BYD CO. LTD H YC 1

Commented by Carsten Mainitz on October 22nd, 2021 | 12:18 CEST

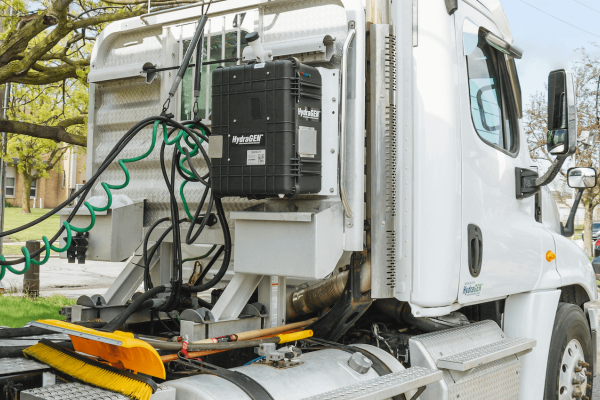

Clean Logistics, Plug Power, BYD - Huge upheavals in the transport industry fuel share prices

"Decarbonization" - this term could make it to "word of the year." That is because it describes what urgently needs to be implemented in all sectors to preserve the Earth's habitat: the switch from fossil, carbon-based energy sources to sustainably and climate-neutrally produced energy sources. The transport industry plays a significant role in global warming. In Germany alone, road freight transport is expected to increase by a further 19% by 2030. Innovative ideas and solutions that can be implemented quickly are therefore urgently needed. In doing so, manufacturers are relying on a variety of technologies.

ReadCommented by Nico Popp on October 18th, 2021 | 15:08 CEST

BYD, dynaCERT, Daimler: Alternative drives are flying again

Trends and moods are sometimes decisive on the stock market: Even a proven future technology has to lose ground when the investor crowd moves on to another industry or prefers to watch the markets from the sidelines. That is what has happened in recent months concerning electromobility and hydrogen. Even big names like BYD and Tesla corrected. However, things have been on the up again for a few days now. We explain where opportunities could lie now.

ReadCommented by Nico Popp on October 14th, 2021 | 13:37 CEST

ThyssenKrupp, Graphano Energy, BYD: The hype returns

Prices are rising and the economy is booming. Supply chains are not yet running smoothly again, meaning that many basic materials are expensive. But the signs for rising raw material prices are also good in the long term: New technology is driving demand, both for entirely new applications such as batteries and for infrastructure. Buildings, bridges, wind turbines - all of these will remain a topic for years to come. We present three stocks that could benefit from these developments.

ReadCommented by André Will-Laudien on October 13th, 2021 | 13:23 CEST

BASF, Almonty Industries, Millennial Lithium, BYD - All sold out?

Anyone who can offer scarce raw materials today is in a fortunate position as far as business prospects are concerned. In particular, metals and battery raw materials are in high demand and have become a bone of contention in globalization. That is because many critical metals are majority-owned by China, meaning that the regime decides on potential allocations to foreign countries. Admittedly, the Middle Kingdom wants to stay in business with the West, so long-term contracts exist. Nevertheless, the domestic industry is naturally given preferential treatment; we can only hope for political stability and incremental improvements in the West. Who are the interesting players in the tight commodity market?

ReadCommented by Stefan Feulner on October 6th, 2021 | 12:56 CEST

BYD, Saturn Oil + Gas, Royal Dutch Shell - Explosion on the oil market

The Organization of Petroleum Exporting Countries OPEC and its alliance partners led by Russia (OPEC+) have decided to increase production only gradually, despite tight supply. Demand is recovering strongly as the Delta variant of the coronavirus subsides. The result is skyrocketing oil prices, which are the highest they have been in seven years. In contrast, oil producer shares are still far from their highs.

ReadCommented by Stefan Feulner on September 30th, 2021 | 14:07 CEST

BYD, Barsele Minerals, GEA Group - The clock is ticking!

Rising inflation, the fear of rising interest rates and further exploding commodity prices. In addition, a looming crisis, triggered by the real estate group China Evergrande. The shadows over the partly excessively overvalued stock markets are getting bigger and bigger. Historically, a flight into crisis metals would be the logical consequence. But also, the precious metals are in the correction mode - still! In the long run, investors should think about building up positions in mining stocks.

ReadCommented by André Will-Laudien on September 28th, 2021 | 14:06 CEST

BYD, Fisker, Kodiak Copper, Varta: Nothing works without Copper!

Electromobility is becoming increasingly crucial for the energy transition in transportation. And with it the research, development and production of drives, batteries and components. In addition to electricity storage, however, vehicle cabling and the assembly of e-components are also coming to the fore. Today, an electric vehicle requires three to four times the amount of copper as it did 20 years ago, plus the demand in industrial manufacturing processes. The earth's deposits are exhaustible, and copper, in particular, is pretty much on the edge. A spot price of just under USD 10,000 per kilo clearly shows how the markets are processing this situation. Rising prices!

ReadCommented by Fabian Lorenz on September 23rd, 2021 | 12:29 CEST

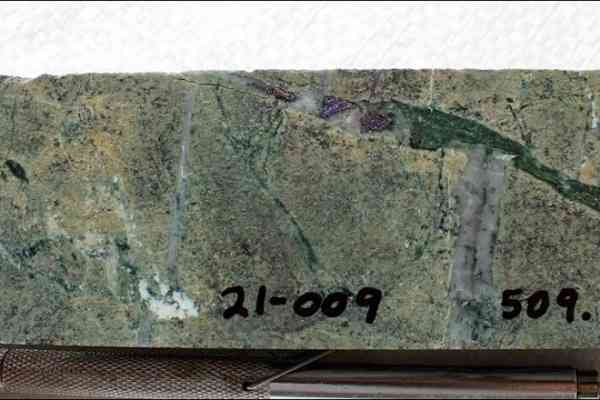

BYD, Nel, Defense Metals: In which direction is it going?

After the significant setback on Monday, the stock markets are looking for a direction. Individual stocks have held up well in recent days. Among these is Nel. The hydrogen specialist was even able to gain on Monday. That was not the case with BYD, but the shares of the Chinese car manufacturer are holding up surprisingly well given the crisis surrounding the Evergrande real estate group and the regulatory fury of the Chinese government. In addition, there are positive reports from the Company. Defense Metals also has positive news to report. Initial drilling results exceed expectations. All three shares are benefiting from the trend towards alternative drives.

ReadCommented by Stefan Feulner on September 22nd, 2021 | 13:33 CEST

Steinhoff, Silver Viper, BYD - Buy when the guns are thundering!

Right now, it is not an easy time for silver fans. After Reddit traders joined forces at the beginning of the year and shot the precious metal not "to the moon", but at least to a high of USD 30.06 per ounce, a sharp correction started, which has led to around USD 22 as of today. Technically, there is still room to go down. Still, from a fundamental perspective, silver is a clear long-term buy because the white metal can support in crisis and is also crucial for producing renewable energy.

ReadCommented by Stefan Feulner on September 17th, 2021 | 12:16 CEST

LVMH, Diamcor, BYD - Consumption without limit

The gap between rich and poor is widening in Germany. The Corona pandemic has further exacerbated the situation. More than 13 million people, around 16% of the population, were below the poverty line and had to live on EUR 781 or less. In contrast, the number of millionaires in the Federal Republic continued to rise from 1.47 million to the current figure of 1.54 million. Due to the sudden rise of the nouveau riche, consumption and the purchase of luxury goods are also rising. After all, expensive cars, watches and diamonds are essential for prestige, to be able to show one's "wealth".

Read