Energy

Commented by Armin Schulz on November 25th, 2025 | 07:40 CET

Mercedes-Benz searches, Graphano Energy finds, Siemens Energy uses: The three stocks for the next phase of energy storage

The global energy transition is heating up the market for critical raw materials. The spotlight is on a true jack-of-all-trades: graphite. Without it, lithium-ion batteries, which power electric vehicles and modern energy storage systems, simply would not work. But supply is lagging behind rapidly growing demand. This gap poses enormous challenges for supply chains. It is driving up prices, opening up exciting opportunities for companies – both those that source the raw materials and those that forge high-tech products from them. We therefore take a closer look at automotive giant Mercedes-Benz, raw materials expert Graphano Energy, and energy professional Siemens Energy.

ReadCommented by Fabian Lorenz on November 24th, 2025 | 07:20 CET

The winners of the AI boom?! Oklo, Plug Power, Siemens Energy, and dividend gem RE Royalties

Companies involved in energy generation and technology are the real winners of the AI boom. Without electricity, all data center operators would be in trouble. Siemens Energy is one of the 1,000% stocks in industry. RE Royalties is another company that has not yet been discovered. The Company primarily finances renewable energy projects in North America and has a long-term share in the proceeds. Until the stock is discovered, shareholders can look forward to a dividend yield of over 10%. Shareholders of Oklo and Plug Power currently have little to be happy about. Their share prices have fallen sharply. Rightly so?

ReadCommented by Fabian Lorenz on November 24th, 2025 | 06:00 CET

Nel facing a shutdown? JinkoSolar weak! NEO Battery Materials' Next Big Moves!

Will the lights soon go out at Nel? After weak figures, the share price briefly rebounded. However, that rally has already faded, with the all-time low back in focus. Orders are seemingly being ignored by investors. The shares of NEO Battery Materials appear interesting for investors with a bit of patience. It is likely only a matter of time before battery stocks are rediscovered by the market. After all, they are essential for megatrends such as robotics, drones, and electromobility. NEO Battery has not only developed a new generation of high-performance batteries, but has also already secured orders and is scaling up production. And what about JinkoSolar? Will the quarterly figures provide a tailwind, or will the stock continue to underperform?

ReadCommented by Armin Schulz on November 14th, 2025 | 07:00 CET

BYD, Power Metallic Mines, and Nordex: How to benefit from industry leaders in the energy transition

A new industrial era is dawning. Driven by the global energy transition, there is an unprecedented demand for clean technology, powerful batteries, and the metals that power them. But this multi-billion-dollar arms race reveals a critical vulnerability: the scarcity of strategic raw materials and fragile supply chains. The key to success no longer lies solely in innovation, but in mastering the entire value chain, from the mine to the finished plant. We take a closer look at three companies at the forefront of the energy transition: BYD, Power Metallic Mines, and Nordex.

ReadCommented by Armin Schulz on November 7th, 2025 | 07:05 CET

BYD and Graphano Energy are driving the energy storage revolution - even Nordex is benefiting indirectly

The energy landscape is undergoing radical change. The key no longer lies solely in the generation of green electricity, but in its intelligent storage and use. Electric vehicles are mutating into rolling power tanks that can stabilize grids, while extensive stationary storage facilities compensate for the fluctuating feed-in from wind and solar power. This revolution opens up massive savings potential for consumers and reduces the need for expensive grid upgrades. We take a look at whether BYD, Graphano Energy, and Nordex can benefit from this booming ecosystem.

ReadCommented by Fabian Lorenz on October 29th, 2025 | 07:25 CET

BIG NEWS at Nordex! OpenAI fuels the AI energy boom! Siemens Energy and dividend stock RE Royalties benefit

Good news for the energy sector. OpenAI is calling on the US government to expand its energy infrastructure. Siemens Energy owes its 1,000% rally to the AI boom. However, analysts are cautioning ahead of the next quarterly results. Another hidden gem in the energy sector is RE Royalties. The Canadian company primarily finances renewable energy projects across North America, combining steady growth with an attractive dividend yield of over 10%. The CEO recently detailed the firm's strategy in an interview. It is not entirely clear where Nordex's sudden growth is coming from. In any case, the stock market is celebrating the forecast upgrade.

ReadCommented by Nico Popp on October 28th, 2025 | 07:20 CET

Turnaround thanks to port business? Siemens, dynaCERT, Konecranes

The entire industrial sector must transition toward sustainability - and that includes logistics. The shipping industry, in particular, is seeing growing momentum. Global shipping currently accounts for around 3% of total emissions – and, as the Reuters news agency reports with reference to the International Maritime Organization (IMO), this share could rise to 5-8% by 2050 if no countermeasures are taken. Reason enough to take action. We highlight the different strategies being implemented and explain how the up-and-coming company dynaCERT could gain market share in this area.

ReadCommented by Armin Schulz on October 28th, 2025 | 07:10 CET

Energy Investing 2.0: Siemens Energy, RE Royalties, and RWE - Formulas for stable profits in times of change

The global energy transition will reach a historic tipping point in 2025. For the first time, renewables surpassed coal in the electricity mix, driven by record investments in solar and wind power. This revolution, fueled by investments of over USD 386 billion, is creating an entirely new ecosystem for profitable business models and strategic positioning. The focus is on three companies that are not only mastering this change but also actively shaping it and offering investors unique opportunities in a rapidly evolving market: Siemens Energy, RE Royalties, and RWE.

ReadCommented by Nico Popp on October 28th, 2025 | 07:05 CET

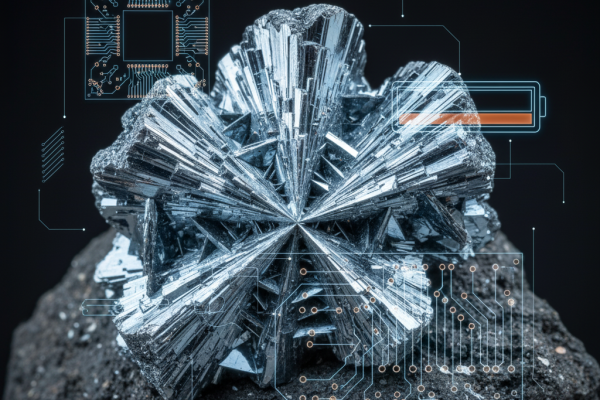

Antimony remains scarce and in demand: EnerSys, Aurubis, Antimony Resources

Antimony is a semi-metal with a silvery sheen, primarily used in lead-acid batteries, flame retardants, electronics, and military technology. In recent months, China has severely restricted its antimony exports. According to estimates, China produced around 60% of the world's antimony in 2024, followed by Tajikistan. China's dominance is heightening supply fears: as Reuters reported in June this year, US battery manufacturers are already referring to a "national emergency." This is reason enough to take a closer look at the supply chain in the West and examine the role of Antimony Resources, which recently attracted attention in the stock market.

ReadCommented by Fabian Lorenz on October 24th, 2025 | 07:25 CEST

Yesterday +16%! D-Wave explodes again! Siemens Energy and First Hydrogen shares benefit from AI's energy hunger

What a bounce for D-Wave. After a sharp correction yesterday, the quantum stock rose 16%. Is the Trump administration getting involved in quantum companies? That is the rumor making the rounds. Meanwhile, the energy hunger of AI data centers is also keeping the stock market on tenterhooks. One beneficiary from Germany is Siemens Energy. The stock is running like clockwork. Small modular reactors (SMRs) are a huge topic in North America. The Canadian government is providing massive support to industry, which should benefit First Hydrogen. The Company plans to combine its hydrogen expertise with SMR technology. So - buy now?

Read