Comments

Commented by Nico Popp on June 30th, 2021 | 13:59 CEST

Gazprom, Theta Gold Mines, Yamana Gold: Which commodities are the best?

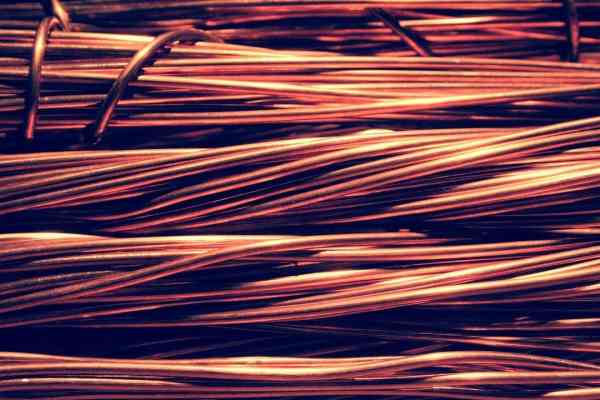

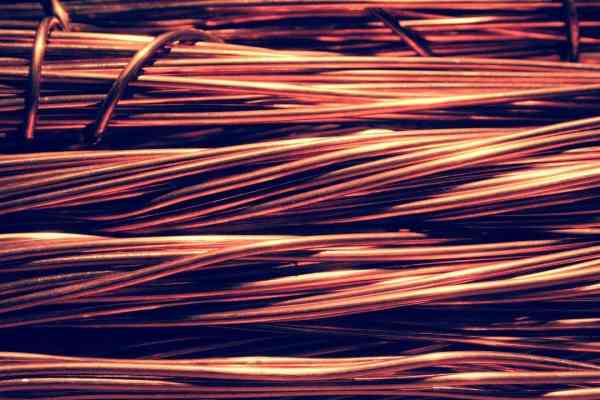

Commodity prices have always been considered an indicator of fundamental changes in the global economy. It is not for nothing that the price of copper is known as "Dr. Copper" because of its role as an economic indicator. Oil and gold also have a signaling effect: when the energy commodity rises, it stands for an intact global economy and incipient inflationary tendencies. Gold is also an inflationary metal in a certain sense. Added to this is the property as crisis insurance. But which commodities are best suited for investment? We run through three scenarios using companies as examples.

ReadCommented by Carsten Mainitz on June 30th, 2021 | 12:59 CEST

CureVac, Cardiol Therapeutics, MorphoSys - Here it is going powerfully upwards!

Biotech stocks offer investors not only an exciting but also a very profitable investment environment. But the sector is also attractive for traders due to its high volatility. CureVac took a beating recently as the efficacy of its Corona vaccine disappointed. The price of MorphoSys falls despite good news and positive analyst comments. The Canadian Cardiol Therapeutics could be on the verge of a revaluation. Where can the most significant gains be made in the short term?

ReadCommented by Armin Schulz on June 30th, 2021 | 12:07 CEST

SAP, Barsele Minerals, BioNTech - Shares have no alternative

The USA is expecting growth of 7% this year and Germany is expected to grow by 3.7%. This growth is above the currently expected inflation. As an investor, you should not be afraid of 2023, even if the FED wants to raise interest rates twice by then. One can confidently assume that interest rates will rise marginally from this historically low level, and that, in turn, is a sign of economies with growth prospects. In addition, the boom in equities could last much longer due to major changes such as e-mobility, climate neutrality and the like. In times of significant changes such as industrialization, there were long-lasting bull markets in equities. Since bonds are still hardly yielding any returns, equities remain highly attractive.

ReadCommented by Stefan Feulner on June 30th, 2021 | 11:12 CEST

JinkoSolar, Kodiak Copper, BASF - Caution: This market will explode!

