For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

He first came into contact with the stock market and shares during his banking apprenticeship. After completing this in 2000, he gained his first journalistic experience in the editorial department of a financial portal. During his subsequent studies in business administration, he also worked in the area of investor relations.

Since then, he has remained true to the capital markets and is excited to report on every newly discovered interesting story - as well as on long-standing success stories.

Commented by Fabian Lorenz

Commented by Fabian Lorenz on January 16th, 2026 | 07:05 CET

First Majestic reports, but the stock fails to benefit! Bayer continues to rise! Silver Viper takes off!

The upward trend in silver remains fully intact, and clear triple-digit price targets are circulating through the market. Yesterday, core holding First Majestic Silver reported on the fourth quarter and full year 2025. However, the stock failed to benefit from the news. Investors may find better opportunities in 2026 with Silver Viper shares. The silver explorer is undergoing a transformation and now holds three projects in Mexico. The most recent capital increase was met with strong demand, and drilling programs and results are expected in the current year. Looking at the share price chart of Bayer, one might think that the Leverkusen-based company had struck silver. The share price rose sharply in the first few days of the new year. However, analysts believe the upside potential has largely been exhausted.

ReadCommented by Fabian Lorenz on January 14th, 2026 | 07:35 CET

Fraunhofer Sounds the Alarm! Will Batteries Soon Be Scarce from China? NEO Battery Materials Offers an Alternative – Launching in 2026!

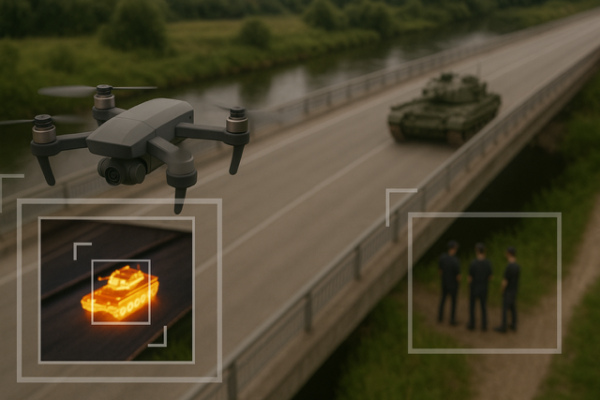

Fraunhofer is sounding the alarm with unusual clarity. Europe's largest research and innovation organization warns that China's new trade policy measures on battery technology pose a strategic risk. In extreme cases, an export ban could become a reality "in a very short time." What is particularly explosive is that Beijing is not only targeting batteries and preliminary products, but also the machines without which no cell factory can start up. This could not only slow down German car manufacturers' race to catch up in electromobility but also create bottlenecks in drones, robotics, and other emerging technologies. Battery suppliers from "Western" production, such as NEO Battery Materials, could benefit from this development. The Company's revolutionary technology is market-ready, with mass production set to begin in South Korea. NEO shares currently appear undervalued.

ReadCommented by Fabian Lorenz on January 13th, 2026 | 07:30 CET

This stock is skyrocketing! Antimony Resources is stealing the show from MP Materials and Standard Lithium!

While investor attention is mainly focused on rare earths and lithium, antimony is quietly gaining momentum. The US government is attempting to free itself from its dependence on China through a billion-dollar deal. In China, antimony smugglers are being sentenced to lengthy prison terms. And Antimony Resources' stock exploded by 18% on Friday. As a result, the Company is increasingly stealing the spotlight from investor favorites in the critical raw materials sector, such as Standard Lithium and MP Materials. This trend could continue over the course of the year, as the exploration project appears to be a real hit, and Antimony Resources' shares still look far from expensive.

ReadCommented by Fabian Lorenz on January 12th, 2026 | 07:25 CET

Bombshell at D-Wave! Rheinmetall and Almonty Industries involved in future technologies, fusion energy, and laser technology!

There is a bombshell at D-Wave. The quantum specialist plans to expand its business model through an acquisition, investing USD 550 million in the process. Whether this will pay off is difficult to assess today. It is, however, easy to see that Almonty benefits from the high demand and tight supply of tungsten in the Western world. The stock was one of the high flyers in 2025 and still does not appear expensive. Another potential driver is emerging: tungsten plays a key role in advances in fusion energy. Rheinmetall is also working on future technologies. Germany's largest defense contractor aims to shoot down drones and other missiles with lasers in the future. Diversifying beyond tanks and other heavy equipment is both smart and important.

