Mining

Commented by Mario Hose on June 16th, 2025 | 07:25 CEST

Gold rush 2025: Why Desert Gold Ventures Inc. is now on the brink of a historic revaluation!

Imagine this: A company is sitting on a gold treasure trove of over 1.1 million ounces – and is valued by the market as if this treasure were worthless. While the gold price has soared to a record high of over USD 3,442 per troy ounce, shares in Desert Gold Ventures Inc. (WKN: A14X09 | ISIN: CA25039N4084 | TSXV: DAU) are currently still trading at rock-bottom prices. But that could change radically in the near future. The escalation of the conflict between Iran and Israel is driving the price of the precious metal to rise, which in turn is boosting the appeal of gold companies. The countdown to a revaluation is on – and savvy investors should take a close look now!

ReadCommented by Fabian Lorenz on June 16th, 2025 | 07:20 CEST

Alarm bells ringing for GOLD and DEFENSE: RENK, Barrick Mining, and comeback story AJN Resources

Is the gold price facing a short squeeze? The ECB is certainly painting a horror scenario. This could have serious consequences for banks and the entire financial system. For gold producers and exploration companies, this means further momentum. While Barrick Mining is a core investment, it is also suffering from home-grown problems. AJN Resources is working on the comeback story of the year in the commodities sector. The valuation is still favorable, and exciting news is on the horizon. In the defense sector, consolidation could already be over. The escalating conflict between Israel and Iran will likely drive the shares of RENK, Rheinmetall, and others. Analysts see potential for RENK to reach a new all-time high, and the Company recently reported an order from outside Europe.

ReadCommented by André Will-Laudien on June 16th, 2025 | 07:15 CEST

Gaza, Iran, Ukraine – Conflicts are driving up metal prices! Rheinmetall, European Lithium, Hensoldt, and RENK

The problem is getting bigger! Strategic metals are currently having a massive impact on the geopolitical balance of power, as they play a decisive role in determining the economic and military capabilities of countries. Conflicts such as those in Gaza, Ukraine, and, more recently, Iran are exacerbating shortages because long-standing trade relationships can be terminated overnight. The concentration of metal production in a few countries makes supply chains vulnerable to political influence. Export restrictions, embargoes or targeted shortages imposed by China or Russia can lead to bottlenecks in consumer countries and severely affect the economy. We describe the current situation and offer solutions for dynamic investors.

ReadCommented by Armin Schulz on June 12th, 2025 | 07:15 CEST

Almonty Industries – NASDAQ listing, Pentagon, world-class mine, critical raw materials: ride the perfect wave

Tungsten – hard, heat-resistant, indispensable for rockets, semiconductors, and high-tech tools. However, the global supply chain for this critical metal is on the verge of collapse. China's export restrictions have choked the market, and Western stockpiles are depleting rapidly. In this volatile situation, one company is increasingly stepping into the spotlight: Almonty Industries. With the imminent commissioning of the world's largest tungsten mine outside of China and its unique vertical integration, the Canadian company is no longer just a mine operator - it is becoming the architect of Western raw material security. Here is why investors should take a closer look.

ReadCommented by Fabian Lorenz on June 12th, 2025 | 07:10 CEST

Short squeeze, hedge funds, and summer rally: Plug Power, Novo Nordisk, Power Metallic Mines

Is Power Metallic Mines poised for a summer rally? There are certainly good reasons to believe so: Following the discovery of its world-class multi-metal project, the stock has consolidated healthily. At the same time, further positive drilling results were reported, followed by a massive expansion of the area this week. Now, an extensive new drilling program is getting underway. Plug Power has shown in recent days how quickly a stock can rise by 50%. The insolvency candidate has delivered several pieces of positive news, and a short squeeze could drive the stock further. At Novo Nordisk, investors are realizing that the sell-off in recent months may have been too severe. The stock is working on a new upward trend. A hedge fund and a partnership in the AI sector are providing tailwinds.

