Comments

Commented by André Will-Laudien on September 28th, 2021 | 14:06 CEST

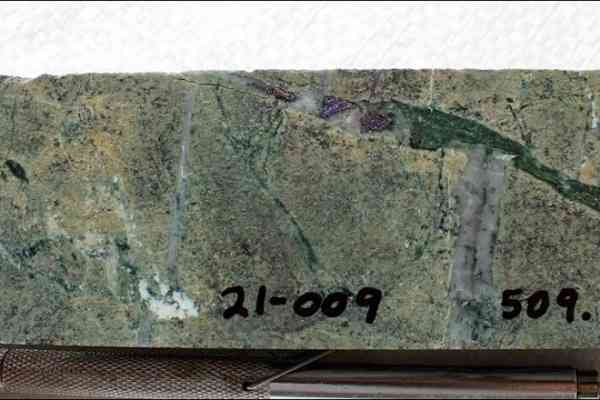

BYD, Fisker, Kodiak Copper, Varta: Nothing works without Copper!

Electromobility is becoming increasingly crucial for the energy transition in transportation. And with it the research, development and production of drives, batteries and components. In addition to electricity storage, however, vehicle cabling and the assembly of e-components are also coming to the fore. Today, an electric vehicle requires three to four times the amount of copper as it did 20 years ago, plus the demand in industrial manufacturing processes. The earth's deposits are exhaustible, and copper, in particular, is pretty much on the edge. A spot price of just under USD 10,000 per kilo clearly shows how the markets are processing this situation. Rising prices!

ReadCommented by Fabian Lorenz on September 28th, 2021 | 13:31 CEST

Nel, JinkoSolar, Saturn Oil + Gas: It looks good!

Shares from the solar, hydrogen and oil sectors are in demand again. And the chances are good that it will continue. The federal elections are creating a good mood for solar and hydrogen; whether it is a traffic light or Jamaica, the new government will be greener. So good news for Nel and JinkoSolar. Both have also reported positive news. But oil stocks could also be in for a hot fall. That is because little work is being done on new projects, and demand will remain high for decades to come. So oil could become scarce despite the trend toward clean energy, according to one expert. Saturn Oil & Gas should benefit from this. The Canadians just bought huge oil reserves at a bargain price.

ReadCommented by André Will-Laudien on September 28th, 2021 | 12:56 CEST

Standard Lithium, Defense Metals, Orocobre, Millennial Lithium: Separating the wheat from the chaff!

Lithium has become one of the most important metals in electromobility. Where all this lithium will come from is critical, as the logic behind electromobility is to generate more sustainable technologies. For more climate protection, mining companies must also fit into a sustainable concept. Lithium extraction should therefore follow high environmental standards and take place in an appropriate economic and social context. But beware: the overall market has recently stopped following every battle cry. Separating the wheat from the chaff is becoming a portfolio challenge!

ReadCommented by Stefan Feulner on September 28th, 2021 | 12:04 CEST

Nordex, GSP Resource, NIO - These are the election winners

Germany has voted, and the decision was very close. According to the leading candidates Scholz and Laschet, the government should be in place by Christmas at the latest. Whether it is a traffic light or Jamaica, the Greens will almost certainly be part of the coalition. As a result, this means that the energy transition and climate protection topic will be more in the focus of politics than ever before. The expansion of infrastructure topics such as energy, construction and transport promises growing sources of income and full order books for the companies concerned.

ReadCommented by Carsten Mainitz on September 28th, 2021 | 11:19 CEST

Cardiol Therapeutics, BioNTech, Valneva - Volatility offers good opportunities!

The share prices of the Corona vaccine manufacturers are not growing sky-high after all. Most recently, developments at France's Valneva caused uncertainty. The French Company wanted to bring a Corona vaccine to market by the end of 2021 and had already received an order from the British government for 100 million units. This contract has now been canceled. Where does the industry go from here?

ReadCommented by Nico Popp on September 28th, 2021 | 10:37 CEST

Intel, BrainChip, AMD: A chip like the human brain

Chips are in short supply. When assembly lines in Wolfsburg, Munich or Sindelfingen come to a standstill because of a shortage of inexpensive semiconductors, it is frustrating for the German automotive industry. But powerful chips and processors with entirely new architecture are also urgently needed for future technology. Machine learning and artificial intelligence are also placing new demands on chipmakers. We profile three titles.

ReadCommented by Armin Schulz on September 27th, 2021 | 13:24 CEST

Valneva, Defence Therapeutics, CureVac - Second-tier vaccine makers offer high potential

The battle against the Coronavirus is still ongoing, although more and more people have been vaccinated with vector or mRNA vaccines. In Europe, an average of 60% of all people have received the vaccination. Herd immunity has not yet been achieved, in part because of vaccine skeptics who do not yet trust novel vaccines. New vaccines based on dead viruses promise to remedy the situation. This method has already been tried and tested in influenza vaccinations, for example. According to a study in Switzerland, about 70% of the unvaccinated would still be vaccinated if the method had already been tested. Herd immunity could thus be achieved, and everyday life could return to normal. So, which vaccine manufacturer that does not currently have an approved product could shake up the market?

ReadCommented by André Will-Laudien on September 27th, 2021 | 12:52 CEST

Central African Gold, TUI, Lufthansa - Attention, these were the lows!

The upward movement at the stock exchanges is very advanced because, in the last years, the higher valuation of the shares (and real estate) was funded by cheap money from the central banks. Now, however, inflation shows up in the statistics, for Europe officially a plus of 3,8%. This inflation rate, by its measuring method, corresponds little to reality. It is generally known, the actual price markup in the relevant goods might already lie beyond the 5% mark. One thinks here only of the exploding gasoline prices, the bread roll at the baker or the restaurant attendance after the reopening. Precious metals could be a tried and tested means of achieving real purchasing power protection. Let us do the math.

ReadCommented by Carsten Mainitz on September 27th, 2021 | 12:20 CEST

Diamcor Mining, TUI, Xiaomi - Consumer stocks are among the winners!

To consume or to save? Everyone is faced with this fundamental decision. The individual rate depends on the level of income and the prospects regarding the labor market and economic growth. In the course of the Corona pandemic, private consumption declined significantly. With economic recovery and the removal of lock-downs, personal consumption is picking up again considerably. The companies mentioned above are benefiting from this.

ReadCommented by Stefan Feulner on September 27th, 2021 | 11:23 CEST

JinkoSolar, dynaCERT, Alstom, Nel ASA - Hydrogen as the key

For the first time right before a federal election, Fridays for Future demonstrated nationwide for more climate protection. According to Greta Thunberg, who made her appearance in Berlin, Germany is the fourth-largest carbon dioxide emitter in history, and that with a population of only 80 million people. Politicians must act and accelerate the switch from gasoline and diesel to environmentally friendly drives. In addition to electromobility, there is no way around hydrogen and fuel cell technology in the future, especially for heavy vehicles.

Read