January 29th, 2025 | 07:00 CET

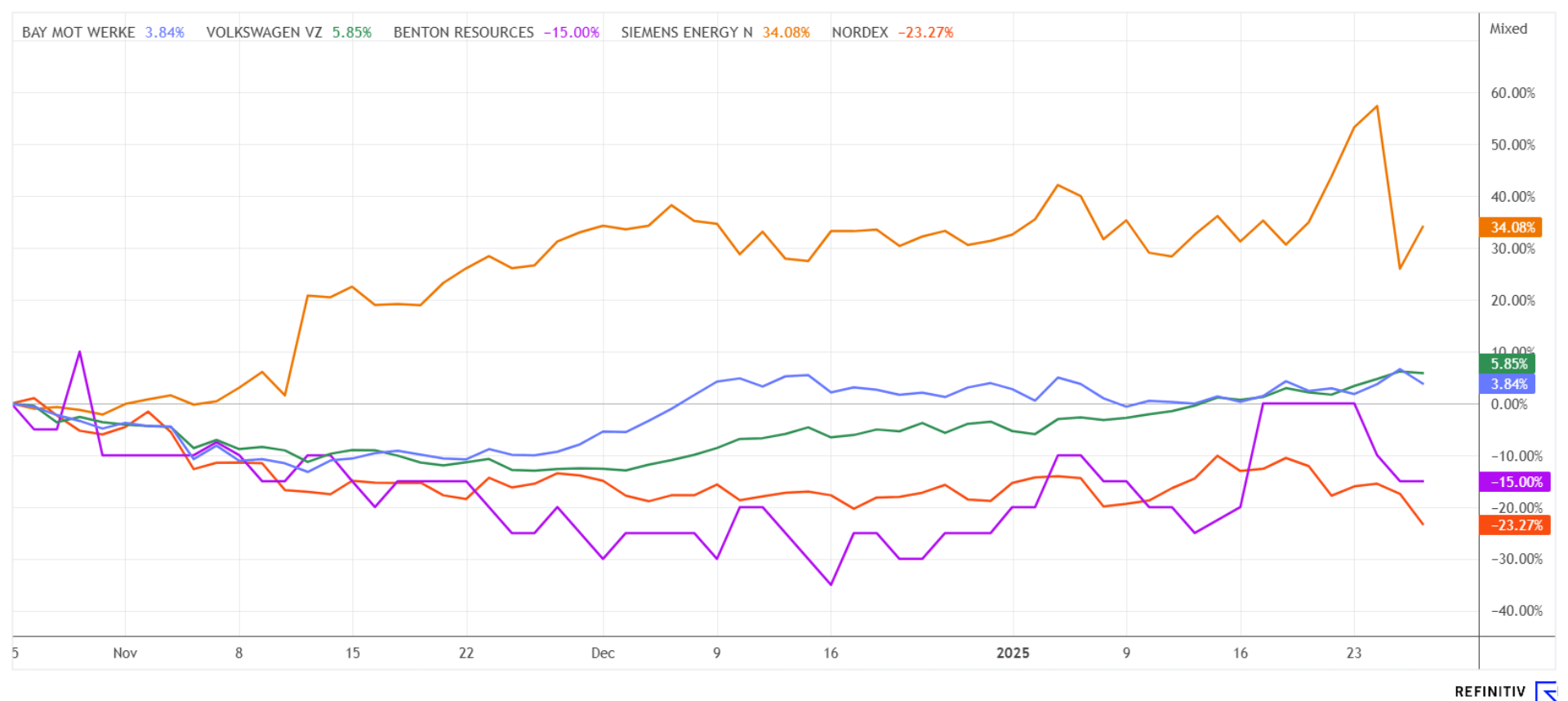

Watch out! VW and BMW are turning, Benton Resources is stepping on the gas, while Nordex and Siemens Energy are on the sidelines

For the German economy, a 180-degree shift in economic policy is needed to stop the ongoing migration of industries abroad. However, this requires signs of a consistent refocusing on burning issues, which neither the parties with a claim to the government nor the opposition can really present. International investors have refocused on European markets at the beginning of the year, as reforms are expected. The premature praise for Donald Trump has generated new highs in the US, but now the NASDAQ seems to be running out of steam. Germany, as the laggard in terms of economic growth, offers very low valuations that have rarely been seen for longer periods. We highlight some opportunities.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , BAY.MOTOREN WERKE AG ST | DE0005190003 , BENTON RESOURCES INC. | CA0832981090 , NORDEX SE O.N. | DE000A0D6554 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Volkswagen and Mercedes – This could have been the turnaround

The German automotive market is in a state of great uncertainty. While foreign manufacturers are entering the market with a great deal of innovative strength, domestic manufacturers have been holding on to the combustion engine for too long. Volkswagen and BMW are currently struggling. For 2024, global deliveries of VW are expected to drop to about 9 million vehicles. The necessary restructuring program sounds drastic: a good 35,000 jobs are to be cut by 2030 at the VW core brand, the group's trouble spot. That is around a third of the VW brand's workforce in Germany. At the same time, production capacity at domestic plants will be reduced by 734,000 units. This will reduce significant overcapacity, and the job guarantee, which has been in place since 1994, will initially remain until at least 2030. VW shares hit lows of EUR 79, but yesterday, the Wolfsburg-based company was back at EUR 97. Analysts on the Refinitiv Eikon platform expect only modest growth to EUR 113.50 in 12 months, but the 2025 P/E ratio of 3.9 is the lowest in 15 years.

