renewableenergies

Commented by Stefan Feulner on April 3rd, 2024 | 07:45 CEST

Ballard Power, Exasol, Xiaomi - Shares on the rise

The stock market year 2024 is entering its second quarter and has again started with record highs. The DAX reached new all-time highs of 18,571 points, while the Dow Jones broke through the 40,000-point barrier for the first time in its history. Despite the boom in the most important stock market barometers, many sectors are still in a deep sleep and are waiting to be kissed awake. The recent weeks have shown, with cannabis stocks as an example, how quickly a rebound can be initiated.

ReadCommented by André Will-Laudien on March 28th, 2024 | 09:00 CET

Attention: Uranium despite the energy transition! Does this fit together? Plug Power, Nel ASA, Kraken Energy and Renk Group in focus

It feels like a paradox. The EU aims to be largely climate-neutral by 2050. The main focus is on mobility, heat and energy generation. As a core country of the EU, Germany is taking the political lead in the necessary measures. While France, Poland, Finland and the Czech Republic are actively expanding nuclear energy, this form of energy is virtually taboo in many other countries. Germany has been able to increase its renewable energy sources to over 50% with billions in subsidies at the expense of the taxpayer and the price of energy. Yet, Berlin still has to buy cheap electricity from abroad and also use coal and gas to stabilize the grid. It all sounds kind of crazy, but it gets really interesting when the wind isn't blowing and the sun is only to be found behind the clouds. Which shares should be considered in this mixed situation?

ReadCommented by Juliane Zielonka on March 27th, 2024 | 08:15 CET

Energy sector on the upswing: Siemens Energy, Manuka Resources and Nordex Group focus on a sustainable future

International collaborations are lucrative ventures for energy companies such as Siemens Energy. As a strong partner for Iraq, the Group supports the country in the secondary utilization of by-product gases for power generation that would otherwise be lost. Vanadium, a critical raw material for sustainable construction and electromobility, is needed. China and Russia possess the most deposits but are politically insecure. This is reason enough for the company Manuka Resources to explore a rich vanadium area off the coast of New Zealand. Thanks to an accelerated procedure for granting mining permits by the New Zealand government, operations could commence soon. Wind turbine manufacturer Nordex is also in the starting blocks: with an order from South Africa, the Hamburg-based company will deliver 57 turbines to the coastal region. Here are the details.

ReadCommented by Stefan Feulner on March 25th, 2024 | 07:00 CET

Siemens Energy, Carbon Done Right Developments, Rheinmetall - Light at the end of the tunnel

Due to the global arms race and the shift in focus, defense stocks such as Rheinmetall and Hensoldt are currently all the rage on the stock market. Unfortunately, this trend will likely continue over the next few years as orders increase. In contrast, another fundamental topic, climate change, is currently receiving little attention, at least in the markets. Renewable energy companies have been correcting for months but are currently increasingly working on bottoming out. In the long term, this presents anti-cyclical entry opportunities.

ReadCommented by Juliane Zielonka on March 22nd, 2024 | 07:45 CET

BYD, Globex Mining, Mercedes-Benz shares: The energy transition is picking up speed with these companies

BYD in China is regarded as innovative and successful with its wide range of models and brands. The Company has become one of the top ten car manufacturers and is the global leader in the production of new energy vehicles (NEVs). In the fourth quarter of last year, BYD even overtook Tesla with over half a million electric vehicles sold. BYD is now pushing further into international markets in order to maintain its growth trajectory. The increasing demand for electrification also means a higher demand for the corresponding raw materials. Globex Mining is well positioned in this regard; with 247 different projects and over 40 years of industry experience, investors benefit from the unbeatable expertise of the experienced management team. Mercedes-Benz leadership has reason to rejoice. The figures from the last financial year are solid, and the salaries of the Executive Board have been generously increased. Who is really picking up speed now?

