ZALANDO SE

Commented by Fabian Lorenz on November 25th, 2025 | 07:00 CET

Up to 100% with German stocks!? RENK, Zalando, HelloFresh, and UMT

HelloFresh shares have more than halved in value this year. Analysts remain cautious even now. They are more optimistic about Zalando, predicting a possible 100% gain in share price. But now, possible criminal offences in Switzerland are making the rounds. There are not many AI specialists in Germany. One of the few is UMT United Mobility Technology. The "digital clerk" is designed to help automate order, email, invoice, and customs document processing, saving time and money for small and medium-sized businesses. Defense stocks are currently trending weak. The example of RENK shows that a lot of positive factors are already priced in.

ReadCommented by Fabian Lorenz on October 8th, 2025 | 07:15 CEST

More than 50% upside potential! Zalando, thyssenkrupp, and stock market newcomer Finexity!

What is happening at thyssenkrupp? After the marine division (TKMS) drove the share price up this year with its defense fantasies, the planned IPO now appears to be stalling. Meanwhile, the steel division is once again dominating the headlines. Finexity, on the other hand, has successfully made the leap onto the trading floor. The next step is to attract greater investor attention. Those who get in early could profit, as the Company's growth prospects are excellent. Recently, Finexity announced plans for international expansion, targeting one of the most dynamic real estate markets in the world. In contrast, Zalando is facing strikes. When will the stock react? According to analysts, it might not. Yet they still see up to 50% upside potential.

ReadCommented by Fabian Lorenz on October 1st, 2025 | 07:20 CEST

1,000% not enough for D-Wave? 70% price potential for Zalando! Will Walmart partner MiMedia's stock now take off?

After a meteoric 1,000% rise in just 12 months, D-Wave Quantum shares continue to attract attention. Analysts are significantly raising their price targets - is the next short squeeze already looming? Meanwhile, bargain hunters should take a closer look at MiMedia. The Walmart partner's shares have halved since July, yet the Company is making strong progress in expanding its cloud platform. A rebound of up to 100% back to its previous high is possible. And in Europe, Zalando is back on investors' radar. Analysts see up to 70% upside potential, while the chart is also looking more favorable again. However, the weak consumer climate continues to weigh on business sentiment.

ReadCommented by Fabian Lorenz on September 16th, 2025 | 07:10 CEST

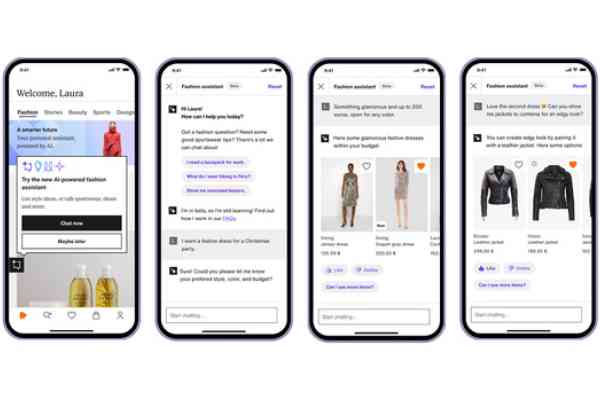

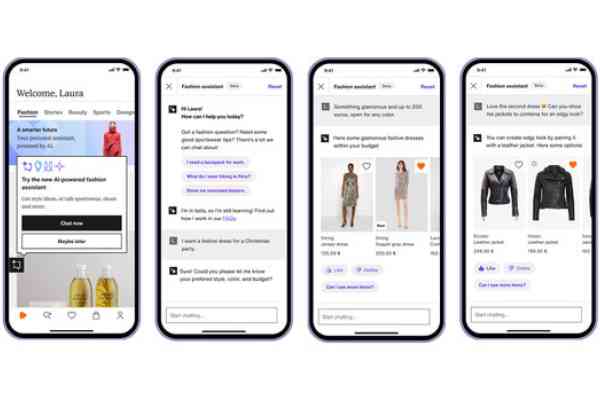

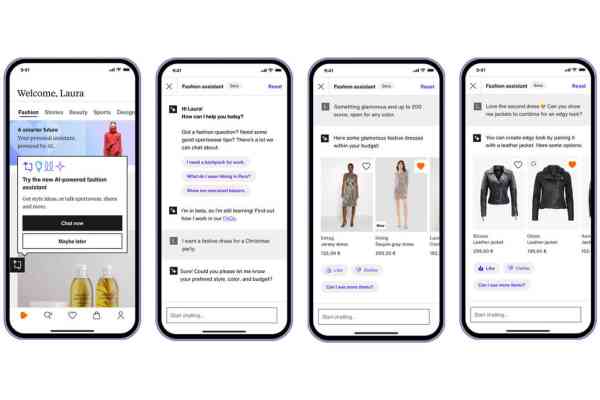

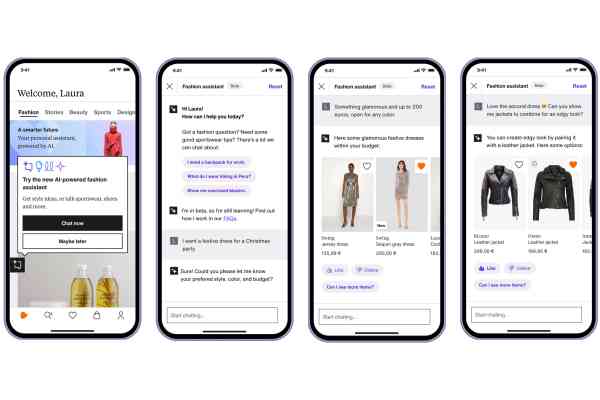

OPPORTUNITY for 100% returns and a short squeeze! D-Wave Quantum, Zalando and Rio Tinto partner Aspermont