Industry peer BMW posted a dramatic drop in profits in 2024, triggered by weakening business in China. Now, the Munich-based company is reporting that the margin will probably only be at the lower end of the 6 to 7% range that was lowered in September. However, at least more than EUR 4 billion in free cash flow has been achieved, and the technological outlook is encouraging. The new model series is now said to be on par with the competition from China and also to be competitive in terms of costs. Details will be announced on March 14 with the annual report. At EUR 79, BMW shares have initially bounced back from their lows, and an upward rebound has now become likely.

Benton Resources – Plenty of gold and copper available

Anyone thinking in terms of the energy transition and e-mobility cannot ignore copper. The red metal is one of the most important metals in the electrification of our world. Copper plays an important role wherever a lot of electrical energy has to be generated or transmitted. In addition to high-tech applications, it is used as an industrial metal in construction, infrastructure, and medicine. The ever-increasing sales figures of e-mobile manufacturers are also leading to a huge, long-term demand for copper. However, the crucial factor is the point in time at which the demand becomes acute and problematic. This is because global production is limited locally and cannot be scaled up as required over the next five years.

The Canadian explorer Benton Resources owns some promising gold and copper properties. In addition to a diversified and extremely promising portfolio of properties, the Company also holds large equity positions in other mining companies that are developing high-quality assets. The main focus of its own geological activities is currently on the Great Burnt project in Newfoundland, which has an estimated mineral resource of 667,000 tons at 3.21% Cu (indicated) and 482,000 tons at 2.35% Cu (inferred). The VMS property has an excellent geological setting, covering 25 km of strike length with six known copper-gold-silver zones over 15 km in length. The potential for further discovery is excellent, as there are a large number of untested geophysical targets and Cu-Au soil anomalies.

Phase 1, 2 and 3 drilling programs returned impressive results, including 25.42 m of 5.51% Cu, including 9.78 m of 8.31% Cu, and 1.00 m of 12.70% Cu. Drilling at the South Pond Gold Zone, located approximately 7.5 km north of the Great Burnt, has confirmed a robust gold mineralized system over 2.5 km with results ranging from 74.20 m of 1.43 g/t Au and 43.75 m of 1.62 g/t Au and remains open for expansion in all directions. The Company currently has CAD 4.5 million in cash and shareholdings and is evaluating many new zones for further development. Benton holds a 70% interest in the Great Burnt project, with Homeland Nickel Inc. holding the remaining 30%. In mid-January, shares in Vinland Lithium were split among existing shareholders, and strong drill results were reported again, with peak values of 7.47 and 11.93% copper. The 205.6 million shares issued result in a valuation of CAD 18.5 million at prices of CAD 0.09. This currently offers an attractive entry point, as prices of around CAD 0.20 were already being seen in mid-2024. Collect!

Siemens Energy and Nordex – Greentech is not a one-way street

Donald Trump's inauguration as the 47th President of the United States also marked the country's withdrawal from the Paris Agreement. This means lower investment in the greentech sector for the time being. Stocks that have performed well, such as Siemens Energy and Nordex, have lost ground in recent days due to Trump's announcements. On top of that, Siemens was hit by the DeepSeek discussion. But if you look at it from a medium-term perspective, these stocks are clear winners of the global "Net Zero" efforts. And they need the metals that Benton Resources is currently tracking down in Newfoundland. Not least, the producers of energy products need to ensure the security of their supply chains. Even Donald Trump, who repeatedly doubts climate change, has described access to resources as a prerequisite for a functioning industrial infrastructure.

While Siemens Energy, after a performance of over 500% and prices of around EUR 60 in the last 12 months, is allowed to let off some steam, Nordex shares look quite attractive at a level of EUR 10.70. After all, the stock had already crossed the EUR 15 mark twice in 2024. A change in the management board had caused the stock to falter yesterday, with a temporary minus of 7%. Investment bank Goldman Sachs has renewed its "Buy" vote, but analysts still expect momentum in wind turbine construction to decline. The consensus on Refinitiv Eikon is around EUR 16.80 for the next 12 months. Figures for the past fiscal year from Siemens Energy and Nordex will be available on February 12 and 27, respectively. Exciting!

From an investor's perspective, both opportunities and risks lie ahead in the current year. Stocks in the high-tech, artificial intelligence and defense sectors have already performed well and are therefore very highly valued. From a valuation perspective, turnaround speculators are increasingly turning to German automotive and greentech stocks. Benton Resources is extremely interesting from a critical metals perspective. A well-defined spread reduces portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.