At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on June 30th, 2021 | 13:59 CEST

Gazprom, Theta Gold Mines, Yamana Gold: Which commodities are the best?

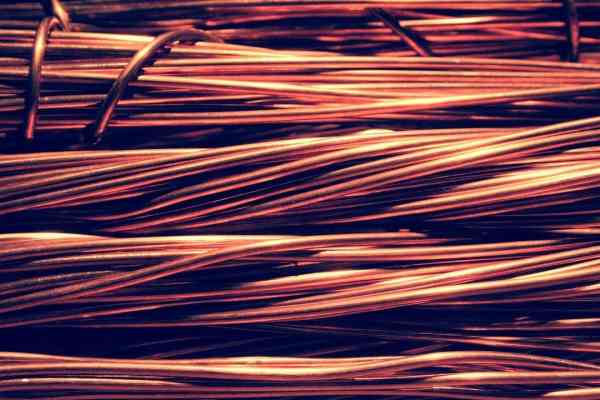

Commodity prices have always been considered an indicator of fundamental changes in the global economy. It is not for nothing that the price of copper is known as "Dr. Copper" because of its role as an economic indicator. Oil and gold also have a signaling effect: when the energy commodity rises, it stands for an intact global economy and incipient inflationary tendencies. Gold is also an inflationary metal in a certain sense. Added to this is the property as crisis insurance. But which commodities are best suited for investment? We run through three scenarios using companies as examples.

ReadCommented by Nico Popp on June 30th, 2021 | 11:04 CEST

BP, NewPeak Metals, Nordex: Three shares with energy

The energy turnaround offers excellent opportunities - that is what you read in many media reports. Indeed, regenerative energy has a great appeal - it does not produce any CO2 emissions. But this is not entirely true. The production of solar panels and wind turbines requires raw materials. Only when these are also produced in a climate-neutral way are regenerative energy sources genuinely sustainable. At the same time, oil and gas still play a significant role in the energy mix. We outline three companies involved in this complex of topics and also examine investment opportunities.

ReadCommented by Nico Popp on June 29th, 2021 | 14:04 CEST

SAP, Barrick Gold, GSP Resource: How to invest smartly

Stocks rise and rise. A little more than a year ago, the hope that not everything would be so bad in the end boosted share prices. The end of the pandemic now seems to be near. Linked to this is the hope that the future will bring many new things and that established companies, in particular, will be able to secure a large piece of the pie. But which sectors are exciting? We take a look at two different industries and discuss the opportunities and risks.

ReadCommented by Nico Popp on June 28th, 2021 | 11:15 CEST

Pfizer, Sartorius, Defence Therapeutics: Health as an investment opportunity

Tremendous opportunities lie dormant in biotech companies. New therapeutic approaches are suitable for fighting civilization diseases such as cardiovascular problems, cancer and Alzheimer's. In recent years, there has been a whole series of scientific breakthroughs. Some studies have shown phenomenal possibilities. It is now up to innovative companies to turn laboratory findings into practical clinical results. For shareholders, the opportunities are plentiful.

ReadCommented by Nico Popp on June 25th, 2021 | 14:01 CEST

BYD, Siemens Healthineers, Silver Viper: Many trends in one share

Trends and hypes on the stock market are not always easy: Sometimes they are slow, then there are dynamic upward phases, and sometimes you need patience. Whether it is electromobility, renewable energy or the latest developments in medical technology, no one knows when prices will rise. What is certain, however, is that all of the industries mentioned have a future. So how do you invest? We outline three stocks around the mentioned industries.

ReadCommented by Nico Popp on June 24th, 2021 | 11:59 CEST

Plug Power, NEL, Pure Extraction: Hydrogen on hold - here is what's next

Hydrogen is clean and suitable for storing large amounts of energy. Especially around trucks, ships and even airplanes, the technology is under discussion. Moreover, if the hydrogen is produced using renewable energies, the energy source is even essentially climate-neutral. Nevertheless, the sky is not currently full of violins for all hydrogen companies. Why? The competition is growing, and not every area of application is proving to have a promising future.

ReadCommented by Nico Popp on June 23rd, 2021 | 15:15 CEST

BYD, Plug Power, Saturn Oil & Gas: Take a close look at the energy transition!

Everyone is talking about electromobility and hydrogen - but what does it look like in reality? There are still many combustion engines in good condition on the roads. Scrapping them cannot be sustainable. The global energy mix also shows that renewable energies are a welcome trend but by no means the rule: As reported by the International Energy Agency, oil accounted for 31.5% of primary energy supply in 2018. It is followed by coal at 26.8%, and gas at 22.8%. Fossil energy sources thus had a share of more than 80% in 2018. These energy sources will still be needed in the coming years.

ReadCommented by Nico Popp on June 23rd, 2021 | 10:40 CEST

Deutsche Bank, Telekom, Aspermont: Here are the digitization winners

We now see in our everyday lives that digital solutions promise significant benefits: searching for a car-sharing vehicle or an electric scooter is only really fun with a smartphone. Many of the inconveniences of the Corona pandemic are also bearable, thanks to digital solutions. For example, the transmission of test results or proof of vaccination. Many traditional industries are also facing change thanks to digitalization. While large companies sometimes suffer from the change, small companies can gain market share. We outline three values.

ReadCommented by Nico Popp on June 22nd, 2021 | 15:02 CEST

JinkoSolar, Defense Metals, Gazprom: Values for the yield kick

The fight against climate change is an ideological issue in many places. That is why there are bitter opponents of the measures. But clean energy should be in everyone's interest - at least if it is profitable to produce. Many people rightly have reservations about pushing technology onto the market solely based on subsidies. History has shown that this creates the wrong incentives and even restricts the development of technology that could become established in the long term.

ReadCommented by Nico Popp on June 21st, 2021 | 12:06 CEST

Deutsche Bank, ThyssenKrupp, White Metal Resources: When opportunities arise from legacy issues

What will the market bring in the second half of the year? Will the takeover merry-go-round spin and blue chips continue to climb in the wake of the booming comeback economy? Or do infrastructure programs and further construction drive the steel sector? The chances are good that the economy is again breathing a breath of fresh air and is on the verge of a long-lasting upswing. Traditionally, this upswing is characterized by setbacks, particularly at the beginning. We outline how investors can invest, taking three stocks as examples.

Read