AIRBUS

Commented by André Will-Laudien on December 3rd, 2021 | 12:22 CET

BYD, Kleos Space, Airbus, Boeing - This could go wrong again!

The states are again on the verge of tightening all known measures to contain the pandemic. The tourism and aviation industries are always strongly affected by this. The investor can bypass this issue. After all, those who focus on technological achievements related to aviation and aerospace can profit from the increased business volumes in sometimes very disruptive areas. An example here would be Big Data and security technology. These are two booming sectors that are setting many an old-school business ablaze. We are looking at stocks from the high-tech industry in 2021, where the right choice was the trump card.

ReadCommented by Nico Popp on November 17th, 2021 | 14:03 CET

Airbus, Kleos Space, Secunet Security Networks: Where analysts see 600% returns

Data is the raw material of the 21st century. Almost everyone has read this sentence at least once. But what is the truth behind the mantra of tech-savvy journalists and visionaries? The fact is that today, thanks to sensors and satellites, we can collect data both below and above ground. In mining, for example, sensors ensure that problems in the mine are detected early on, and productivity can be kept high. In the atmosphere and space, aircraft and satellites collect a wide range of data on weather and activities on Earth. This data flows into climate research, border protection or the fight against smugglers. We present three companies that are taking innovative approaches to the raw material of the 21st century.

ReadCommented by André Will-Laudien on August 9th, 2021 | 13:29 CEST

Varta, Carnavale Resources, Airbus - High tech in a bind - Metals are scarce!

Currently, metal prices are not calming down! That puts pressure on the supply chains. Many companies are struggling with their inventories at the moment. If too much is ordered, the shelves could overflow due to delays in completion and cause extreme costs later on because high working capital is a margin killer for the industry. But the problem is also more topical in nature. There are many orders on hand, but essential components such as chips are unavailable, causing sales to decline, despite full order books. Conversely: When everything returns to normal, prices for metals will probably have to correct sharply again because no one will order more because of full warehouses - a real dilemma for mines and industrial customers alike.

ReadCommented by Carsten Mainitz on July 5th, 2021 | 14:19 CEST

Almonty Industries, K+S, Airbus - Rising demand will be reflected in share price increases!

The metal tungsten has special properties that make it unique as a material. The metal is highly resistant to corrosion, as heavy as gold and, as tungsten carbide, as hard as diamond. In addition, at 3,422 degrees Celsius, it has the highest melting point of all metals. However, processing it is expensive and time-consuming. At the moment, researchers in Karlsruhe are working on processing tungsten using 3D printing methods. Due to its unique properties, tungsten plays a vital role in high-temperature applications in energy and lighting technology and space travel and medical technology. How can investors profit from the rising demand? We will show you.

ReadCommented by André Will-Laudien on May 28th, 2021 | 10:44 CEST

Airbus, Lufthansa, TUI, Silver Viper - Here we go!

In the third wave of the Corona pandemic, hope is now growing that life is returning to a new normal for ordinary citizens. If this is the correct decision criterion, the daily incidence figures are falling briskly, and public life seems to be gradually becoming possible again. Airbus, Lufthansa and TUI are showing the first signs of economic relief. Reason for us to research a few things in more detail.

ReadCommented by Nico Popp on April 19th, 2021 | 07:35 CEST

Rheinmetall, Airbus, Almonty Industries: Potential lurks here

Certain industries may have a bad reputation, but they are still lucrative. Examples of these include the defense industry and aircraft manufacturing. Germany's military spending has risen steadily in recent years. The German government recently stepped it up a notch and spent EUR 51.4 billion on armaments in 2020. Given the consistent demand from the USA and NATO to further increase spending, defense companies are operating in an attractive market - demand is growing and growing and the market is also regulated.

ReadCommented by André Will-Laudien on April 13th, 2021 | 10:59 CEST

Kleos Space, Airbus SE, SAP SE - Buy space high-tech now!

Three themes combined: big data - artificial intelligence - satellite technology. Cathie Wood, a world-renowned fund manager, is the CEO and CIO of ARK Invest, which runs the three highest-yielding equity ETFs of the past three years. According to the Wall Street Journal, her latest product, ARKX Space Exploration, raised a whopping USD 536 million in its first five days of trading. Cathie Wood's newly launched and exchange-traded fund, which focuses on investments in space exploration, is thus well on its way to becoming one of the most successful fund launches in history. The figures far exceed the industry average of all ETFs, which raised an average of USD 100 million in the first 3 years. We take a closer look at possible target investments for the fund.

ReadCommented by André Will-Laudien on April 8th, 2021 | 09:49 CEST

Infineon, Airbus, Lufthansa, Almonty Industries - High-tech is the bottleneck!

In order to limit global warming, the world must become climate-neutral. For this, it will require removing billions of tons of CO2 from the atmosphere and storing it. Meanwhile, the Corona pandemic raises entirely different problems. Planned investments in research and development cannot be carried out as planned due to a lack of raw materials and the supply of certain necessary resources. Primarily, this affects high-tech manufacturers, but even basic technologies can only be developed with difficulty. We shed light on the facets of an economy trying to move a great deal, but with a giant brake block in front of it.

ReadCommented by Carsten Mainitz on March 18th, 2021 | 09:30 CET

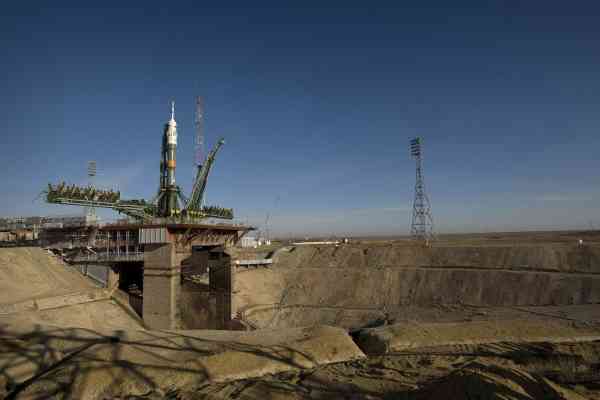

Kleos Space, PayPal, Airbus - Watch out: Performance rockets at the start!

You have to hand it to Elon Musk: Little of what he has tried has flopped in the end. He seems to have an excellent feel for feasible concepts. He was involved early on in PayPal, which came out of nowhere to become the world's most important payment service provider. Although not founded by him but protected very early on, Tesla developed under his aegis over the last 16 years from a startup to the world's most valuable car manufacturer. And Kleos Space? While not a company founded by Elon Musk either, it does have a business relationship with SpaceX, which depicts another field of activity for the go-getting and visionary "technoking." And as an established industry veteran, Airbus shares should not go unmentioned either. Who has the greatest potential?

ReadCommented by André Will-Laudien on March 12th, 2021 | 07:39 CET

Linde plc, Airbus SE, Royal Helium - Things are taking off!

Despite the second wave of the pandemic, the European Central Bank (ECB) has slightly raised its economic forecast for the eurozone economy, which has been battered by the Corona Crisis. The central bank announced on Thursday after the interest rate decision in Frankfurt that ECB economists now expect the gross domestic product (GDP) to grow by 4% for the current year. In December, central bank economists had still predicted 3.9%. So when the economy shifts into the next gear, commodity demand must be linked to this scenario. It provides a reasonable explanation for the bullish copper price. In this context, we take a look at the important industrial gases.

Read