ReadCommented by Juliane Zielonka on March 21st, 2024 | 06:45 CET

Energy in transition: RWE, Kraken Energy, and Plug Power in focus

The energy sector remains in flux. RWE was able to double its adjusted EBITDA. CEO Markus Krebber, who has been in office since 2021, is doing everything he can to make the energy giant fit for renewable energies. Under the term "Phaseout Technologies," he aims to bid farewell to nuclear energy and fossil fuels. However, nuclear energy is a low-carbon and adequate supply for many industrialized nations. There are 93 reactors in the USA alone, which account for 20% of the national energy supply. This is reason enough for Kraken Energy to explore uranium deposits in the US in order to establish the shortest possible supply chains. The US is also a pioneer in hydrogen technologies. Plug Power can, therefore, look forward to a considerable amount of government funding and is becoming a job engine...

ReadCommented by Fabian Lorenz on March 20th, 2024 | 07:45 CET

Buying opportunity for HelloFresh and Plug Power? When will the dynaCERT share breakthrough happen?

HelloFresh shares have already lost over 50% of their value in 2024. It should be time for a countermovement, but there is currently no sign of it. One analyst believes the share price could rise by almost 100%. However, he is pretty much alone in this prediction. There are also few optimists at Plug Power at the moment. And from tomorrow, the path to profitability will be a little further away for the hydrogen specialist. In contrast, dynaCERT has been showing relative strength for months. The order intake is decent, and an event should trigger the breakthrough for the share.

ReadCommented by Armin Schulz on March 20th, 2024 | 07:00 CET

RWE, Almonty Industries, Nel ASA - Emission-free energy as a booster for the portfolio?

The search for an emission-free energy future is one of the most urgent undertakings of our time. In the face of increasing climate challenges and the growing need to reduce global carbon emissions drastically, innovative energy solutions are becoming the focus of scientific and public attention. At the heart of this energy revolution lie three key technologies: Fusion reactors, renewables and hydrogen. These three fields of technology form the cornerstones of an emission-free energy future. They promise not only a sustainable energy supply but also the transformation of our energy systems towards greater efficiency, security and climate compatibility.

ReadCommented by Juliane Zielonka on March 15th, 2024 | 06:00 CET

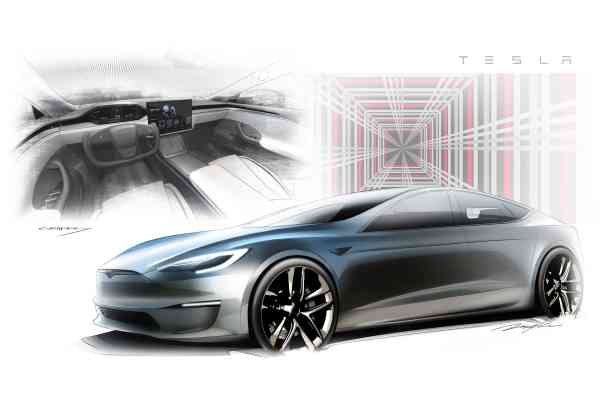

Altech Advanced Materials, Tesla, E.ON - Accelerators of the Future in Europe

Germany's automotive industry is in a state of upheaval. With an annual turnover of EUR 411 billion, solutions are urgently needed to drive electrification forward. E.ON, as one of the largest utilities, is investing billions in European infrastructure for this purpose. The Company is also increasing its dividend. Heidelberg-based Altech Advanced Materials is launching stationary battery storage systems on the market at the beginning of April. It has also published the results of the current feasibility study for its second pillar: a special coating for silicon battery anodes that ensures greater power and longevity. These are exactly the sticking points that customers have been complaining about so far. Tesla also relies on silicon batteries in its models. This week, Elon Musk visited the German plant in Grünheide, and has some good news in store...

ReadCommented by Armin Schulz on March 12th, 2024 | 07:00 CET

BYD, Carbon Done Right Developments, Plug Power - Ecological responsibility becomes a success factor

Companies are faced with the urgent task of improving their carbon footprint and paving the way to climate neutrality. In an age in which environmental protection and sustainability are increasingly coming into focus, companies are called upon to act proactively and make their contribution to climate protection. Effective strategies to achieve this goal include a range of measures, from increasing energy efficiency and switching to renewable energy to optimizing transport routes and promoting a circular economy. If these steps are insufficient because the Company is too energy-hungry, the unavoidable emissions must be offset by investing in climate protection projects. Every climate-neutral company has a competitive advantage, making the achievement of this goal quite lucrative.

Read