ReadCommented by Fabian Lorenz on January 9th, 2026 | 07:10 CET

Trump plans to invest over USD 1.5 trillion into the military! Opportunity for Rheinmetall and Graphano Energy!? CAUTION with Standard Lithium!

A bombshell on Wednesday! US President Donald Trump wants to increase military spending to USD 1.5 trillion per year. Already this year, the US is spending USD 901 billion on its military, more than any other country. In addition to US defense contractors, other companies could also benefit. One example is Graphano Energy. The Company is developing a graphite deposit in Canada. Graphite is considered a critical input for the military supply chain. Germany's largest defense contractor, Rheinmetall, is also hoping for growth in the US. Lithium producers are already being supported by the US government, which benefits Standard Lithium. However, Fitch is questioning market expectations.

ReadCommented by Fabian Lorenz on January 8th, 2026 | 07:00 CET

Shares in rally mode: D-Wave and Power Metallic Mines! And what is Nel ASA doing?

At Power Metallic Mines, the knot has finally been broken. Since mid-December, the share price of this commodity gem has risen by around 50%. This is likely just the beginning, as there are good reasons for prices to continue rising, and analysts believe that a price gain of over 100% is still possible. D-Wave shares are also rallying. The quantum specialist recently announced a technological breakthrough. Further details are expected in the coming weeks. And what is Nel ASA doing? Shareholders are waiting for major orders from the problem child in the hydrogen sector. The industry is developing positively in Germany, for example. But Nel shares remain flat.

ReadCommented by Fabian Lorenz on January 7th, 2026 | 07:35 CET

+23% price increase in just a few days! DroneShield, BioNTech, and WashTec shares!

DroneShield shares have already gained over 23% in the first few trading days of the year. The drone defense specialist is receiving a boost from two orders placed shortly before the turn of the year. Is it now heading towards an all-time high? WashTec shares are also performing strongly. While German stocks are weakening overall, WashTec shares are at their highest level in a long time, and analysts see further upside potential. BioNTech has important study data coming up in 2026. But first, the acquisition of CureVac will be completed. This marks the end of a stock market story that caused only brief euphoria.

ReadCommented by Fabian Lorenz on January 7th, 2026 | 07:15 CET

Nordex shares unstoppable! Sell Hensoldt? Gold gem Kobo Resources with takeover speculation!

Nordex shares continue their strong momentum in 2026, rising nearly 10% in just a few trading days. Investors are responding to the wind turbine manufacturer's strong year-end performance with heavy buying, prompting analysts to raise their price targets. In contrast, sentiment on Hensoldt is more cautious. Analysts recommend selling, citing a lack of fundamental support for the recent price gains and warning of rising competitive pressures. Meanwhile, gold has shrugged off recent selling pressure and is marching back toward USD 4,500. Gold explorer Kobo Resources stands to benefit from this trend. In a recent interview, the CEO expressed optimism and even mentioned the possibility of a takeover. The question for investors: Is now the right time to buy?

ReadCommented by Fabian Lorenz on January 6th, 2026 | 07:10 CET

Caution with Plug Power! TKMS with major order! Pasinex Resources completes acquisition!

In 2026, investors are likely to continue to focus on stocks in the defense, raw materials, and hydrogen sectors. Pasinex Resources currently offers an opportunity to buy or add to positions. The zinc high-flyer impressed investors in 2025, and the positive news flow is likely to continue in 2026. A producing mine is being expanded, and a project is set to go into production soon. TKMS started the new year with a major order, giving the stock a new boost. After halving in value, analysts see Plug Power as a buying opportunity. But caution is advised! The hydrogen pioneer faces an important decision on January 15, 2026.

ReadCommented by Fabian Lorenz on January 5th, 2026 | 07:10 CET

Solar, wind & co. with a breakthrough in 2025: Is now the time to buy Nordex, JinkoSolar, or RE Royalties stock?

The science magazine "Science" has declared the global boom in renewable energy the "Breakthrough of the Year 2025." The industry is booming. But shares in the sector are struggling. One share that clearly has catch-up potential is RE Royalties. The financing company has a convincing, diversified business model, and its dividend yield currently stands at a sensational 16%. The stock should really be moving higher. 2025 was very volatile for JinkoSolar. A halving of the share price was followed by a doubling. What do analysts say? One of the clear high flyers of the sector in 2025 was Nordex. Will the rally continue?

Read