The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on February 9th, 2021 | 08:30 CET

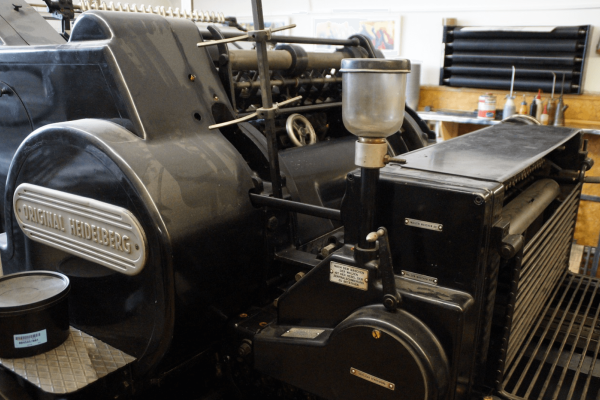

Heidelberger Druckmaschinen, Fokus Mining, Baumot Group - once a penny stock, always a penny stock?

In the following, we present three shares currently trading below the EUR 1 mark or have been trading below this mark for some time. But nothing is forever. When the good news hits and business is going in the right direction, prices and valuations can quickly find themselves at a different level. Where is the most significant potential?

ReadCommented by Carsten Mainitz on February 8th, 2021 | 09:48 CET

Lang & Schwarz, Deutsche Rohstoff, NanoRepro - Top Picks: German Small Caps!

Many studies show that small listed companies, so-called small caps, generate higher returns over more extended periods than larger corporations. A broadly diversified small-cap portfolio, when combined with mid and large caps, increases returns and reduces risk in the overall context. Thus, small caps should not be a side issue when it comes to investing. We present three exciting and promising German small caps.

ReadCommented by Carsten Mainitz on February 3rd, 2021 | 08:46 CET

Varta, Almonty Industries, Sartorius - on to new all-time highs!

Trend-following models or concepts such as relative strength or momentum rely on the past winners because investors assume a continuation of the price movement. In chart technology, a strong buy signal is generated when a new all-time high is marked. We show you three dynamically growing companies about to open a new chapter in their corporate history. Who has the greatest potential?

ReadCommented by Carsten Mainitz on February 2nd, 2021 | 07:20 CET

Facebook, AdTiger, ProSiebenSat.1 - anything but boring, don't miss this opportunity!

According to Statista, the market for digital advertising will increase globally to USD 526 billion by 2024. In 2018, the market volume was still at USD 283 billion, representing an annual growth rate of almost 12%. The continuing shift of advertising budgets to digital is irreversible. We present three exciting investment stories from the advertising sector. Not to be missed.

ReadCommented by Carsten Mainitz on February 1st, 2021 | 07:20 CET

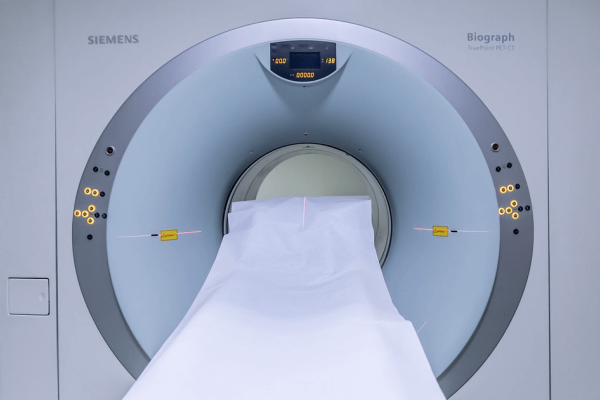

Royal Helium, Siemens Healthineers, Eckert & Ziegler - Is helium coming after hydrogen?

Hydrogen as an investment topic is on everyone's lips. No other chemical element has such a large occurrence in the universe (outside the earth's crust). But it could also be lucrative to look at the second most abundant element in the universe: helium. Helium has the lowest melting and boiling points of all elements. It is used in low-temperature technology, especially as a coolant for superconducting magnets, e.g., medical technology for MRI (magnetic resonance imaging) equipment. We present investment ideas associated with helium, ranging from the noble gas extraction to its use in certain products. Which stock has the most potential?

ReadCommented by Carsten Mainitz on January 27th, 2021 | 09:18 CET

Enapter, Nel, Linde - The hydrogen boom is far from over. Take the right action now!

Energy supply and mobility are two crucial areas in our everyday life but also in the economy. Long misunderstood, hydrogen technology has finally moved into the spotlight, providing new answers to urgent questions. Hydrogen can be used universally, is easy to store, and can be converted back into electricity. But wherever there is potential and growth, there are occasional exaggerations. That is a normal course of events in the stock market world. We are convinced that the growth of the industry will continue sustainably and dynamically. We show you how to position yourself correctly now.

ReadCommented by Carsten Mainitz on January 26th, 2021 | 08:05 CET

Lynas Rare Earths, Defense Metals, Arafura Resources - Rare Earths: still in time to get in before the boom!

China has dominated the rare earths market for a long time. A supply shortage in the People's Republic and a substantial increase in demand can lead to a massive price increase of the commodity group at any time. These price increases are then often reflected in the share price of relevant players. Rare earth metals are in demand in a wide range of industries and to close the emerging supply gap the production of rare earth metals must be increased outside of China. We present three opportunity stocks that will benefit from industry trends and scarcity prices as producers or prospective producers.

ReadCommented by Carsten Mainitz on January 25th, 2021 | 11:49 CET

Steinhoff International, Blackrock Gold, Halo Labs - Watch out: Something is up with these penny stocks!

Stocks below the 1 dollar or euro mark, so-called penny stocks, are often sweepingly pigeonholed. Of course, there are some ailing companies or bankruptcy candidates among the penny stocks. When assessing the risk structure, it is also helpful to look at the nominal value. If this is only cents or fractions of cents anyway, then it is relatively "normal" that many companies are quoted in cents range. For investors and traders, however, the commitment in penny stocks has a decisive positive side effect. The mere fact that the share certificates are visually cheap makes them easier to buy, which increases trading volume and price movements. Thus, information that has not yet been adequately understood by the broad market and incorporated into the price is an excellent opportunity to make money. We present three penny stocks that should continue to gain in the near future.

ReadCommented by Carsten Mainitz on January 20th, 2021 | 09:23 CET

Varta, Nevada Copper, Millennial Lithium - Electrified: you can still get in at a fair price!

The growth in the areas of electromobility, renewable energies and the multi-faceted technology industry is leading to a substantial increase in demand for raw materials. If expert forecasts are to be believed, demand will significantly exceed supply in the coming years, which can only lead to the conclusion that prices will continue to rise. Copper and lithium are good examples of this. Linked to the topic of energy are also the challenges regarding new storage media. We present three promising companies for which demand and growth play into the cards.

ReadCommented by Carsten Mainitz on January 19th, 2021 | 10:19 CET

Sibanye-Stillwater, Desert Gold Ventures, Barrick Gold - Take advantage of the consolidation to enter quickly!

When the broad stock market is bullish and the prices of cryptocurrencies go through the roof, it is expected that crisis-proof investments stagnate or fall. Such has been the case with gold recently. But even if the bull market feeds the bull market, a stock market correction is inevitable. Corona and central bank policies' economic scars are too massive to be ignored in the long run. Profiteers from this new reality will undoubtedly be precious metals prices. Those who have fair quality shares of gold producers or gold explorers in their portfolio will outperform the gold price. We present three promising players, where an engagement in the current gold price consolidation will pay off.

Read