DEFENSE METALS CORP.

Commented by Carsten Mainitz on December 1st, 2021 | 10:44 CET

Defense Metals, Aixtron, TUI - Winners or losers?

Supply chain problems have hit many industries hard in the wake of the Corona pandemic. Essential parts and components were missing, and as a result, production lines at automotive manufacturers, among others, came to a standstill. In addition, raw materials and components such as chips have become much more expensive. Now, in the wake of the new wave of the pandemic, there are signs that the situation will worsen. Who are the winners, and who are the losers?

ReadCommented by Stefan Feulner on November 26th, 2021 | 13:09 CET

Steinhoff, Defense Metals, Deutsche Bank - Good news

So now it has been presented, the new coalition agreement of the traffic light coalition, consisting of the SPD, FDP and the Greens. Besides the connoisseurs of cannabis, which is to be legalized in Germany, the banking and insurance industry should also be satisfied with the drafting. In addition, one focus of the alliance is on transformation in terms of the energy transition. The plan sounds optimistic, but implementation will be all the more difficult.

ReadCommented by Fabian Lorenz on November 16th, 2021 | 12:56 CET

Climate conference ends: Nel, Plug Power and Defense Metals continue with momentum

After two weeks, the climate conference in Glasgow has come to an end. The results are manageable. Although coal and other fossil fuels were declared to be phased out for the first time, the wording was watered down several times. For example, it was only possible to agree on a call that the use of coal-fired power plants without CO2 capture should be "gradually reduced". But even without concrete resolutions, one thing is sure: the energy turnaround is in full swing, and investor darlings Nel and Plug Power are again stepping on the gas. Defense Metals could be due for a reassessment after the completion of drilling.

ReadCommented by Nico Popp on November 11th, 2021 | 11:36 CET

Nordex, Defense Metals, American Lithium: USA pushes lithium market - will rare earths follow?

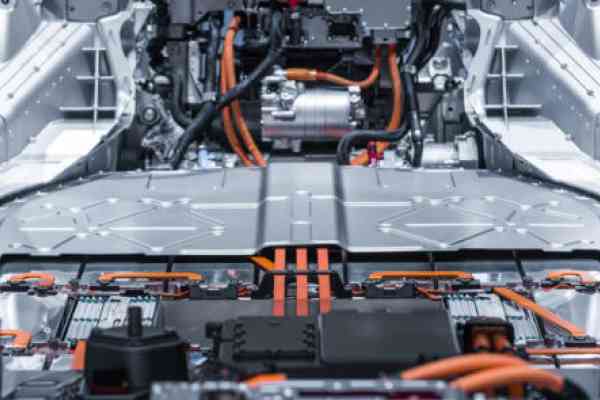

The run on lithium has caused a furor on the stock market in recent weeks. Almost all companies with "lithium" in their names have made significant gains. The background to this is the governments' e-car offensive and a lot of government funding and subsidies for battery technology. The lithium required is held mainly in the ground by smaller companies. Investors who missed out on this wave may be wondering where the music will play next. To find out, one only has to spin the e-car story further: As Tesla, BYD or even VW's green runabouts are preferred to be charged with green electricity, rare earths could soon experience a similar hype. We present shares around the hype topics of e-mobility and the energy transition.

ReadCommented by André Will-Laudien on November 2nd, 2021 | 13:26 CET

BYD, NIO, Defense Metals - Save the climate, make a profit!

No one at the G20 meeting had expected any great leaps forward in climate policy - the participants had already made sure of that in advance by lowering expectations considerably. Nevertheless, there was a common goal before the summit in Rome: to send a strong signal for the UN Climate Change Conference in Glasgow. So postponed is not canceled. Of course, everyone is aware that this is the least that the heads of state and government of the 20 largest industrialized and emerging countries can do. After all, together, their countries are responsible for 80% of global greenhouse gas emissions. If they do not act, climate protection will be in a dire state. We take a look at exciting investments with climate relevance.

ReadCommented by Armin Schulz on October 27th, 2021 | 11:43 CEST

Defense Metals, Nordex, Xiaomi - Battle for raw materials intensifies

China is scaling back its magnesium production due to electricity problems. The Chinese government is aiming to reduce energy consumption and thus emissions. It will inevitably lead to supply bottlenecks worldwide, and in Germany, it will initially affect the metal industry. However, since China produces 90% of the world's magnesium, there are, in fact, no alternatives. Similar problems exist with tungsten and rare earths, needed for almost all new technologies, from renewable energies to consumer electronics and e-cars. If you want to reduce this dependence, you have to look for alternatives.

ReadCommented by Carsten Mainitz on October 18th, 2021 | 13:05 CEST

Defense Metals, Nordex, Varta - These are the reasons for the rising prices!

Rare earths are indispensable for the production of laptops, cell phones, electric motors and wind turbines. However, their extraction is complicated, which is why the supply is also relatively low. The EU has classified many of these metals as critical with regard to their availability given their great importance for many industries, also because of China's dominance as the largest supplier. Efforts to build rare earth mines outside China are proceeding at full speed.

ReadCommented by Stefan Feulner on October 12th, 2021 | 11:55 CEST

NIO, Defense Metals, Plug Power - It is getting critical

Today we are faced with ever-tighter climate targets on the one hand and the availability of critical minerals for a safe and fast energy transition on the other. The disparity between scarce supply and steadily increasing demand is widening. There has been a threat of extreme scarcity and a crashing failure of the widely announced climate change for many years. The few producers of strategic materials are likely to have a bright future.

ReadCommented by André Will-Laudien on September 28th, 2021 | 12:56 CEST

Standard Lithium, Defense Metals, Orocobre, Millennial Lithium: Separating the wheat from the chaff!

Lithium has become one of the most important metals in electromobility. Where all this lithium will come from is critical, as the logic behind electromobility is to generate more sustainable technologies. For more climate protection, mining companies must also fit into a sustainable concept. Lithium extraction should therefore follow high environmental standards and take place in an appropriate economic and social context. But beware: the overall market has recently stopped following every battle cry. Separating the wheat from the chaff is becoming a portfolio challenge!

ReadCommented by Fabian Lorenz on September 23rd, 2021 | 12:29 CEST

BYD, Nel, Defense Metals: In which direction is it going?

After the significant setback on Monday, the stock markets are looking for a direction. Individual stocks have held up well in recent days. Among these is Nel. The hydrogen specialist was even able to gain on Monday. That was not the case with BYD, but the shares of the Chinese car manufacturer are holding up surprisingly well given the crisis surrounding the Evergrande real estate group and the regulatory fury of the Chinese government. In addition, there are positive reports from the Company. Defense Metals also has positive news to report. Initial drilling results exceed expectations. All three shares are benefiting from the trend towards alternative drives.

Read