Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

She discovered the world of the stock market in 1998. With her passion for innovation and digitalization, she focused on companies from the technology and healthcare sectors early on.

Analyzing fundamentals, business models and their scalability is as much her passion as thinking into complex future scenarios. Since 2019, she has regularly organized stock exchange roundtables and attended international investment events to deepen and pass on her knowledge.

Commented by Juliane Zielonka

Commented by Juliane Zielonka on September 28th, 2023 | 09:20 CEST

First Hydrogen, Siemens Energy, PayPal - Innovative growth with hydrogen and its own currency

Global Market Insights forecasts that the parcel delivery vehicle market is expected to reach over USD 210 billion by 2032, driven by the uninterrupted growth of e-commerce. First Hydrogen is a company specializing in sustainable propulsion solutions for such fleet vehicles. Hydrogen-powered vehicles are also currently finding their way onto the streets of India. India is the world's fifth-largest economy and is sending a crucial signal with hydrogen technology. First Hydrogen has positioned itself in a promising market. Siemens Energy is also betting on hydrogen. After the debacle caused by the takeover of the wind energy company Siemens Gamesa, the hydrogen deal with Air Liquide is finally leading to an increase in the share price. At PayPal, the new CEO is a breath of fresh air. The Company is expanding its growth potential in the direction of its own cryptocurrency. Find out what that means for investors here.

ReadCommented by Juliane Zielonka on September 22nd, 2023 | 06:50 CEST

Cardiol Therapeutics, BioNTech, BYD - At top speed to new markets

Cardiol Therapeutics is enjoying a remarkable development. The biotech company is now rolling out its ARCHER patient recruitment trial internationally at 35 participating centers. This accelerates research in the development of their therapy to combat myocarditis, a heart inflammation which has been associated with COVID-19 vaccination. For Cardiol Therapeutics, this represents an opportunity to get its therapy approved as an orphan drug. Approval is also at stake for BioNTech. With a multimillion-dollar funding boost, the Company is working on accelerated approval for a vaccine against a virus that caused quite a stir last year. The shortened development time is likely to impress investors. While business nations agree on fighting viruses, they disagree on commodities for the road. The EU would prefer to restrict BYD's successful sales on domestic roads - by imposing tariffs. BYD, meanwhile, is tapping into a completely different market.

ReadCommented by Juliane Zielonka on September 21st, 2023 | 07:55 CEST

dynaCERT, Amazon, FREYR Battery - Those who are focused on CO2 reduction and successful at it

At the Fleet Services Expo in Ottawa, dynaCERT will showcase its "Hydrogen-on-Demand" technology. For the first time, dynaCERT is demonstrating its fully functional HydraGEN™ technology on a company-owned Mercedes Sprinter Van, providing environmentally friendly hydrogen power to fleet vehicles in Ontario. This innovative solution reduces CO2 emissions and also lowers operating costs. On the other hand, as the upcoming seasonal business approaches, Amazon is increasing its workforce, most of whom use non-CO2-reducing vehicles to make deliveries in the US. A renowned institute has, therefore, removed Amazon from the CO2 index. Meanwhile, the Norwegian battery manufacturer FREYR Battery is moving to the US. The Company has filed its documents for incorporation in Delaware and sees a lot of benefits for business expansion and shareholders with its US location.

ReadCommented by Juliane Zielonka on September 14th, 2023 | 08:05 CEST

Almonty Industries, Covestro, Bayer AG - Which stocks are taking off?

Energy, pharmaceuticals and defence are the performance candidates of the hour. To support further economic growth, countries like South Korea and France are turning to nuclear power, which requires the metal tungsten. Almonty Industries, which has specialized in the mining and processing of this rare metal since 2009, is particularly eye-catching here. The current takeover talks of the DAX-listed group Covestro show how valuable know-how can be. The Abu Dhabi-based oil company Adnoc is very interested in Covestro's specialist knowledge of plastics for e-mobility, building insulation and adhesives. Bayer AG also demonstrates significant expertise. Researchers at its US subsidiary BlueRock Therapeutics have achieved a breakthrough in treating Parkinson's disease. Find out which shares are now taking off here.

