ALAMOS GOLD (NEW)

Commented by Nico Popp on January 23rd, 2026 | 07:05 CET

The battle for resources is being fought in the data room: How Aspermont Uses AI to Boost the Returns of Rio Tinto, Alamos Gold & Co.

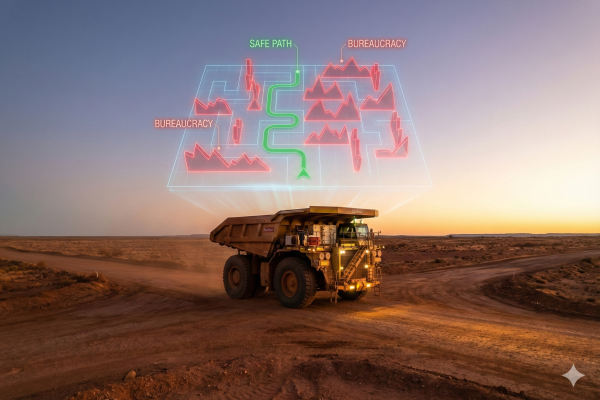

It is the greatest paradox of the modern economy: while demand for copper, lithium, and rare earths is exploding due to trade wars and the insatiable appetite of the AI industry, building a new mine has never been more difficult. Large mining corporations are increasingly failing not because of geology, but because of bureaucracy, environmental regulations, and, in remote regions of the world, geopolitical pitfalls. In this new era, where a legally binding permit is often more valuable than spectacular drilling results, validated information is becoming the most critical resource in the commodities sector. Analyst firms such as McKinsey and the International Energy Agency (IEA) warn of a massive structural supply deficit, as the development of new mines in the West often requires more than a decade of legal wrangling. It is precisely in this area of tension that the Australian media and tech company Aspermont is positioning itself as the decisive problem solver. With a treasure trove of data spanning centuries of industrial history and a new alliance with industry giant Rio Tinto, the Company is transforming itself from a media company into a kind of "Google of mining" – offering investors an opportunity based on intelligence rather than luck.

ReadCommented by Stefan Feulner on July 8th, 2025 | 07:10 CEST

Gold and defense stocks on trend – Alamos Gold, AJN Resources, Lockheed Martin

Increasing geopolitical conflicts and escalating wars in Ukraine and the Middle East, coupled with global trade policies that are increasingly lacking a clear strategy - we are currently living in the most uncertain times in decades. Even though stock indices around the world are still moving from one all-time high to the next, caution is advised. The beneficiaries, on the other hand, are clear. In addition to a booming defense industry fueled by the current era of rearmament, gold is once again asserting its role as a safe haven.

ReadCommented by Stefan Feulner on March 18th, 2025 | 07:20 CET

Barrick Gold, Golden Cariboo, Alamos Gold – Gold stocks on the verge of a breakout

Last week, history was made on the stock market. For the first time, the price of gold rose above the magical mark of USD 3,000 per troy ounce. Escalating trade wars, the announcement of punitive tariffs, and the continued geopolitical uncertainty fueled demand for the yellow precious metal. The primary beneficiaries of this boom are gold producers and exploration companies, which, however, are lagging in terms of price performance against the strike price and, therefore, have a high catch-up potential.

ReadCommented by Stefan Feulner on August 19th, 2024 | 07:00 CEST

Alamos Gold, Prismo Metals, Hudbay Minerals - Gold breaks out, copper turns, act now!

After a brief pause, gold returned with a brilliant breakout and crossed the USD 2,500 per ounce mark for the first time. This new all-time high has generated a striking buy signal. The conditions, with further escalation in geopolitics, provide the best opportunities for continued price increases. Copper also sent out positive signals. Despite economic concerns, the industrial metal may have found a bottom after the correction of recent weeks.

Read