Biotechnology

Commented by André Will-Laudien on October 12th, 2022 | 11:31 CEST

Biotech in the scope: BioNTech, XPhyto Therapeutics, MorphoSys, Valneva - The cards are reshuffled!

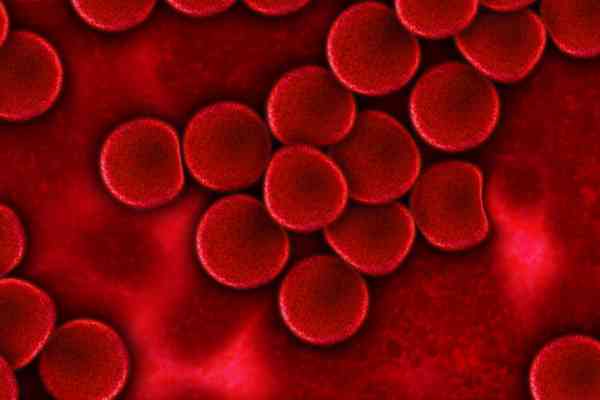

Cancer remains one of the greatest afflictions of our time, along with cardiovascular disease. Despite the tremendous progress already made in the fight against cancer, there remains an unmet medical need for many types of cancer. Cancer was responsible for nearly 10 million deaths worldwide in 2020. Other diseases, such as Alzheimer's and Parkinson's, also continue to be the focus of research. How is the biotech industry faring after the pandemic and during the stock market storm?

ReadCommented by Stefan Feulner on October 10th, 2022 | 10:43 CEST

BioNTech, Fonterelli GmbH & Co KGaA, Fonterelli SPAC 2 AG, MorphoSys - Bullish forecasts

The capital-intensive biotech and pharma sector has been stuck in a correction since the central banks changed their strategy at the beginning of the stock market year. In particular, vaccine manufacturers, which have exploded since the outbreak of COVID-19, have lost disproportionately in value since their highs in August of last year. However, the pandemic is likely to be with us for the next few years, albeit in a weakened form. The development of new drugs benefits companies that could now face a similar path as the vaccine producers.

ReadCommented by Stefan Feulner on October 6th, 2022 | 11:43 CEST

Nordex, Cardiol Therapeutics, Rock Tech Lithium - Great opportunities in bombed-out stocks

The market correction of recent months due to geopolitical conflicts, fears of recession, and rising interest rates have taken their toll. While the broad market indices such as the DAX with 23% or the NASDAQ 100 technology index with 30% slipped into the red zone year-to-date, growth and financially intensive stocks, in particular, have suffered losses of over 70% in some cases. Despite corporate successes, the stocks have been sold off and are trading below their cash levels in some cases. In the long term, these are outstanding entry opportunities for patient investors.

ReadCommented by Juliane Zielonka on September 30th, 2022 | 10:59 CEST

Biogen, XPhyto, BioNTech: Alzheimer's disease, depression, cancer - Pharma for life

About 350 million people worldwide are affected by depression, a disorder of the brain. Each person also has a 16 to 20% chance of becoming depressed. Reason enough for the Canadian Company XPhyto Therapeutics to research a drug that is not addictive and can defeat the mental health-related medical condition. This week, Biogen, among others, achieved a breakthrough with an active substance against Alzheimer's disease. And if you follow the Bundesliga closely, you may be aware of the cases of testicular cancer among the players. Now BioNTech senses a new opportunity...

ReadCommented by Fabian Lorenz on September 29th, 2022 | 13:17 CEST

Up to 200% share price potential: Kion, BioNTech, Aspermont in analyst check

The profit warning was a shock for Kion shareholders. Accordingly, the share price halved to EUR 20 in September alone. Now analysts are also slashing their estimates. The price targets for the forklift manufacturer are falling accordingly. Berenberg surprises with a high price target for the BioNTech share. At the same time, the analysts emphasize their hope for a continued generous dividend. Shareholders could thus be kept in good spirits until the next blockbuster. The roadshow of Aspermont in Germany has probably also created a good mood. At least the share price has jumped. The current consolidation could be an entry opportunity. Analysts see a price potential of over 200%.

ReadCommented by Stefan Feulner on September 27th, 2022 | 11:45 CEST

Evotec, Defence Therapeutics, Formycon - Biotech opportunity!

Due to the stricter monetary policy of the central banks and inflation concerns, the capital-intensive biotech sector is also suffering. The NASDAQ Biotechnology Index has lost almost a quarter of its value since the beginning of the stock market year. In addition, the number of companies trading even below their cash levels is higher than ever. At the same time, as can be seen with vaccine manufacturers, the industry is becoming increasingly important in everyday life. Especially in cancer research, some companies have the opportunity to multiply in the coming years based on their product pipeline.

ReadCommented by Juliane Zielonka on September 23rd, 2022 | 11:28 CEST

Defence Therapeutics, Amazon, BioNTech - Innovative technologies for health

While WHO Director-General Tedros Adhanom Ghebreyesus sees the end of the Corona pandemic within reach, companies like BioNTech have more products in the pipeline to bring successful drugs to market. In order to ensure that this happens thoroughly and more quickly, Canadian company Defence Therapeutics is stepping up to shorten development cycles with a unique platform technology in oncology. Cancer has still not been eradicated. An end, however, is in sight for Amazon's in-house healthcare division. Amazon Care is closing its doors at the end of the year, but the Seattle-based corporation still cannot let go of the lucrative healthcare business...

ReadCommented by Juliane Zielonka on September 22nd, 2022 | 11:58 CEST

Cardiol Therapeutics, Apple, Nel - Crisis-proof shares, despite inflation

Heart fluttering, pulse racing among investors, share prices highly volatile due to FED measures. Inflation and recessionary times are brutal for investors in the capital market. Three candidates have the potential to become profitable long-term investments: Cardiol Therapeutics, Apple and Nel. Cardiol Therapeutics fills the gap in the pharmaceutical market for the treatment of the heart disease, myocarditis. Apple is increasingly focusing on monitoring heart health, as cardiovascular disease is one of the leading causes of death in industrialized nations. In turn, these nations are struggling with extremely high energy prices. No wonder, then, that the Norwegian government is financially supporting the Company Nel to produce green hydrogen as quickly as possible...

ReadCommented by Stefan Feulner on September 22nd, 2022 | 11:32 CEST

BioNTech, XPhyto, Valneva - It is over!

In an interview with the television station "CBS", the most powerful man in the world, US President Joe Biden, declared the pandemic over. While people in Germany have to wear face masks to the Oktoberfest in local and long-distance transport and then blare the latest hits from Mallorca in the marquee, without masks, of course, outside the former growth engine of Europe, relaxation seems to be setting in regarding COVID-19. A blow to the global vaccine industry! Meanwhile, a new market is growing unnoticed in the healthcare industry that could trigger a lasting trend in the near future.

ReadCommented by André Will-Laudien on September 15th, 2022 | 13:35 CEST

Fighting Cancer: BioNTech, Defence Therapeutics, Valneva, MorphoSys - Which biotech stock is ahead in Biden's Moonshot?

Since the original launch of the Cancer Moonshot in 2016, the US cancer community has made measurable progress toward three ambitious goals. Namely, accelerating the scientific discovery of cancer, fostering greater collaboration, and improving cancer data sharing. In early 2022, President Biden announced a relaunch of the Cancer Moonshot and named new goals: To cut the cancer death rate in half within 25 years and significantly improve the lives of people with cancer. The initiative is just getting a new lease on life in the United States. Some biotech shares could make significant gains in this environment.

Read