Saudi oil giant Saudi Aramco, with profits quadrupling in the last quarter, the oil price fell more than 4% due to resurgent concerns over the Corona pandemic. A correction is more than healthy after a price quadrupling and the brilliant recovery rally since the crash in the spring. Experts see black gold beyond the USD 100 mark in the long term, despite the energy transition and the switch from fossil fuels to renewables.

ReadCommented by Stefan Feulner on August 9th, 2021 | 11:24 CEST

Plug Power, Silver Viper, Xiaomi - The pressure is mounting

The Federal Reserve is in a tight spot. Due to positive labor market data, the US economy has created more jobs in July than at any time in a year; the bulk of market participants expect a swing in monetary policy soon. Due to the fear of interest rate hikes, the precious metals gold and silver fell drastically. But are the monetary authorities even in a position to raise interest rates significantly due to the general conditions? Probably not, which should cause both gold and silver prices to soar in the long term.

Read