SALZGITTER AG O.N.

Commented by Stefan Feulner on November 1st, 2021 | 13:20 CET

Bayer, MAS Gold, Salzgitter - Positive turnaround

At chemical and pharmaceutical giant Bayer, the mood continues to brighten following the important decision of the European Patent Office. Also, the number season, which has been running for weeks, gives the markets an additional boost with solid figures and forecast increases. New highs in the most critical global stock indices are the result. On the other hand, the high inflation rates are a cause for concern, although they continue to be underestimated by the monetary watchdogs. The still weak precious metals markets could therefore experience a boom in the coming months.

ReadCommented by Stefan Feulner on September 8th, 2021 | 13:18 CEST

BYD, Aspermont, Salzgitter AG - Extreme surge in demand

The improved mood in the economy and the reviving business cycle brought companies record results in the second quarter. Above all, electric car manufacturers shone with significantly rising sales figures. In June alone, the number of new registrations in Germany climbed 311% year-on-year. The switch from combustion engines to electric cars is only just beginning. The percentage of battery-powered vehicles on German roads is just 12%.

ReadCommented by Stefan Feulner on June 17th, 2021 | 11:21 CEST

Volkswagen, Defense Metals, Salzgitter AG - Disastrous consequences!

The NATO summit in Brussels last weekend once again showed the increasingly hardening relations between the USA on the one hand and China and Russia on the other. At the same time, the NATO powers seem to underestimate how dependent they are on the Middle Kingdom in terms of the energy transition. By capping access to rare minerals essential for electric vehicles, wind turbines and drones, the Western states are threatened with a bottleneck that will have a major impact on the development of new technologies.

ReadCommented by Nico Popp on May 27th, 2021 | 07:25 CEST

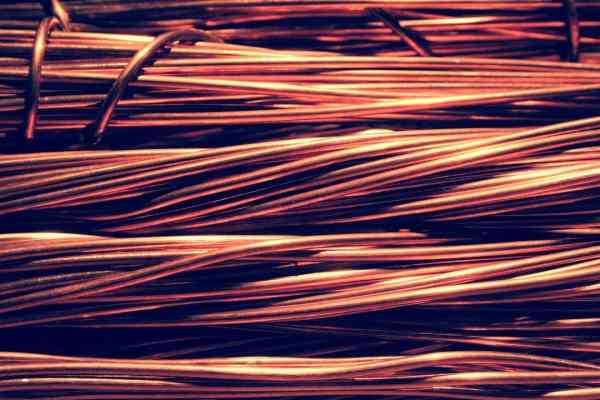

Nevada Copper, Salzgitter, NIO: The Greens and the Copper Price

Since the end of March 2020, the copper price has doubled. The trend is intact and investors are using every minor interim correction to get in. After the pandemic, countries worldwide want to get their economies back on track and fit for the future. Investments in infrastructure have been overdue for years anyway and are the very first measure for many countries. Sustainable solutions, such as charging infrastructure for electromobility, are also on the agenda. The copper price should continue to benefit. Demand from Germany, in particular, is likely to increase - a look at the polls in the election year suggests that it should soon rain billions for electric cars and their charging infrastructure. Some stocks are already benefiting.

Read