April 30th, 2025 | 07:10 CEST

Here we go! Plug Power turns, rollout at dynaCERT, opportunities with Mutares, VW, and BYD?

Some say the volatility is unbearable, while traders shout: opportunities everywhere. The stock market is currently relentless. Those positioned poorly can quickly see double-digit losses, but on the upside, profits are once again within reach. The former high-tech favorites are taking off again. After a spectacular sell-off at Plug Power in April, there have been strong buybacks in recent days. dynaCERT is also going full steam ahead in sales. Mutares recently delivered rather disappointing figures, and BYD could become the world's most successful automotive company in 2025. We take a closer look.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DYNACERT INC. | CA26780A1084 , MUTARES KGAA NA O.N. | DE000A2NB650 , BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power – 50% premium after loan granted

After three years of total losses of up to 95%, Plug Power's share price found itself back at around USD 0.70. Investors and experts were already suspecting insolvency if the Company could not refinance itself quickly. In 2024, it had still been able to raise over USD 1 billion in equity on the market, but confidence was waning. Now CEO Andy Marsh can announce a success. The US hydrogen specialist has secured a credit facility of up to USD 525 million with financier Yorkville Advisors. The first tranche of USD 210 million is to be disbursed by the beginning of May. Plug intends to use the funds to repay an existing convertible bond with a volume of USD 82.5 million, among other things, to reduce potential dilution effects for its shareholders. This means that concerns about the Company's solvency have been put to rest for the time being. At the end of March, Plug had only USD 296 million in free liquidity - however, operating costs amount to over USD 150 million per month. Thanks to strict cost management and annual savings of over USD 200 million, CEO Marsh believes the Company is well-positioned for a secure future and further growth. There are no plans for further capital increases in 2025.

The Company expects revenue of between USD 130 million and USD 134 million for the first quarter and between USD 140 million and USD 180 million for the second quarter. Another milestone is the commissioning of a new hydrogen plant in the US state of Louisiana. The gigantic electrolyser produces 15 tons of hydrogen daily and will supply Amazon and Walmart, among others. In the long term, management expects to achieve a positive operating result by 2027 and even report a net profit from 2028 onwards. The Q1 figures are to be announced on May 8. Highly speculative!