ReadCommented by Juliane Zielonka on September 5th, 2023 | 08:10 CEST

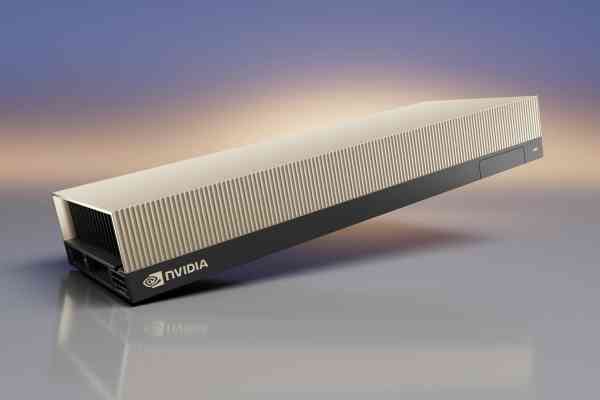

Gold rush mood at NVIDIA and Desert Gold - Concrete gold share Vonovia crumbling

Stock market darling NVIDIA is behaving bullish again after a moderate decline. Over 50% of NVIDIA's buying comes from S&P500 heavyweights like Microsoft, Google and Amazon. All these companies invest heavily in GPUs to develop AI models. The rising importance of Artificial Intelligence (AI) and the increased use of GPUs in this industry contribute to the increased demand for gold and other commodities used in the manufacture of GPUs. Desert Gold, an exploration and development company in Mali, is benefiting from this trend. Its main project, the SMSZ project, covers 440 sq km and has proven and indicated gold resources of 8.47 million tons with a grade of 1.14 g/t gold. The venerable concrete gold real estate market is currently experiencing severe dislocation. 31% of project development volume in Germany is experiencing delays in residential construction. We look at what investors should do now to protect their portfolios.

ReadCommented by Juliane Zielonka on September 1st, 2023 | 08:10 CEST

GoviEx, Siemens Energy, Delivery Hero - Which stocks have the greatest growth potential

Seamless energy supply has become a competitive advantage. France, for example, gets 70% of its electricity from uranium. With an outstanding uranium recovery rate of 88% in Zambia, GoviEx supplies the world with this valuable energy source. The Company focuses on the exploration and development of uranium deposits in Africa. Renewables, however, are not quite taking off for them. Siemens Energy is facing significant cost problems in its onshore wind turbine business. Damages to rotor blades and bearings could cost the Company up to EUR 4.5 billion. People always need to eat. Those who prefer ordering food in light of high electricity costs should look at Delivery Hero. Citigroup seems to have better information on the delivery service than current investor sentiment suggests.

ReadCommented by Juliane Zielonka on August 31st, 2023 | 09:05 CEST

Strategic turning points in Chemicals, Automotive and Energy: Investment opportunities with Defense Metals, Volkswagen and BASF

Rare earths are becoming increasingly important due to digitalization, especially for the electronics industry. Defense Metals, a company from Canada, is focusing on the extraction of rare earths at the Wicheeda project. Geotechnical investigations are progressing rapidly in order to develop the valuable raw material. Volkswagen reports an impressive 17.9% increase in car sales in July. Nevertheless, the Company is lowering its annual sales forecast due to growing competition in China. Germany's energy transition is affecting major corporations like BASF. The US company Cheniere Energy will supply BASF with liquefied gas in the future. To adapt to the new market conditions, BASF has successfully completed the spin-off of its mobile exhaust catalyst and precious metal services businesses. The new site surprises.

ReadCommented by Juliane Zielonka on August 27th, 2023 | 09:00 CEST

Altech Advanced Materials, Volkswagen, FREYR Battery - Investment opportunity in the future energy storage market

The booming energy storage market will bring investments of USD 620 billion over the next 22 years, according to BloombergNEF. In this context, the focus shifts to Heidelberg-based Altech Advanced Materials AG, which specializes in emission-free energy storage solutions. Their innovative approach to generating energy from an abundant raw material in Europe - salt - is worth highlighting. Volkswagen is also striving for seamless supply in the electrification market and is re-sorting its semiconductor supply chains with the help of German taxpayer money. At Norway's FREYR Battery, quarterly results are in, surprising analysts.

ReadCommented by Juliane Zielonka on August 24th, 2023 | 07:00 CEST

Defence Therapeutics, Bayer, Palantir - Milestones, Power Shifts and Mishmash

The radiopharmaceuticals market is expected to grow to USD 13.818 billion by 2028. In collaboration with Orano Group, Defence Therapeutics has developed innovative radioactive cancer therapies that destroy cancer at the cellular level, thereby increasing efficacy and minimizing side effects. According to Defence Therapeutics CEO Sebastien Plouffe, this partnership will lead to top-tier therapies in a growing market. Meanwhile, heads are rolling at Bayer, as CEO Bill Anderson has big plans and is replacing key positions with promising candidates. Employees of the British NHS have probably spoken a bit too much. The US company Palantir has been awarded five NHS contracts without competitive bidding and is currently the favorite for a multi-million dollar contract in the healthcare sector. Find out what this means for investors here.

ReadCommented by Juliane Zielonka on August 18th, 2023 | 08:00 CEST

Globex Mining, Deutsche Lufthansa, Rheinmetall: Share prices soar on the back of impressive deals

Globex Mining achieves several deal highlights: The exploration company receives CAD 2 million in cash from Agnico Eagle for a land purchase, with further opportunity for a growing asset. Over 23 months, an additional CAD 6 million is expected to flow to Globex Mining. Then follows an option agreement with Tomagold Corporation on a Canadian gold property at Gwillin Lake near Quebec. Total payments of six figures are due over the next four years. In addition, shares in Tomagold will be transferred to Globex Mining. While German Foreign Minister Baerbock was more conspicuous for flight mishaps, the Lufthansa Group achieved an adjusted EBIT of around EUR 1.1 billion in Q2/23. The subsidiaries SWISS, Austrian Airlines, Brussels Airlines, Eurowings and Lufthansa Technik also posted record results. Furthermore, Rheinmetall is also taking to the skies - now supplying drones to Ukraine.

Read