Pharma

Commented by Carsten Mainitz on October 1st, 2025 | 07:05 CEST

Almonty Industries, Gerresheimer, BASF – It is not too late yet!

The race for critical high-tech goods and raw materials is already underway. The COVID-19 pandemic painfully highlighted the downsides of a globally interconnected economy. China's export ban on critical raw materials is currently having a double impact, as the country dominates the market. This effect is expected to continue to intensify in the future as demand continues to rise dynamically while supply increases only slowly. This provides a strong tailwind for raw material producers, but poses significant challenges for companies in other sectors.

ReadCommented by Armin Schulz on September 30th, 2025 | 07:00 CEST

What is happening at Gerresheimer? Almonty Industries and Rheinmetall are booming again!

In uncertain times, the focus shifts to companies that form the backbone of our critical infrastructure. Their ability to build resilient and transparent supply chains for essential goods determines our collective resilience to geopolitical and economic upheavals. Where the highest quality and safety standards prevail in areas such as pharmaceuticals, high tech, and defense, sustainable and ethical conduct becomes a decisive competitive advantage, while strict traceability along the value chain becomes the new benchmark. This development makes values such as those of Gerresheimer, Almonty Industries, and Rheinmetall particularly interesting.

ReadCommented by Fabian Lorenz on September 29th, 2025 | 07:00 CEST

Takeover in the Ozempic market! BioNxt Solutions next? Novo Nordisk, Eli Lilly, and Pfizer are fighting!

The battle against obesity is considered one of the biggest growth markets in the global pharmaceutical sector. According to estimates, the market for obesity therapies could reach a volume of up to USD 150 billion by 2030. So far, Novo Nordisk and Eli Lilly have dominated the market. But almost every major corporation and innovative challenger wants a piece of the pie. The latest example: Pfizer is planning a billion-dollar takeover of US-based Metsera, a company competing with novel drugs against obesity. BioNxt Solutions is also a hot takeover candidate. The Company aims to revolutionize the market and attract new customers with an oral dosage form, and the first prototypes have already been developed. That makes it an attractive prospect for virtually every pharmaceutical company.

ReadCommented by Carsten Mainitz on September 26th, 2025 | 07:35 CEST

Gerresheimer, dynaCERT, Volkswagen – Exciting developments!

News drives prices. However, the pendulum can swing in both directions. For informed investors, the correct interpretation of events is crucial. Often, this then leads to lucrative entry and exit signals. Gerresheimer was the latest to be hit, but which stock could be next? However, there are also stocks that are due for a realignment, offering opportunities for rising prices.

ReadCommented by André Will-Laudien on September 26th, 2025 | 07:15 CEST

BioNxt Solutions – Biotech specialist with significant leverage in mega markets

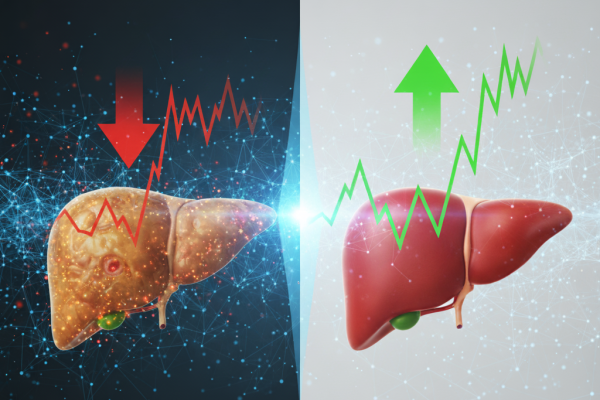

Modern medicine faces an enormous challenge: More and more people are suffering from so-called diseases of affluence, such as obesity, diabetes, multiple sclerosis, and MASH, the dreaded fatty liver disease. At the same time, there is a growing need for innovative therapies and new dosage forms that make treatments more effective, simpler, and more patient-friendly. This is precisely where BioNxt Solutions comes in, a young biotech company that is addressing several billion-dollar markets with its patented thin-film technology. By enabling the oral administration of important active ingredients such as semaglutide and cladribine, BioNxt is not only opening up new therapeutic avenues but also significantly enhancing the effectiveness of existing drugs. At a time when pharmaceutical giants are investing billions in new solutions, BioNxt could become one of the most exciting future players in the industry.

ReadCommented by Nico Popp on September 23rd, 2025 | 07:10 CEST

The AI doctor in your pocket: PanGenomic Health, Bayer, CVS Health

Healthcare costs are a pressing political issue worldwide - in Germany, for example, debates are resurfacing over co-payments and the requirement to see a general practitioner first. This drives more people to self-medicate. The situation is even more extreme in the US: without mandatory insurance and facing extremely high healthcare costs, almost 9% of the population is uninsured, and around 33% is underinsured, leading many citizens to turn to alternative solutions. We examine business models related to increasing personal responsibility in healthcare, with a special focus on a smaller-cap stock.

ReadCommented by Nico Popp on September 23rd, 2025 | 07:00 CEST

What MASH could do for your portfolio: BioNxt, Roche, Novo Nordisk

Have you heard of MASH? The acronym stands for metabolic-associated steatohepatitis, which was previously simply called "fatty liver." Medications targeting this disease, which studies suggest affects around 6% of Americans, are being hailed as the next big trend in the biotech market. Overall, one in three overweight individuals is affected. Since many patients initially show no symptoms, MASH is considered particularly insidious. The growing discussion around the condition could turn many at-risk individuals into patients who take medication, which is excellent news for certain companies in the sector. For a small-cap stock, the hype surrounding MASH could even be transformative.

ReadCommented by Armin Schulz on September 22nd, 2025 | 07:40 CEST

BioNxt Solutions: Your chance to get in early on the next biotech blockbuster

Imagine a cancer treatment that doesn't affect the whole body, but instead acts only at the tumor site. Or a treatment for multiple sclerosis that no longer needs to be swallowed, but simply dissolves under the tongue. What sounds like a dream of the future is already being pursued with full force by the German-Canadian biotech company BioNxt Solutions. The Company is developing two innovative platform technologies that aim to solve some of the biggest challenges in modern medicine. For investors, this opens up extraordinary opportunities.

ReadCommented by Nico Popp on September 18th, 2025 | 07:05 CEST

Understanding metabolism, generating returns: Vidac Pharma, Roche, AstraZeneca

In the search for new treatments against diseases, researchers agree on one thing: the holy grail is unlikely to be found. Instead, it is incremental improvements and combination therapies that promise progress in complex diseases such as cancer. Cell metabolism is considered a promising approach, for example, in cancer, when the metabolism of a cancer cell is disrupted, the cell dies. In this article, we present current approaches and also discuss a biotechnology company that is wholly dedicated to cellular metabolism.

ReadCommented by Fabian Lorenz on September 16th, 2025 | 07:00 CEST

Hot Stock shakes up Big Pharma! BioNxt Solutions aims to replace Ozempic weight loss injection!

BioNxt is currently shaking up Big Pharma. The announcement that it plans to replace the Ozempic weight loss injection with an oral dissolvable film is once again fueling speculation about the share price. Just like in the multiple sclerosis space, the Company aims to disrupt a billion-dollar obesity market. Further exciting operational news is expected in the coming months. Key patents are already in place. With a market capitalization of around CAD 100 million, the Canadian-German life sciences company is far from expensive – even for Big Pharma. The major corporations will undoubtedly be watching BioNxt's development very closely in the coming months. Until then, the stock is likely to trade significantly higher.

Read