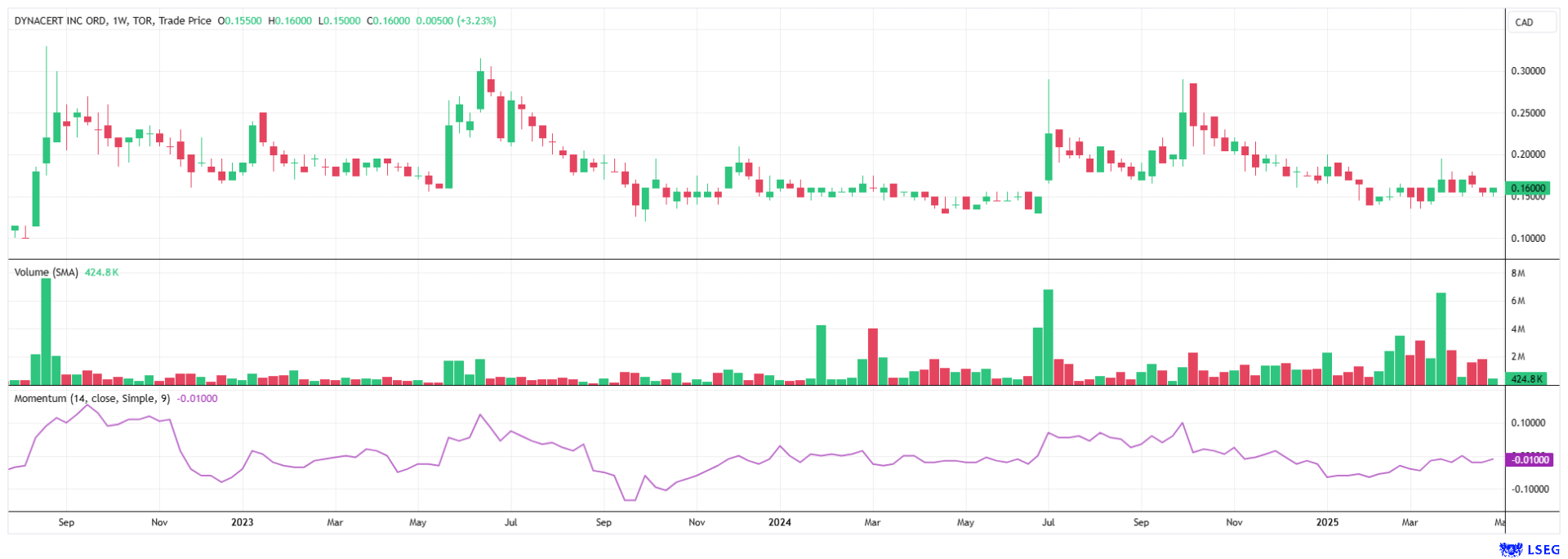

dynaCERT – Things are heating up after bauma

Canadian hydrogen expert dynaCERT is considered a technology supplier for the transport industry in all segments. With its in-house hydrogen add-on devices under the name HydraGEN™, diesel combustion processes can be optimized to such an extent that, depending on the type of use, fuel savings of between 5 and 15% can ultimately be achieved. The HydraGEN™ technology is a recognized process and part of the VERRA organization's range of applications, meaning that users of the technology can generate CO2 certificates when using it.

dynaCERT attracted a great deal of attention at the bauma trade fair in Munich, the world's largest trade fair for construction vehicles and construction applications. 1,000 HydraGEN™ units were produced in advance. They can now be distributed internationally from the new German location. Thanks to numerous preliminary discussions in recent months, dynaCERT should now be able to invoice several orders. The resulting sales potential for the coming months is obvious. The Company has recently been particularly active in the mining sector. The key benefit for users is that the fuel savings can lead to a complete amortization of the entire investment in less than 12 months.

In their initial report for 2025 and 2026, analysts at GBC Research believe that sales could pick up momentum, with total revenues of CAD 12 million and CAD 21 million, respectively. In the DCF calculation, this yields a price target of CAD 0.75. Well-known investor Eric Sprott has already invested CAD 14 million at around CAD 0.50 per share. The technology stock's current market capitalization of CAD 83 million is very low. The first major order could lead to a multiplication.

Mutares – The stock market expects more

In fiscal year 2024, Mutares successfully advanced the further development of its portfolio in all four business segments with 13 completed acquisitions and 6 pending acquisitions. As of the reporting date, the diversified portfolio comprises 32 investments with annualized revenues of just under EUR 7 billion. Even before yesterday's conference call on the 2024 annual results, doubts arose as to whether Mutares would be able to achieve the growth targets it had recently communicated. The focus of its investments remains on the automotive sector, where margins are under pressure. The biggest gains from the placement of Steyr shares will not be felt until 2025, as the Mutares share, with its Austrian investment, became a sought-after vehicle for feeding investors' defense fantasies in the wake of the defense stock rally in Q1. However, after the significant rise and subsequent correction of Steyr shares, the euphoria quickly faded. From last week's closing price of around EUR 37, the share price fell to around EUR 30 yesterday. The final figures are due on May 20, and the Annual General Meeting will take place in early July. Investors can hope for a hefty dividend. Mutares shares remain a hot potato.

BYD – The VW challenger is here to stay

Let's take a quick look at BYD shares. After extensive consolidation in 2024, the Chinese technology company started 2025 with a share price gain of over 60%. Many factors are playing into the electric vehicle specialist's hands. First, eight new models are now ready for sale on the EU market. Brussels is still imposing additional tariffs of 17%, but from 2026, deliveries will be duty-free from neighboring Hungary. The biggest competitor, VW, is currently gaining some ground, but BYD and other Far Eastern manufacturers still have a technological lead of around two years. And then there is the decline of Tesla. The e-pioneer is facing strong headwinds due to Elon Musk's political activism, which has angered many target customers. Orders have been canceled, causing revenues in Europe to plummet by over 30%. Tesla delivered a total of 336,681 vehicles worldwide in the first quarter of 2025, representing a decline of 13% compared to the same period last year, with a 29% drop in China. Even VW outperformed Tesla in the EU in Q1. Nevertheless, BYD should be able to continue to leverage its market advantages in price and quality. With a 2026 P/E ratio of 11, the stock remains attractive at EUR 42.50. VW should be closely watched with a P/E ratio of 3.5, as it could soon regain the EUR 100 mark.

**The stock markets are currently showing themselves to be very volatile. Familiar names like Plug Power are making an impressive comeback. Mutares, VW, and BYD are currently in a consolidation phase. dynaCERT has positioned itself perfectly over the last three years now to penetrate the market with its emission reduction solutions. It represents an interesting addition to the portfolio for sustainability-oriented, risk-conscious investors.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.