The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on April 15th, 2022 | 12:11 CEST

Deutsche Bank, wallstreet:online, Commerzbank - Financial stocks about to jump

Rising and longer-lasting inflation is worrying market participants. The central banks, which held on to their ultra-loose monetary policy for too long in favor of possible economic growth, must act now. While the ECB is still in a deep sleep, the US Federal Reserve started with the first interest rate hikes, and more will follow. The beneficiaries of the interest rate turnaround are financial institutions, which also performed after the announcements. However, the war in Ukraine knocked them back. A possible second chance to invest in attractive financial service providers.

ReadCommented by Stefan Feulner on April 13th, 2022 | 17:59 CEST

Commerzbank, Kodiak Copper, NIO - Unstoppable trend

Remember last year when both Federal Reserve chief Jerome Powell and ECB frontwoman Christine Lagarde called rising inflation "temporary"? According to the Federal Statistical Office, consumer prices for March have come in fresh across the news tickers, showing a 7.30% increase, the highest level since reunification. On the one hand, of course, the Ukraine conflict impacts rising energy and commodity prices, but even after the end of the warlike activities, many goods in demand because of the energy transition are likely to at least maintain the high price level.

ReadCommented by Stefan Feulner on April 13th, 2022 | 17:50 CEST

Infineon, BrainChip, Nvidia - Chip market facing the next wave

Due to current events in connection with the Ukraine conflict and the announced sanctions against Russia, certain everyday goods are becoming scarce. Currently, consumers face empty supermarket shelves for sunflower oil, for example. It seems almost forgotten that there is also still a shortage of semiconductors. This crisis could worsen because of the war. One reason is that the noble gas neon, which is necessary for chip production, could run out. Intel CEO Gelsinger expects the chip shortage to last into 2023.

ReadCommented by Stefan Feulner on April 12th, 2022 | 20:31 CEST

BioNTech, Desert Gold Ventures, BYD - Decisive steps

There is currently great uncertainty on the capital markets. While the Ukraine war and the fear of interest rate hikes due to the enormous increase in inflation are weighing on the minds of investors in Europe, investors in Asia are pulling back due to the tightened Corona measures in China. The zero-covid policy could result in widespread mass shutdowns, negatively impacting industrial production and domestic consumption. Electric car maker NIO, for example, has already halted production.

ReadCommented by Stefan Feulner on April 12th, 2022 | 18:37 CEST

Plug Power, Phoenix Copper, JinkoSolar - Shares for freedom

The conflict between Russia and Ukraine, which has been simmering for weeks, dominates world events. Above all, the implementation of the energy turnaround is at the top of the agenda. Due to the declared sanctions, politics and the economy are facing a stress test on becoming more independent from Russian gas and coal in the future. Longer coal and nuclear lifetimes are on the cards. The traffic light politicians agree that the real path to energy independence is to phase out fossil fuels in the long term. However, scarce raw materials such as copper make this an expensive undertaking.

ReadCommented by Stefan Feulner on April 11th, 2022 | 19:03 CEST

K+S, Edgemont Gold, NIO - Shares as protection against demonetization

Inflation rates have been rising steadily since the end of 2020. What was initially declared by central bankers as a temporary event is becoming a permanent problem for society and the economy. The loose monetary policy, the shortage of raw materials, and the blown-up supply chains were responsible for the fact that the inflation rate in the USA was 7.9% in March, the highest since 1982. As a result of the sanctions imposed on Russia, the supply of raw materials and oil and gas is becoming even tighter, causing prices to shoot up once again. Investors can protect themselves by investing in producers of scarce commodities. In addition, for diversification, gold should not be missing in any portfolio as protection against currency devaluation.

ReadCommented by Stefan Feulner on April 9th, 2022 | 07:27 CEST

BioNTech, Triumph Gold, Rheinmetall - Uncertainties everywhere

The ongoing fighting in Ukraine and concerns about an escalation of the situation are worrying capital markets worldwide. Nevertheless, the leading stock market barometers were able to distance themselves significantly from their lows. Now, the next blow has followed with the publication of the FED's meeting minutes. The US Federal Reserve wants to accelerate the reduction of its balance sheet total and let bonds worth up to USD 95 billion expire without buying again. In doing so, the monetary authorities are hitting technology stocks in particular, which have already been in a sharp correction since the beginning of the year. Gold, on the other hand, is barely reacting despite the expected interest rate hikes, a strong sign for the precious metal.

ReadCommented by Stefan Feulner on April 7th, 2022 | 14:35 CEST

Newmont, MAS Gold, Barrick Gold - This will be the hard currency

Precious metals lived up to their name as a crisis currency when the Russian army invaded Ukraine at the end of February. Gold rose by almost 10% in the first rush and marked a new high at USD 2,070.18 per ounce. Only USD 4 was missing to climb to a new all-time high in the current world reserve currency, the US dollar. Since then, the yellow metal has been correcting, but new highs should only be a matter of time in the long term. The importance of gold can currently be seen due to geopolitical tensions. The chairman of the Russian Energy Commission, Pavel Zavalny, proposed to pay for Russian oil and gas in "hard currency", i.e. in gold.

ReadCommented by Stefan Feulner on April 6th, 2022 | 10:19 CEST

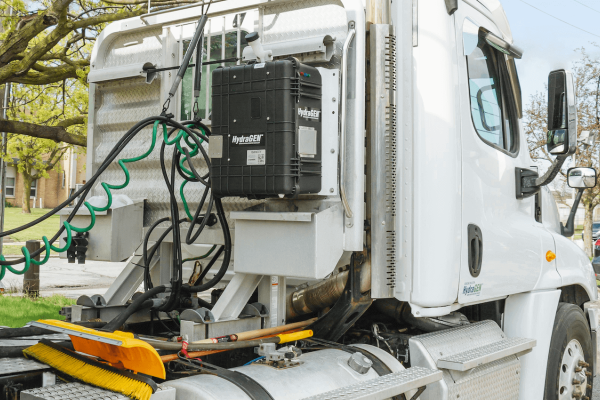

Ballard Power, dynaCERT, Plug Power - Hydrogen more important than ever before

The consequences are already apparent, at the latest when you stand at the gas pump and look at the horrendous increases of the last weeks. Germany is paying the price because of its overdependence on one customer, in this case, Russia. It is also a fact that Germany is moving too slowly concerning the energy transition. Acceleration is now imperative. Hydrogen fuel cell technology has already been identified as the missing piece of the puzzle and is becoming all the more important due to the current geopolitical tensions.

ReadCommented by Stefan Feulner on April 5th, 2022 | 12:10 CEST

K+S AG, Globex Mining, KWS Saat - Perfectly positioned

Society has less than 30 years to achieve the climate neutrality agreed upon under the Paris Climate Agreement. But this requires many metals and raw materials. Demand for lithium, copper and nickel will exceed supply as early as 2022. With the outbreak of the Ukraine conflict, there will be a further shortage and an explosion in prices. The beneficiaries of this trend are commodity producers and exploration companies. Globex Mining is a global commodity incubator and stands out with its business model.

Read