While traditional AI stocks like Nvidia, Palantir and Oracle are becoming increasingly overheated, investors are now turning their attention to second- and third-tier companies. These are companies that are poised to benefit from the adoption of AI technologies. One example is the hot stock Aspermont. The Australian company holds a massive trove of data on the global resources industry. The latest bombshell: a partnership with mining giant Rio Tinto, which is paying for access to and processing of Aspermont's valuable data. The stock has not yet reacted. At Zalando, analysts see upside potential of up to 100%. The e-commerce group could also benefit from AI advancements. And then, of course, there is quantum computing, seen as a potential challenger to AI. Could investor favorite D-Wave be on the verge of a short squeeze?

ReadCommented by Fabian Lorenz on August 13th, 2025 | 07:10 CEST

BUY RECOMMENDATIONS and strong figures! Zalando, IONOS, TeamViewer, and naoo

Strong figures for IONOS! The Company is one of the beneficiaries of the planned development of a German and European AI and internet infrastructure. The latest business figures and the upward revision of the forecast were convincing and sent the share price to a new all-time high. Do analysts see even more upside potential? Social media also needs a European alternative. This is exactly what naoo offers. The stock is still flying under the radar of many investors. Analysts see potential for a multiple increase. And what are the established German tech companies Zalando and TeamViewer doing? Zalando's figures were not well received. The price targets are falling. There are positive voices at TeamViewer.

ReadCommented by Fabian Lorenz on July 31st, 2025 | 07:05 CEST

270% surprise! Rheinmetall, Zalando, Walmart partner MiMedia – Time to buy shares?

With a strong performance of 270%, MiMedia shares are one of this year's surprises. And the chances are good that the stock will continue to perform well in the future. With strong partners such as Walmart behind it, the cloud specialist aims to grow significantly in the coming years. Rheinmetall needs to grow massively to justify its ambitious valuation. However, the supercycle in the defense industry promises golden years ahead. The group also wants to carve out a large slice of the billion-dollar pie in other European countries. After a strong start to the year, Zalando shares have slipped considerably. The takeover of competitor AboutYou has now been completed, and analysts see upside potential.

ReadCommented by Fabian Lorenz on July 18th, 2025 | 07:00 CEST

20% in one week! Steyr Motors, Zalando, and Globex Mining shares!

Comeback for Steyr Motors. After a share price explosion in March and the subsequent crash, things had quietened down around the share. However, operations appear to have continued at full speed. Things could get interesting on July 31. Globex Mining also seems to be poised for a comeback. After doubling around the turn of the year, the mining incubator's shares corrected. However, with positive news flow and continued strong gold prices amid a commodities boom, the chances of renewed gains look promising. In Germany, retail is not exactly booming. Zalando is countering this with the takeover of its competitor ABOUT YOU. The transaction has now been completed. Will the share price rise now? Analysts certainly see considerable upside potential.

ReadCommented by Fabian Lorenz on June 17th, 2025 | 07:15 CEST

More than 50% upside potential with European tech! SAP, Zalando, Ionos, and naoo shares

There is a spirit of optimism in the European tech industry. The continent aims to become less dependent on the US, not only in terms of defense, but also in the technology sector. The tariff dispute and Microsoft's blocking of email access at the International Court of Justice are fueling a tech boom in Europe. SAP and Ionos are supporting Schwarz Digits in setting up a hyperscaler. Zalando shares are being recommended as a buy. And the chances for naoo AG to establish a European social network appear better than ever. The Swiss company's shares may be on the verge of a revaluation.

ReadCommented by Fabian Lorenz on January 28th, 2025 | 07:30 CET

4,000% stock Carvana: TeamViewer, Bitcoin Group, Zalando, and Credissential offer opportunities

Away from the big tech stocks, multipliers are waiting. One example from the US is Carvana, which has risen 4,000% in two years. Credissential aims to challenge the online used car dealer. The startup wants to provide brick-and-mortar used car dealers with a response against Carvana using artificial intelligence. Scaling is planned for 2025. If successful, the stock is much too cheap. In the DAX, Zalando offers significant upside potential. The online retailer is back on the growth path and plans to compete with Shein and Temu through the acquisition of About You, with analysts recommending a "Buy". By contrast, TeamViewer's stock lacks momentum. Analyst opinions are divided. And is the Bitcoin Group stock finally waking up?

ReadCommented by Fabian Lorenz on June 29th, 2022 | 12:18 CEST

Buy or sell? Nel, Zalando, Aspermont under analyst review

After the heavy losses of the past months, a countermovement seems to be starting at the moment. Whether this will turn into a real summer rally remains to be seen. Buy or sell is the question. Analysts see a price potential of over 50% for Nel ASA. Even though competition from China and India is increasing. Aspermont also appears attractive at the current price level. The latest quarterly figures were positive, and the positioning of the small-cap in the booming commodities sector is promising. At Zalando, analysts react to the profit warning, and the price targets are significantly reduced. Nevertheless, some advise buying the online fashion retailer, but not everyone.

Read