K+S AG NA O.N.

Commented by Carsten Mainitz on July 5th, 2021 | 14:19 CEST

Almonty Industries, K+S, Airbus - Rising demand will be reflected in share price increases!

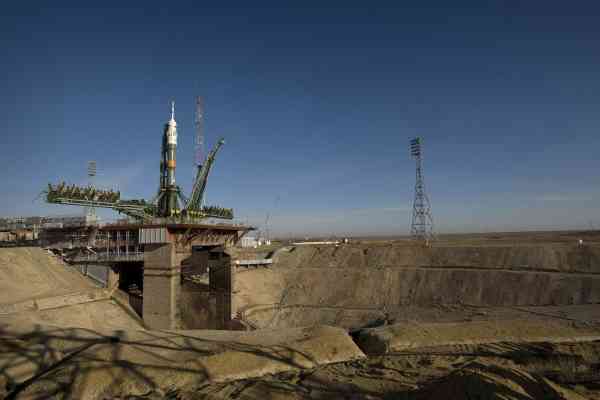

The metal tungsten has special properties that make it unique as a material. The metal is highly resistant to corrosion, as heavy as gold and, as tungsten carbide, as hard as diamond. In addition, at 3,422 degrees Celsius, it has the highest melting point of all metals. However, processing it is expensive and time-consuming. At the moment, researchers in Karlsruhe are working on processing tungsten using 3D printing methods. Due to its unique properties, tungsten plays a vital role in high-temperature applications in energy and lighting technology and space travel and medical technology. How can investors profit from the rising demand? We will show you.

ReadCommented by Carsten Mainitz on June 16th, 2021 | 14:26 CEST

Blackrock Silver, JinkoSolar, K+S - Betting on the trend

Silver is not only in demand as a "crisis currency," but also from industry. The precious metal is characterized by several advantageous physical properties that make it extremely valuable for industrial use. For example, silver plays a major role in solar and battery production. As a result, the price of silver has already risen significantly in recent months. But what if the trend continues for longer?

ReadCommented by Nico Popp on June 9th, 2021 | 08:28 CEST

NEL, Troilus Gold, K+S: After the hype is before the hype

For some time now, more and more private investors have been flocking to the trading floor. New, low-cost smartphone brokers and innovative technologies have attracted these investors. Hydrogen stocks, in particular, triggered a stock market boom in 2020. But what is next for these new stock market investors when the shares of NEL, Ballard Power and others no longer perform? Where are there still opportunities? We provide answers.

ReadCommented by Armin Schulz on May 28th, 2021 | 09:12 CEST

First Majestic Silver, NewPeak Metals, K+S - Soaring commodity prices

Commodity prices continue to soar. If we compare the first quarter of 2021 with 2020, we can assume an average price increase of 36.7%. As the raw materials market is currently unable to respond quickly enough to the high demand in many countries, prices are rising. An end to this spiral is currently not foreseeable, as more and more countries are slowly getting to grips with the Corona pandemic. Thus the demand for raw materials will continue to grow. We have picked out three exciting companies from the commodities sector today.

ReadCommented by Nico Popp on May 26th, 2021 | 09:36 CEST

White Metal Resources, BASF, K+S: How to react to 4% inflation

As reported by Handelsblatt, the German Bundesbank expects an inflation rate of up to 4% by year-end. Within the eurozone, for which the central bank ECB is responsible, it could be well over 2%. This mixed situation is particularly tricky for Germans. While inflation in Germany is already very high, the lower price momentum within the eurozone could ensure that the ECB leaves its money floodgates open for even longer. In the long term, this could encourage inflation to overshoot. How can investors react to this? We present three stocks.

ReadCommented by André Will-Laudien on May 17th, 2021 | 09:15 CEST

Gazprom, K+S, Blackrock Silver: Watch out for the turnaround - Do not miss it!

That was a turbulent week on the stock markets. Since Monday, the German benchmark index had been under pressure and reached its low of around 14,820 points on Thursday morning. But then it turned strongly and put in the biggest 24-hour upswing seen in a good 3 years. In the end, it gained a full 4.4% and reached a new all-time high of 15,472. Car stocks, Siemens and insurers, both trading ex-dividend, were responsible. We take a look at further turnaround candidates.

ReadCommented by Nico Popp on May 6th, 2021 | 07:05 CEST

NSJ Gold, NIO, K+S: Size matters

Project developers in the commodities sector are speculative investments per se. At the same time, however, these projects offer many advantages for growth-oriented investors: they can develop enormous leverage on commodity prices and usually offer a clear investment horizon, as drilling programs and development targets are fixed in advance. Investors can position themselves on a one-to-two-year horizon and quickly assess whether or not an investment is on a sound track once the time limit expires. If a project then combines two megatrends, it becomes all the more exciting.

ReadCommented by Nico Popp on April 30th, 2021 | 08:40 CEST

BASF, Saturn Oil & Gas, K+S: Three stocks for a yield kick

Investors who want to add a few yield drivers to their portfolio have several options. In addition to solid blue chips, which offer little share price excitement but steady dividends, investors can also focus on growth stocks and small caps. Although there are always those who categorically rule out growth stocks for cautious investors, this is not entirely true. Those who control risk via position size can also invest speculatively without having to abandon their fundamental strategy.

ReadCommented by Carsten Mainitz on April 15th, 2021 | 07:09 CEST

K+S, SKRR, Klöckner Co. - Where are the missing puzzle pieces?

Cyclical investments have the advantage of a certain predictability. Nevertheless, each new chapter and the corresponding script differs, sometimes only slightly, sometimes quite significantly. As far as the cyclicality of commodities is concerned, very diverse categories exist within the asset class so that favorable entry opportunities lurk almost at any time. We have brought you a colorful bouquet of commodities, including potash, gold and steel. Which share is ahead?

ReadCommented by Carsten Mainitz on March 22nd, 2021 | 08:40 CET

K+S, Goldseek Resources, Gazprom - those who wait for others to buy will lose out

Almost 70 years ago, economist Harry Markowitz published an article on how best to build an investment portfolio. At its core, it was about the benefits of diversification. By spreading risk across as many asset classes as possible, positive effects could be achieved, all the more so if the assets had a low correlation, i.e. if the returns developed as independently of each other as possible. His findings became an important part of portfolio theory. Markowitz was later awarded the Nobel Prize for his research. Unfortunately, the intuitively conclusive recommendation for action loses its "theoretical" advantages in crash phases since correlations and liquidity, as proven in several studies, change abruptly to the investor's disadvantage. Nevertheless, diversification makes sense and investors should not "put all their eggs in just one basket." Below we will give you a few ideas on how to build a portfolio of commodity stocks that are well diversified and rich in opportunities.

Read