The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on February 4th, 2025 | 07:20 CET

Baidu, dynaCERT, BYD – Using the Trump hammer

After the Trump trades and the subsequent rally, is the Trump hammer coming next? After the stock markets reached historic highs in recent weeks, a sharp correction followed on Monday. The reason for this was the tariffs imposed by the US on Canada, Mexico, and China. The consolidation could continue to expand, given that the Buffett Indicator, which looks at the market capitalization of all US companies in relation to economic output, is at an all-time high. Nevertheless, there are undervalued value stocks that could escape the downtrend.

ReadCommented by Stefan Feulner on February 3rd, 2025 | 07:10 CET

Alibaba, Credissential, ASML – Profiteers and losers of the AI quake

Last week, the new Chinese chatbot DeepSeek caused the stock markets, particularly semiconductor stocks, to falter. Chip giant Nvidia lost 17% of its market value in one day and almost USD 600 billion in market capitalization. Whether DeepSeek can truly follow in the footsteps of ChatGPT after the initial euphoria is questionable. However, new models are coming to market that could steal market share from the established players in the future.

ReadCommented by Stefan Feulner on January 28th, 2025 | 07:00 CET

Rheinmetall, European Lithium, BYD – Drastic measures

The pressure from the former and current US president to increase defense spending among NATO partners remains high, which means that defense companies will likely face a revaluation. By contrast, subsidies for electric vehicles in the US are on the verge of being phased out. However, industry experts and analysts are convinced that the global trend towards electric mobility will remain unaffected. China remains the largest growth market for electric vehicles, with a share of 65% and 11 million vehicles sold, and the trend is rising. As a result, the demand for the basic raw material lithium is increasing.

ReadCommented by Stefan Feulner on January 27th, 2025 | 07:20 CET

Novo Nordisk, Desert Gold Ventures, Palantir – AI madness, Trump fuels the gold rush

Things have been moving at a rapid pace since the old and new President of the United States, Donald Trump, took office. Around 80 decrees were signed on the first working day alone. One of the Republican's goals is to make the US the "global hub for crypto and artificial intelligence". With the commitment of over USD 500 billion for the largest AI project in history, the industry is likely to face further appreciation. The price of gold has also increased, and it is now approaching the magic mark of USD 3,000 per ounce. In this context, producers and exploration companies are now likely to tap into their catch-up potential.

ReadCommented by Stefan Feulner on January 21st, 2025 | 08:30 CET

Rheinmetall, ARI Motors, Volkswagen – Trump sets the course

The inauguration of the 45th and 47th President of the United States is currently overshadowing everything else. In the run-up to the event, the leading German index, DAX and the leading cryptocurrency, Bitcoin, reached new all-time highs. However, uncertainty is growing regarding which industries will be among the so-called "Trump Trades" and which can expect less support from the US government. One thing is certain: market volatility is unlikely to decrease anytime soon.

ReadCommented by Stefan Feulner on January 20th, 2025 | 07:30 CET

Daimler Truck, First Hydrogen, Siemens Energy – Hydrogen with rebound potential

From a stock market perspective, 2024 was a year to forget for companies in the hydrogen fuel cell segment. Companies like Plug Power and Nel ASA faced significant setbacks, continuing to shed the inflated valuations that had ballooned since the pandemic lows. There is no question that hydrogen technology remains fundamental to the climate turnaround. However, smaller, innovative competitors are now pushing their way to the fore and could benefit disproportionately from the next upward wave.

ReadCommented by Stefan Feulner on January 14th, 2025 | 07:55 CET

Qiagen, Vidac Pharma, and Bayer with groundbreaking news

In the years to come, biotechnology will play a central role in solving global challenges. From the development of innovative therapies to sustainable agriculture and biobased industries, biotechnology combines science and technology to make the world more sustainable and efficient. As a driver of growth and innovation, it offers enormous opportunities for companies and investors who want to actively shape the future.

ReadCommented by Stefan Feulner on January 13th, 2025 | 07:00 CET

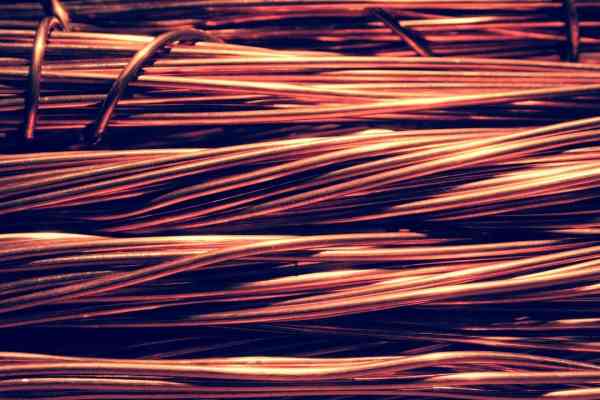

Nordex, XXIX Metal, D-Wave Quantum – Demand is driving prices

The decarbonization of the energy industry and the accelerated expansion of data centres for calculating artificial intelligence are creating a steadily increasing demand for energy sources that are as clean and efficient as possible. In addition to the ramp-up of solar energy, wind power plays a major role. The energy transition is leading to an enormous increase in the demand for copper. Forecasts assume that the demand for copper could increase by around 50–70% by 2030. By contrast, the past decade has seen a failure to meet rising demand by developing new projects. As a result, the few copper producers are likely to benefit from rising prices in the long term.

ReadCommented by Stefan Feulner on January 7th, 2025 | 07:00 CET

MicroStrategy, Almonty Industries and XPeng make headlines

The markets continued to rise in the first trading week of the new year. The DAX has managed to climb past the 20,000-point mark. Bitcoin is also working on reclaiming the magical USD 100,000 mark. For some market experts, this is just the beginning of an unstoppable run for the world's largest cryptocurrency. Less covered in the media but significantly more critical is the Western world's focus on securing vital raw materials. One company is on the launchpad and could soar to new heights after production begins.

ReadCommented by Stefan Feulner on January 6th, 2025 | 07:30 CET

Lilium, Saturn Oil + Gas, D-Wave Quantum – Big opportunities in the new stock market year

Companies in the artificial intelligence sector were undoubtedly the stock market stars of the past stock market year, 2024. This trend will also likely remain in favour with investors over the next 12 months. In addition, quantum computing stocks have come to the fore in recent weeks, and some have multiplied. After a weaker year overall in 2024, oil producers will likely become interesting following the correction. The future US president, Donald Trump, strongly advocates for fossil fuels, prioritizing them far above alternatives like wind power or photovoltaics.

Read