Comments

Commented by Carsten Mainitz on August 31st, 2021 | 12:16 CEST

Square, Aspermont, flatexDEGIRO - FinTechs: Top or Flop?

Many FinTechs have emerged in recent years to put the fear of God into traditional banks with their dusty business models. As with many disruptive business models, the spread of the Internet and smartphones provided the basis for scalable, rapid growth. In addition, sufficient venture capital was available. Valuations in the billions, even before an IPO, were and are not uncommon. In addition, cryptocurrencies began an unprecedented triumphal march. In some places, the sword of Damocles of regulation hovers over the industry and not every Company will reach the finish line. Too many advance praises are priced into some prices. Who will be among the winners?

ReadCommented by Nico Popp on August 31st, 2021 | 11:27 CEST

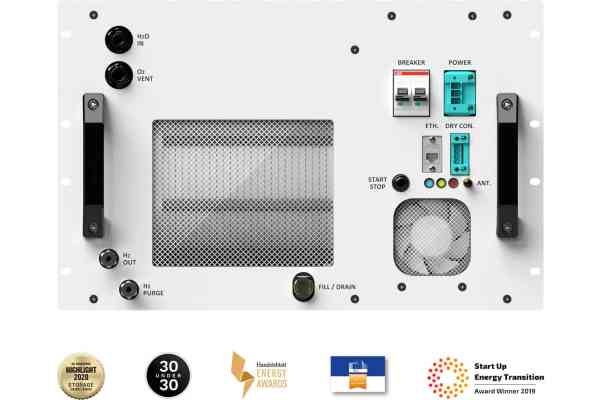

NEL, Enapter, Daimler: Where hydrogen still offers opportunities

And what about hydrogen? CDU/CSU chancellor candidate Armin Laschet not only earned the laughs of Tesla boss Elon Musk when he asked about the appropriate technology for the mobility revolution, but the German media also mocked the CDU chairman. Yet hydrogen as an energy carrier is far from being out of the question, at least for trucks, ships and trains. Hydrogen could also be used as a power source in remote regions. Reason enough to take a closer look at a few stocks.

ReadCommented by Fabian Lorenz on August 31st, 2021 | 10:37 CEST

Sales explosion? Novavax and Diamcor on the trail of BioNTech

When companies suddenly report strong jumps in sales, investors should take a closer look. On the one hand, there may be considerable opportunities for share price gains. On the other hand, it must also be checked whether the development is sustainable or whether it is a one-off or seasonal event. BioNTech has impressively shown that the Company and the share can profit from a sudden increase in sales. Who is next? Investors should take a closer look at the vaccine developer Novavax and the diamond producer Diamcor - it could be worthwhile.

ReadCommented by Stefan Feulner on August 30th, 2021 | 13:22 CEST

BYD, AdTiger, Xpeng - Way clear for further share price gains

As expected, the highly anticipated symposium in Jackson Hole turned into a non-event. Although FED Chairman Jerome Powell is concerned about inflation at current levels, he considers the price increases to be a temporary phenomenon that does not require any changes in key interest rates. Nor was a specific date given for scaling back bond purchases. The ultra-loose monetary policy is thus preparing the ground for further price rises in the asset classes of equities, real estate and precious metals.

ReadCommented by Armin Schulz on August 30th, 2021 | 12:22 CEST

Porsche, Blackrock Silver, Xiaomi - These stocks are making headway!

Last week, the stock markets were eagerly awaiting the statements of US Federal Reserve Chairman Jerome Powell. His words reassured investors, as the tightening of the reins on the printing press is to be more gradual, and interest rate hikes are currently not an issue. From December, bond purchases are to be reduced by USD 15 billion. The US indices then rose again to near their all-time highs. But even without such events, which the whole world is watching, there are always stocks where exciting things are happening that can boost the stock market price. We are taking a closer look at three of these candidates today.

ReadCommented by André Will-Laudien on August 30th, 2021 | 12:13 CEST

First Hydrogen, Nel, Plug Power, FuelCell Energy - Is the next Hydrogen rally coming?

Hydrogen is repeatedly put forward as a solution for climate-neutral energy production. A strong distinction must be made for climate protection because only green hydrogen - produced from 100% renewable energy - is truly climate-friendly. Insufficient differentiation between hydrogen types has fatal consequences for the globe. In a recent study, scientists at the University of Standford in California prove that blue hydrogen, produced from natural gas in combination with the injection of the resulting CO2 through carbon capture-and-storage, actually has a significantly worse climate balance than the direct combustion of crude oil and natural gas. Significant methane gas emissions in production mainly cause this. Today we look at interesting values in the hydrogen environment.

ReadCommented by Carsten Mainitz on August 30th, 2021 | 11:33 CEST

Central African Gold, Nordex, Varta - Performers for the second half of the year!

Climate and energy transition are more than just buzzwords. They affect us all to an ever increasing extent. The production of green energy and the currently also politically favored spread of electric mobility place considerable demands on the availability of raw materials, the sufficient production of green energy and the existence of an area-wide infrastructure. As steering mechanisms, states offer extensive support measures. A market for emission certificates creates incentives as well. It is also important to keep an eye on the development of increasingly stringent ESG standards in the investment sector. Companies that do not do their homework will sooner or later lose out. These three companies have the potential to profit from the energy transition. Who will win the race?

ReadCommented by Stefan Feulner on August 30th, 2021 | 11:22 CEST

Huge opportunities at Steinhoff, Saturn Oil + Gas, MorphoSys

The second-quarter reporting season is drawing to a close and was exceptionally strong. Earnings estimates had already been raised in the run-up to the quarter and were even exceeded again due to the economic recovery following the disastrous Corona year 2020. Looking at the forecasts of most companies for the full year, these were also raised. As a result, some stocks are facing a revaluation that the broader market has yet to realize.

ReadCommented by Nico Popp on August 30th, 2021 | 11:10 CEST

Teck Resources, GSP Resource, Standard Lithium: Thinking of the good times

The summer has caused a lethargic mood on the stock market. There are inflation concerns, and also, the pandemic is again leading to many hospitalizations in many countries. Nevertheless, the markets seem to have weathered the worst. The closer we get to fall, the more likely future issues will dominate the market again. Whenever issues of mobility or regenerative energy come up, commodities also come into play. We take a look at three shares related to popular commodities.

ReadCommented by André Will-Laudien on August 27th, 2021 | 14:38 CEST

wallstreet:online AG, AMC, GameStop, Robinhood - The hunting season has begun!

As of September 20, the DAX, like its French counterpart CAC, will be expanded to 40 stocks, which means that 10 new stocks will move into the focus of major fund managers. One or the other may have been surprised by this decision because, after all, Germany's 30 most valuable companies have reflected the development of the German economy very well for decades. However, international investors and funds appreciate more diversity, especially sector diversification. It is also hoped that the new insolvency clause will mean that criminal incidents, such as those involving Wirecard, will not have to be discussed at index level for long and will continue to affect derived derivatives for months afterward. Entry and exit criteria are also to change, from now on, minimum liquidity counts instead of trading turnover, and the Corporate Governance Code will become binding from September 2022. Modernization has been long overdue since Wirecard.

Read