Due to the energy transition, the raw materials sector is undergoing a historic upheaval. Due to a CO2 reduction in the economy and transport, coal, gas and crude oil will lose importance in the future. The demand for metals such as copper will increase exorbitantly in order to expand the capacities for the generation and storage of renewable energies. Copper is and will remain irreplaceable in the electrification of the global economy due to its chemical properties. In 2020, the supply deficit rose to 560,000 metric tons, the highest in a decade. And transportation electrification is just getting started.

ReadCommented by Nico Popp on June 30th, 2021 | 11:04 CEST

BP, NewPeak Metals, Nordex: Three shares with energy

The energy turnaround offers excellent opportunities - that is what you read in many media reports. Indeed, regenerative energy has a great appeal - it does not produce any CO2 emissions. But this is not entirely true. The production of solar panels and wind turbines requires raw materials. Only when these are also produced in a climate-neutral way are regenerative energy sources genuinely sustainable. At the same time, oil and gas still play a significant role in the energy mix. We outline three companies involved in this complex of topics and also examine investment opportunities.

ReadCommented by Nico Popp on June 29th, 2021 | 14:04 CEST

SAP, Barrick Gold, GSP Resource: How to invest smartly

Stocks rise and rise. A little more than a year ago, the hope that not everything would be so bad in the end boosted share prices. The end of the pandemic now seems to be near. Linked to this is the hope that the future will bring many new things and that established companies, in particular, will be able to secure a large piece of the pie. But which sectors are exciting? We take a look at two different industries and discuss the opportunities and risks.

ReadCommented by Stefan Feulner on June 29th, 2021 | 13:23 CEST

Steinhoff International, Aspermont, Bike24 - Endless possibilities

Do you remember the last few years of the past millennium, when Amazon was ridiculed for trying to sell books over the Internet? Now, around 20 years later, there are hardly any goods that can no longer be purchased on the World Wide Web. The transformation from off to online is already well advanced. Even magazines or books are increasingly read on tablets these days. Digitization offers endless opportunities for media companies to scale their original business model, with massive potential for the respective companies.

ReadCommented by Carsten Mainitz on June 29th, 2021 | 12:37 CEST

Siemens Energy, QMines, AUTO1 Group - Watch out: invest in the best stock market newcomers!

IPO underpricing measures the difference between the price subscribers have to pay for new issues, i.e. the issue price and the prices then traded on the stock exchange. This phenomenon was first addressed in studies some 50 years ago. In sum, IPO underpricing exists worldwide. However, depending on the market phase, country and market capitalization size, this effect can look very different. It is, therefore, wrong to conclude that every IPO is a success. We separate the wheat from the chaff. Which stock is a clear buy?

ReadCommented by André Will-Laudien on June 29th, 2021 | 11:47 CEST

Varta, JinkoSolar, Ballard Power, Sierra Growth - Energy technology on the test bench

What will mobility look like in 10 years? Will we all be riding bicycles because climate regulations make it impossible to move around using electricity or fossil fuels? Or are there still revolutionary developments that go beyond the battery as a universal remedy? Germany continues to experience an energy shortage because we buy cheap nuclear power from abroad. That is how things can go when a messed-up energy policy is associated with climate protection goals. No matter how things go, the world needs copper for modern technologies, and this raw material is in short supply.

ReadCommented by Carsten Mainitz on June 28th, 2021 | 14:42 CEST

BYD, EuroSports Global, Varta - Electric music is playing in Asia

Electromobility is considered the central building block of a sustainable and climate-friendly transportation system based on renewable energies. There are currently around 70 electric vehicle models from German manufacturers on the market. In 2020, the stock of passenger cars with electric drives in Germany comprised only 137,000 vehicles, according to the Federal Motor Transport Authority. The federal government wants to significantly boost the market with purchase incentives by the end of 2025, extensive investments in expanding the charging infrastructure and tax incentives. However, if you look at the global situation, it quickly becomes evident that Asia dominates the action. We introduce you to three stocks that offer great opportunities. Who has the best cards?

Read