ReadCommented by André Will-Laudien on June 12th, 2025 | 07:05 CEST

Unbelievable but true! Bonus shares from BYD, VW restructuring, Antimony Resources and thyssenkrupp in focus

With each passing day of escalating geopolitical conflicts, one thing becomes clear: secure supply chains for industry and manufacturing are a thing of the past. The German and European industrial landscape, in particular, is feeling the effects of increasing sanctions, which are narrowing supply chains and, in some cases, drying them up completely. Capital markets are sensitive to such scarcity scenarios, with long-term interest rates rising and risk indicators skyrocketing. How are industrial companies responding to this environment, and is there any hope for a revival of global trade? These are all legitimate questions when following political developments on both sides of the Atlantic. What trends should investors keep an eye on?

ReadCommented by André Will-Laudien on June 10th, 2025 | 07:15 CEST

Gold or Defense – Where to take action now? Rheinmetall, RENK, and Leonardo require caution, AJN Resources on the launchpad!

Russia's war of aggression against Ukraine shows no signs of ending. Despite all political efforts on both sides of the Atlantic, the Russian commander is continuing his bombardment of his neighboring country. NATO sees many reasons in the aggressor's behavior to significantly increase its military capabilities. This is causing further investor money to flow into defense stocks, but valuations are now very ambitious. However, in their search for security, investors are also increasingly buying gold, which could rise to as high as USD 3,490 per ounce in 2025. Low production costs are bringing low-cost projects in Africa into focus. AJN Resources has just refinanced and is repositioning itself in Ethiopia. How can investors diversify wisely?

ReadCommented by Mario Hose on June 9th, 2025 | 10:15 CEST

Almonty Industries: The new Pillar of Western Raw Material Security

The Western world is facing a raw material crisis with explosive geopolitical implications. In recent months, China has drastically tightened its export controls on critical minerals, affecting primarily strategically important metals such as gallium, germanium, antimony, and, most recently, tungsten. These raw materials are indispensable for the defense industry, semiconductor production, and high-tech manufacturing. Amid this tense situation, one company that is positioning itself as an important part of the solution is stepping into the spotlight: Almonty Industries (TSX: AII). The tungsten specialist operates strategically located tungsten projects in South Korea, Portugal, and Spain and will soon play a key role in supplying Western industries, as global tungsten supplies are expected to run critically low in the near future.

ReadCommented by André Will-Laudien on June 9th, 2025 | 07:05 CEST

Print money now! Gold over 3400, silver already at 36 – Barrick, Globex Mining, First Majestic, D-Wave, and Hensoldt

Debt and inflation are causing yields to rise, and now gold and silver are also booming! In addition to defense and high-tech stocks, investors have finally taken a liking to precious metals. Commodity investors have had to wait a long time for this moment, but now prices are rising rapidly. Investors should add stocks like the long-overlooked Barrick Mining and First Majestic Silver to their portfolios, while Globex Mining is an outright buy. The Company holds over 250 properties, which are currently increasing in value daily. On the other hand, the high-tech stock D-Wave and the defense stock Hensoldt have already advanced excessively. We can help with portfolio rebalancing.

ReadCommented by Nico Popp on June 5th, 2025 | 16:10 CEST

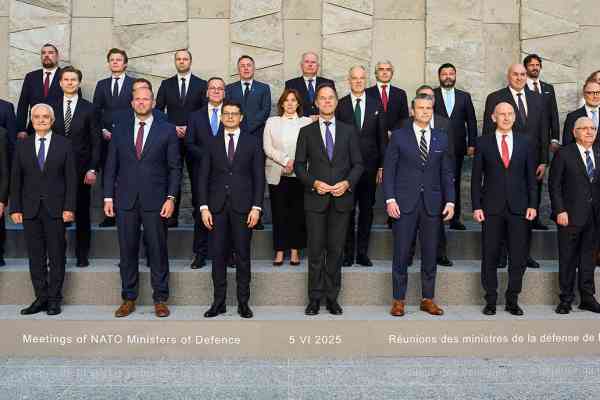

Urgent: NATO approves largest rearmament program since the Cold War - Almonty, Hensoldt, Rheinmetall

The news is a bombshell: In light of an acute threat from Russia, NATO is opening the money floodgates. The most extensive rearmament since 1990 not only provides for a massive increase in conventional military capabilities, but also reveals the dependence of modern armed forces on critical raw materials – especially tungsten. The decision was made during a meeting of NATO defense ministers in Brussels and has far-reaching consequences. For investors, but also for all of us.

Read